EDU

Open Campus

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

TradingOnRank: 2210 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 11/5/2025 |

Price Chart of Open Campus

سود 3 Months :

سیگنالهای Open Campus

Filter

Sort messages by

Trader Type

Time Frame

سقوط بزرگ در راه است؟ تحلیل تکنیکال هشداردهنده برای EDU و اهداف قیمتی پایینتر

The recent price action on EDUUSDT is forming a clear bear flag on the 3D timeframe. After a strong impulsive drop, the market has been consolidating inside an upward-sloping channel — a classic continuation pattern in a downtrend. Price is now losing support at the lower boundary of the channel, suggesting the bear flag may be close to confirming a breakdown. If momentum continues to the downside, the next liquidity zones are located significantly lower. Key observations: Structure aligns with a bear flag , often signaling continuation of the prior sell-off. Price is testing the lower trendline of the channel with increasing weakness. A confirmed breakdown opens the path toward the next demand zones. Downside Targets: $0.09–$0.08 $0.055–$0.045 As long as price remains below the flag resistance, downside continuation remains the dominant scenario.

CryptoAnalystSignal

تحلیل ارز EDU: احتمال جهش صعودی قوی از ناحیه حمایتی کلیدی!

#EDU The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected. We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected. There is a key support zone in green at 0.1580. The price has bounced from this level multiple times and is expected to bounce again. We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement. Entry price: 0.1615 First target: 0.1657 Second target: 0.1710 Third target: 0.1785 Don't forget a simple principle: money management. Place your stop-loss order below the support zone in green. For any questions, please leave a comment. Thank you.

CryptoWithJames

تحلیل انفجاری EDU: فرصت خرید ۴۴٪ در انتظار شکست الگوی گوه نزولی!

