LISTA

Lista DAO

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Lista DAO

سود 3 Months :

سیگنالهای Lista DAO

Filter

Sort messages by

Trader Type

Time Frame

Bithereum_io

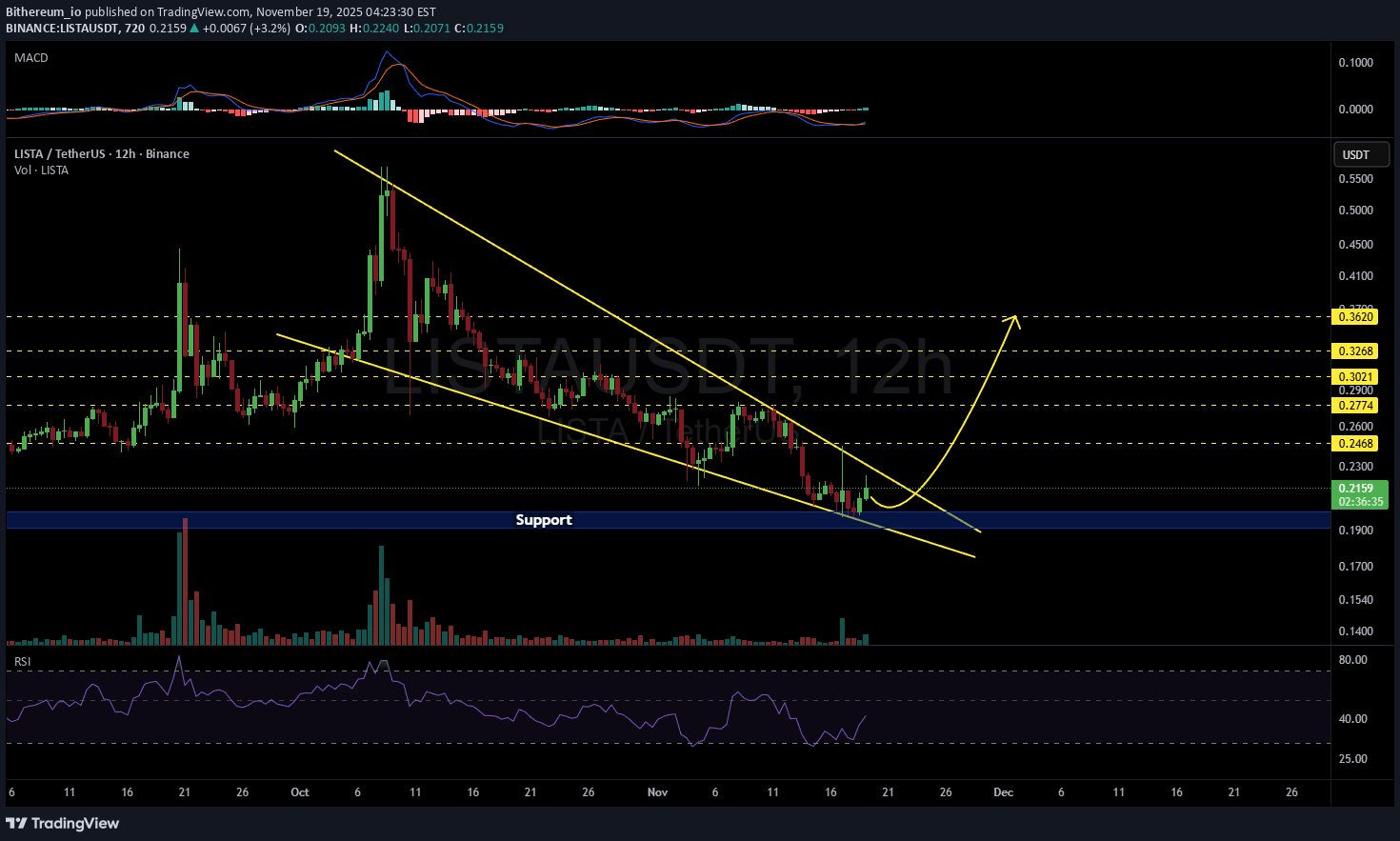

پیشبینی صعودی لیست (LISTA): ورود به گوه نزولی و اهداف جدید در تایم فریم 12 ساعته

#LISTA has formed a falling wedge pattern on the 12H timeframe. Consider buying a small bag here and another near the support in case of a deeper dip. If the price breaks out above the pattern resistance, the potential upside targets are: 🎯 $0.2468 🎯 $0.2774 🎯 $0.3021 🎯 $0.3268 🎯 $0.3620 ⚠️ Always remember to protect your capital with a proper stop-loss and disciplined risk management.

