KAITO

KAITO

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 11/21/2025 |

Price Chart of KAITO

سود 3 Months :

سیگنالهای KAITO

Filter

Sort messages by

Trader Type

Time Frame

سیگنال خرید طلا (KAITO): 4 نشانه قوی برای سود بلندمدت!

Kaitousdt Long position 1HR timeframe Confluence: 1.Right Hand 2.TRBO 3.Oscillator cross 4.Triple Bottom

Bithereum_io

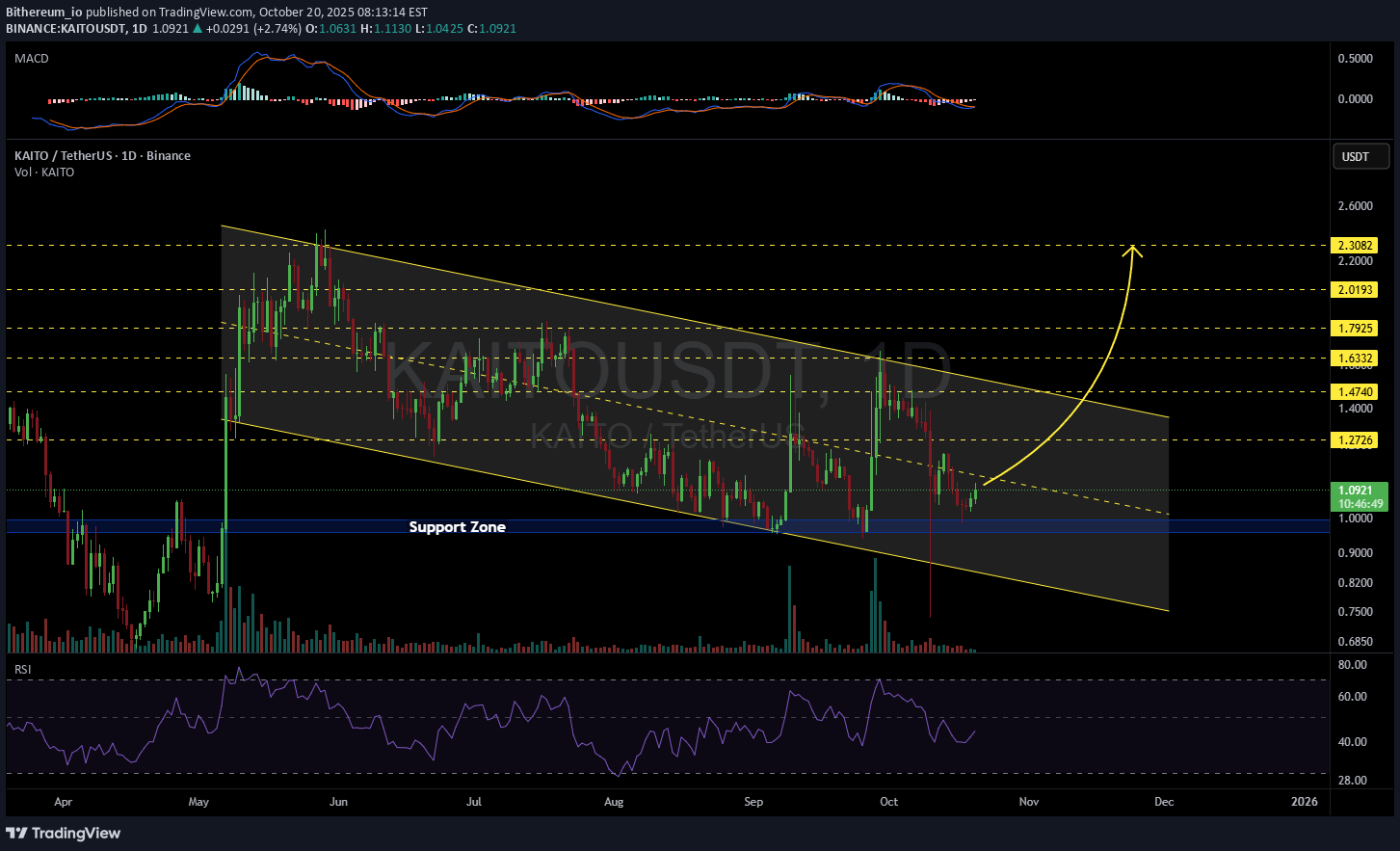

خرید KAITO: فرصت خرید در کانال نزولی با اهداف صعودی بزرگ!

#KAITO is moving inside a descending channel on the daily chart. Consider buying here and near the support zone. The potential targets are: 🎯 $1.2726 🎯 $1.4740 🎯 $1.6332 🎯 $1.7925 🎯 $2.0193 🎯 $2.3082 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Tealstreet

$KAITO - Bearish Outlook

KAITO’s recent performance underscores the growing momentum in AI-driven blockchain projects, signaling robust market potential. The integration of advanced AI tools and increasing adoption are driving bullish sentiment. Similarly, Faith Protocol is carving a niche with its innovative yield farming, NFT offerings, and expanding DeFi ecosystem. Both projects exemplify the synergy of utility and community engagement in fueling growth. KAITO has surged ~80% from its daily support at $1.04, propelled by over $170M in launchpad pledges and heightened anticipation for upcoming airdrop rewards. Key catalysts include record-breaking Launchpad presales, 31.99m tokens staked, ongoing airdrops for projects. MARKET ANALYSIS: On the 2-day chart, $KAITO is testing a critical diagonal resistance at $1.66 but faced strong rejection, indicating potential consolidation. Key support lies between $1.20–$1.06, a zone that has historically held firm. A breach below this could trigger a deeper correction toward $0.80 for a proper bottoming formation. Conversely, a decisive break above $1.66 may signal continuation toward higher resistance levels, with momentum supported by strong fundamentals and market interest. KEY LEVELS: Support: $1.20–$1.06 (critical), $0.80 (secondary) Resistance: $1.66 (immediate)

کاربر تازهوارد

قاضی اوستا کریم

Baslam, see the friends of the current statesmen, because they are better off with blood and people, they are so drunk with their eyes, and they are still sleeping.

کاربر تازهوارد

پرسش در مورد سکههای عتیق: تاریخچه، ظاهر و اصالت

Anticus and Aykimi Coins Since the first people who have so far calculated the multiplication or the appearance and shape of the metal used, of course, not just, copyright or counterfeit.

SatochiTrader

kitejunkiee

Kaito - Big Sym Triangle forming

I entered early around $1.19, a few weeks ago, but this pattern is still forming. Expecting to go for a final low, thus giving a valid pattern. Targets close to $6. I will update once we have the complete pattern.

khalidalmutairi1

وتد هابط و دبل قاع

Two positive models, and, God willing, we have a third wave of Elliot waves targeting a region of $ 7 and good luck to all

Bithereum_io

KAITOUSDT 1D

#KAITO is moving inside a falling wedge pattern on the daily chart. Volume has increased and RSI and MACD are turning bullish. #KAITO is on the verge of breaking out. If that happens, the potential targets are: 🎯 $1.2726 🎯 $1.4740 🎯 $1.6332 🎯 $1.7925 🎯 $2.0193 🎯 $2.3082 ⚠️ Always remember to use a tight stop-loss and follow proper risk management.

Morningtsar

$KAITO

Needs to go ''HOME'' before pumping, otherwise good to stake it for passive airdrops coming

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.