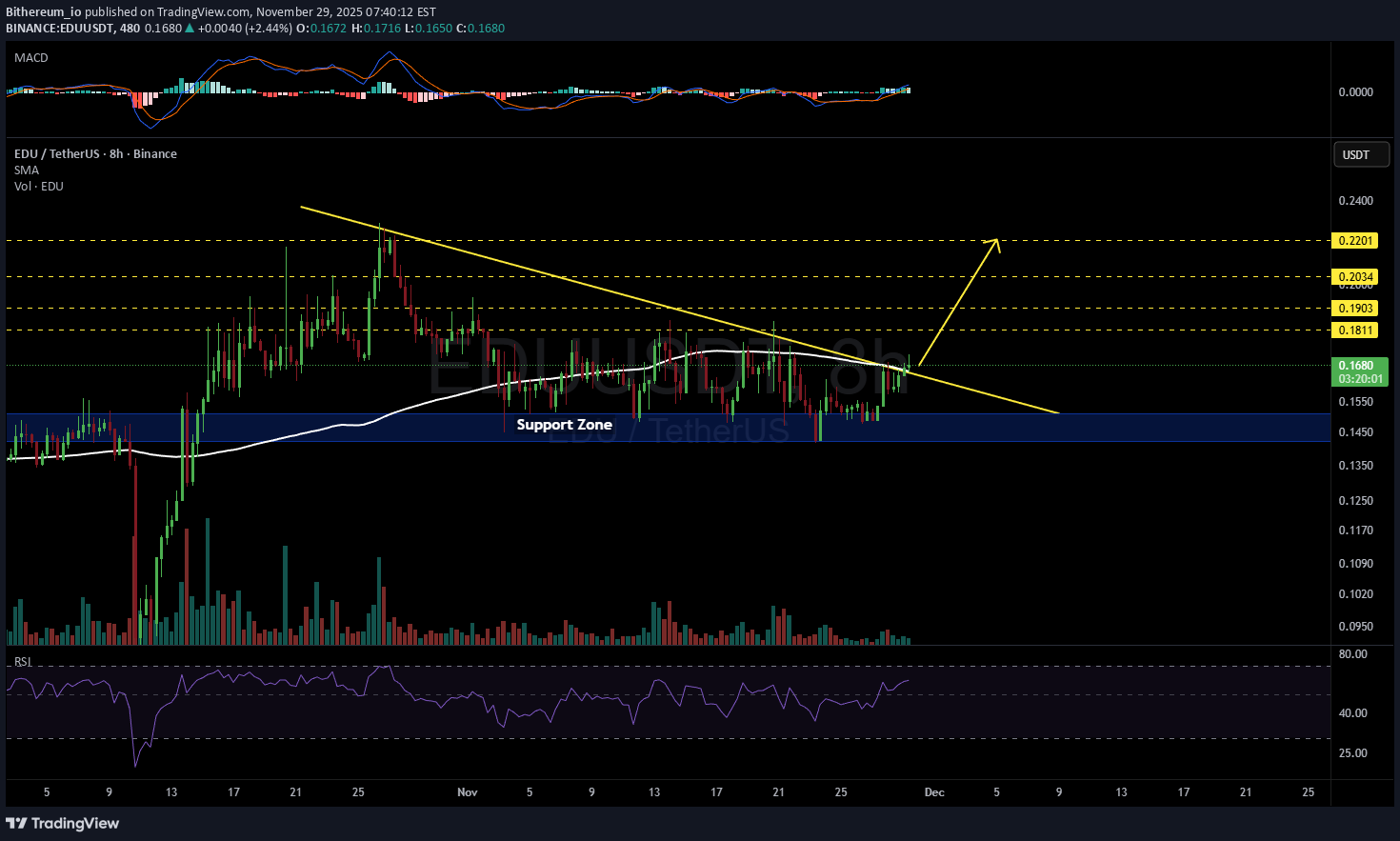

#EDU UPDATE EDU Technical Setup Pattern: Falling Wedge Pattern Current Price: $0.168 Target Price: $0.239 Target % Gain: 44.55% Technical Analysis: EDU is breaking out of a falling wedge pattern on the 4H chart, signaling bullish continuation potential. Price has successfully moved above the descending resistance trendline, confirming the breakout structure. The projected measured move from the wedge points toward the highlighted upside target zone, which aligns with prior resistance and reclaim levels. As long as price holds above the breakout area, momentum favors further upside expansion. Time Frame: 4H Risk Management Tip: Always use proper risk management.

Bithereum_io

سکه EDU به اوج میرسد؟ تحلیل تکنیکال 8 ساعته و اهداف صعودی هیجانانگیز!

#EDU has broken above the descending triangle and the SMA100 on the 8H timeframe. In case of a successful retest, the potential upside targets are: 🎯 $0.1811 🎯 $0.1903 🎯 $0.2034 🎯 $0.2201 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

CryptoAnalystSignal

تحلیل قیمت EDU/USDT: سیگنال صعودی قوی و اهداف کلیدی برای خرید

#EDU The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected. We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected. There is a key support zone in green at 0.1460. The price has bounced from this zone multiple times and is expected to bounce again. We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward move. Entry price: 0.1500 First target: 0.1540 Second target: 0.1591 Third target: 0.1663 Don't forget a simple principle: money management. Place your stop-loss order below the support zone in green. For any questions, please leave a comment. Thank you.#EDU First target: 0.1540 Reached Second target: 0.1591 Reached Third target: 0.1663 Reached

TradingOn

پیشبینی انفجاری قیمت ارز دیجیتال EDU: فرصت خرید عالی با سود ۱۱۷ درصدی!

Open Campus is pulling back to 100EMA regained support where it seems likely to bounce and recover midterm. ⚡️⚡️ #EDU/USDT ⚡️⚡️ Exchanges: ByBit USDT Signal Type: Regular (Long) Leverage: Isolated (1.0X) Amount: 5.1% Current Price: 0.1598 Entry Targets: 1) 0.1587 Take-Profit Targets: 1) 0.3456 Stop Targets: 1) 0.0963 Published By: @Zblaba EDU EDUUSDT.P #1D #OpenCampus #Education opencampus.xyz Risk/Reward= 1:3.0 Expected Profit= +117.8% Possible Loss= -39.3% Estimated Gaintime= 2-3 monthsEntry filled EDUUSDT.P All entry targets achieved Average Entry Price: 0.1592 💵 EDU is bouncing back nicely so far, good bid timing.

god_of_robots

آموزش ارز دیجیتال: موقعیتیابی سودآور در قیمت ۰.۱۷۳۳ (برای معاملهگران تازهکار)

edu Those who want to take a short position can follow the target: 0.1733

CryptoAnalystSignal

تحلیل پامپ قوی #EDU/USDT: منتظر شکست خط روند و رسیدن به اهداف هیجانانگیز!