Cryptojobs

لیستا ۱۰۰٪ رشد کرد! راز این جهش بزرگ چیست؟

🔥🔥🔥My medium term outlook are game changing for my followers! 🔥🔥🔥 #LISTA - 29/08 vs today🤑 100% UP 💥 = 500+ Like for this one! 👍

Cryptojobs

LISTA - HOLDING NICELY

$LISTA , holding nicely! And it's probably gonna print more soon! 📈🚀

Cryptojobs

LISTA - DAILY BREAKOUT AND RETEST??

$LISTA - Daily breakout and retest?? Current price: 0.3250$

indrmrgn

LISTAUSDT

snr reversal, expecting price bounce from support. opportunyti to long

FortuneAI

$lista ready to fly?

Lista DAO’s 3.65% 24-hour price rise appears driven by a major exchange listing, bullish technical momentum, and strategic ecosystem developments. Bithumb listing (24 July) boosted accessibility for South Korean traders. Technical indicators show bullish momentum above key moving averages. Partnerships with NanoLabs and protocol upgrades enhanced investor confidence.Take Profit and Enjoy!

Alpha-GoldFX

LISTAUSDT Forming Falling Wedge

LISTAUSDT is setting up a promising technical scenario with its clear falling wedge pattern, a structure known for signaling bullish reversals after a period of consolidation. The wedge is narrowing nicely, suggesting that selling momentum is weakening while buying pressure is starting to build. With good volume supporting this move, the breakout potential looks strong, and the chart indicates an expected gain in the range of 70% to 80%+ if the pattern plays out as anticipated.Lista is garnering more attention among crypto traders and investors due to its innovative approach and growing ecosystem. The increased investor interest is reflected in recent volume spikes and price action, both of which indicate that a breakout above the wedge’s resistance trendline could see strong follow-through buying. For traders, this pattern combined with solid fundamentals creates a compelling opportunity to watch closely for confirmation.From a broader market perspective, the overall sentiment in altcoins and emerging crypto projects is showing signs of revival. This macro environment can provide an additional tailwind for LISTAUSDT, boosting the chances of the pattern delivering its full upside target. Keep an eye on key support and resistance levels, as a decisive daily close above the wedge could unlock further momentum.If you’re trading or investing in LISTAUSDT, risk management remains critical. A clear invalidation level below the wedge support will help protect capital if the market moves against the setup. Stay tuned to price action and volume for confirmation of this high-probability breakout opportunity.✅ Show your support by hitting the like button and✅ Leaving a comment below! (What is You opinion about this Coin)Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Danyal_mdb

LISTAUSDT

Buy instantSl 0.2125bullish trend continuation expectation

MasterAnanda

Lista DAO: 100% & 346% Targets

Another interesting chart here, the candles might seen small but LISTAUSDT produced more than 200% between April and May, and it is ready to move again.The action is happening now as a strong higher low and buy-volume has been really hiiiiigh lately going up, up, up. This type of chart supports a continuation, a new bullish move prices produce profits easy buy and hold.I used this pair for a short-term trade because the chart is young. I am using the young charts for the short-term trades and the old charts for the long-term ones. Of course, there can be old projects with short-term trades but there can't be new projects with long-term numbers because data is missing from the chart.To play it safe, we can predict easily where prices are headed next but a new project won't reveal its potential for the 2025/26 new all-time high, it is a hard, data-missing guess.Lista DAO looks ready for another wave. The first support is set at 0.1692, the previous higher low and the first target is set at 0.4624 for 100% growth. The main target is 1.03 and this reaches a nice 346%. By the time the bull market ends, there can be more.This is a strong chart setup because of the volume and the strong higher low. I wouldn't want to miss this one.Namaste.

Bithereum_io

LISTAUSDT 1D

#LISTA — Breakout Brewing? ⏳#LISTA is currently trading inside a symmetrical triangle on the daily chart — a potential consolidation before a move.🟢 Buy zone: Near the support level at $0.2177 and the daily EMA100A bounce from this level could lead to a strong bullish breakout.If a breakout occurs, watch these targets:🎯 $0.3119🎯 $0.3723🎯 $0.4326🎯 $0.5186🎯 $0.6281⚠️ Always use a tight stop-loss to manage risk and protect your capital.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.