#EDU The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel. We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move. There is a key support zone in green at 0.1700, representing a strong support point. We have a trend of consolidation above the 100-period moving average. Entry price: 0.1760 First target: 0.1790 Second target: 0.1853 Third target: 0.1911 Don't forget a simple money management rule: Place your stop-loss order below the green support zone. Once you reach the first target, save some money and then change your stop-loss order to an entry order. For any questions, please leave a comment. Thank you.#EDU First target: 0.1790 Reached Second target: 0.1853 Reached Third target: 0.1911 Reached

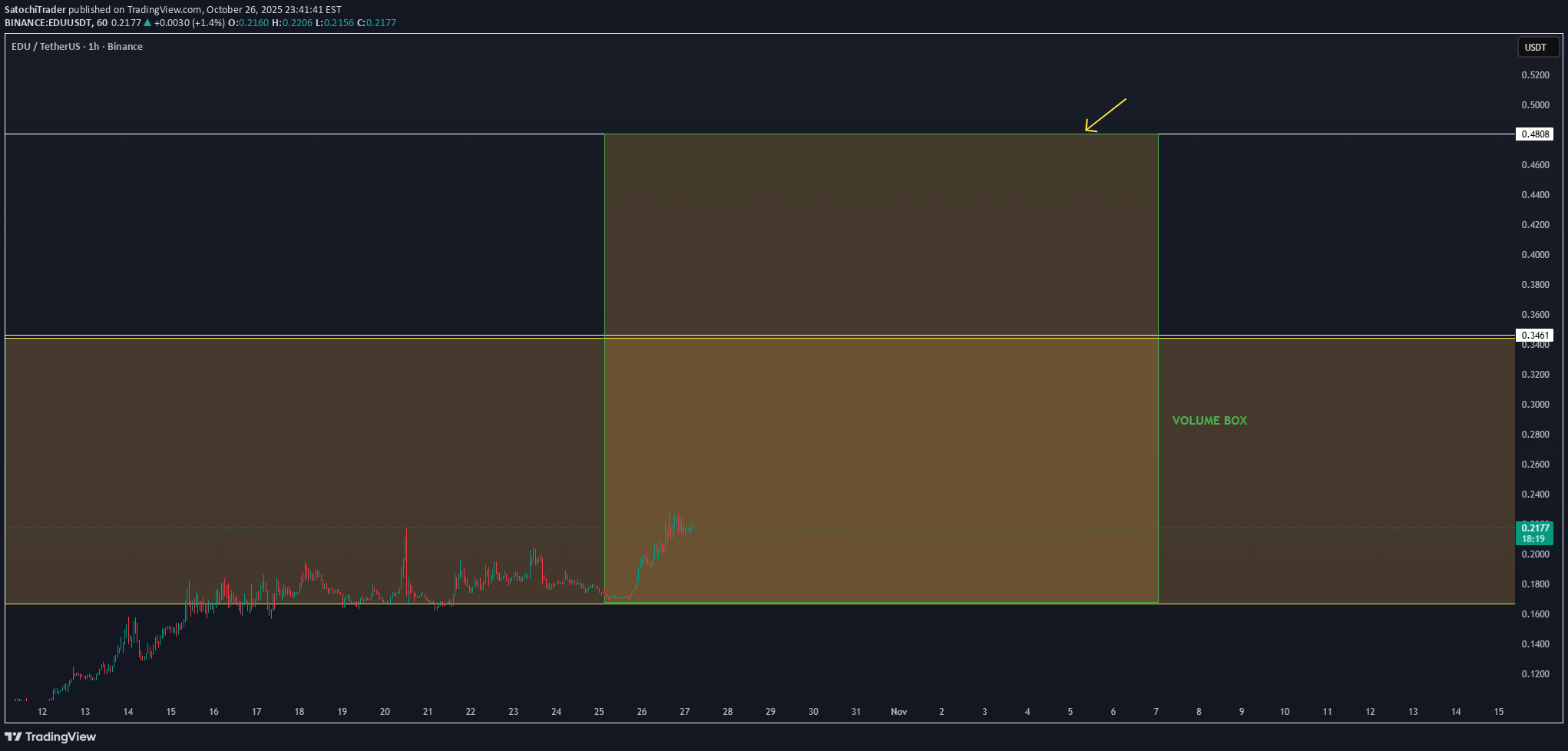

SatochiTrader

آماده صعود بزرگ؟ سیگنالهای تجمع قوی در جفت ارز EDU/USDT برای رسیدن به مقاومت ۰.۴۸ دلار!

🔹 EDU/USDT – Volume Expansion Setup EDU continues to show strong structure after the last move up, holding steady inside the volume box. The pair is building momentum with consistent volume increase on the lower time frames, showing clear accumulation signals. If the current structure remains stable, EDU can continue this short-term uptrend and target the next resistance zone around $0.48, where the main reaction level is expected. We follow the data and volume development closely — as long as the price stays supported inside the box, the momentum remains valid for a potential breakout continuation toward the upper range.There is a high chance EDU: USDT can break out in the coming time.

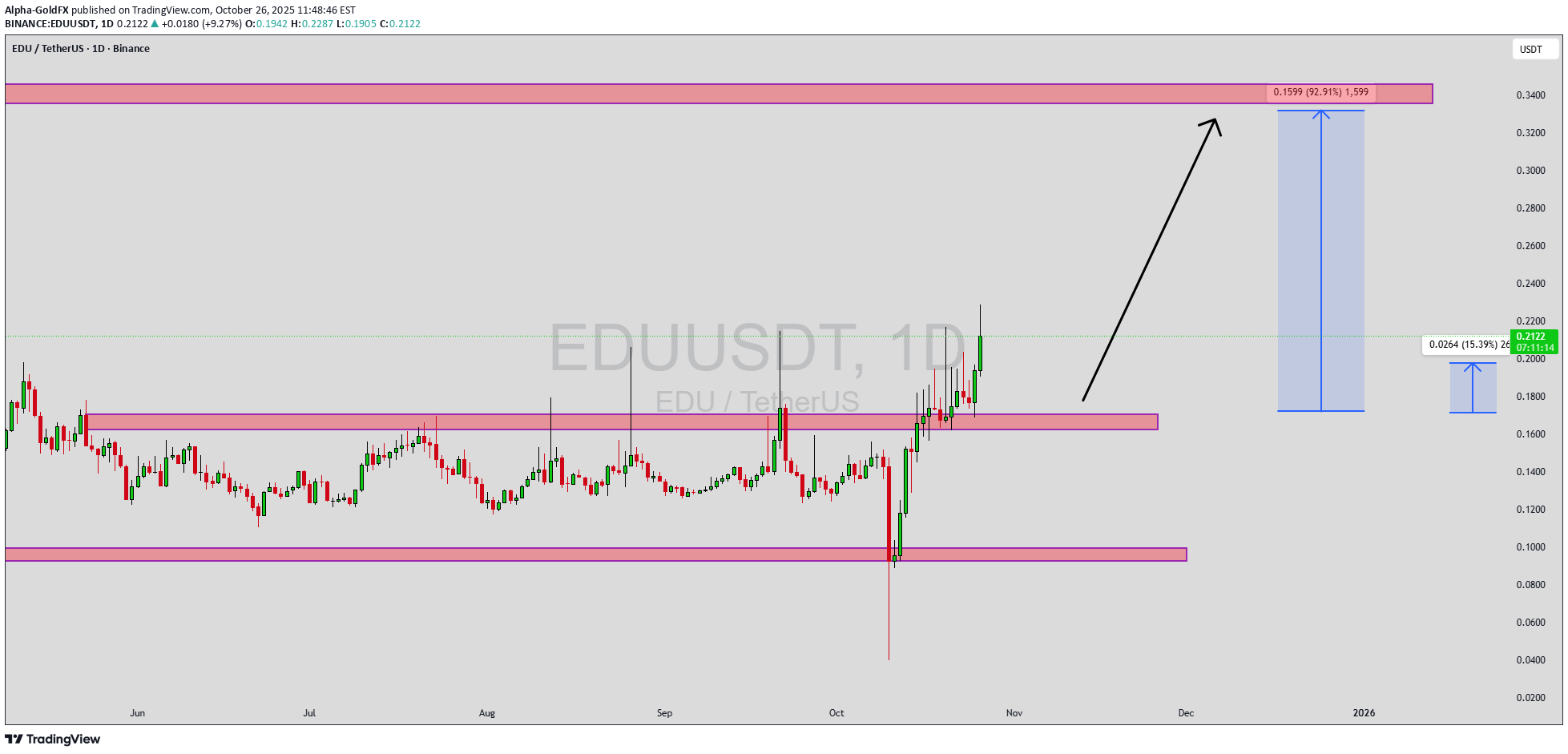

Alpha-GoldFX

مومنتوم انفجاری EDUUSDT: آیا آماده جهش 90 درصدی است؟

EDUUSDT is currently showing a strong bullish momentum pattern, indicating that buyers are firmly in control and price action is building toward a significant upward breakout. The structure suggests consistent higher lows with increasing volume, signaling that accumulation is happening in the background. As the market gains traction, EDUUSDT could be on the verge of a major push to the upside, aligning perfectly with the broader bullish sentiment across select altcoins. The trading volume for EDUUSDT remains strong, confirming active participation and growing confidence among investors. Momentum indicators are pointing toward a continuation of the current trend, with a potential target range showing gains between 80% to 90%+. A breakout above the recent resistance levels could open the way for an extended rally, especially as traders begin positioning themselves ahead of the move. Investor interest in EDUUSDT continues to rise, as many see this as a promising project backed by solid fundamentals and renewed technical strength. With bullish energy building across the crypto market, EDUUSDT could emerge as one of the high-performing assets in the near term. A sustained move above key levels may validate this pattern and lead to a substantial price expansion, rewarding early entries. ✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.