DENT

Dent

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Dent

سود 3 Months :

سیگنالهای Dent

Filter

Sort messages by

Trader Type

Time Frame

without_worries

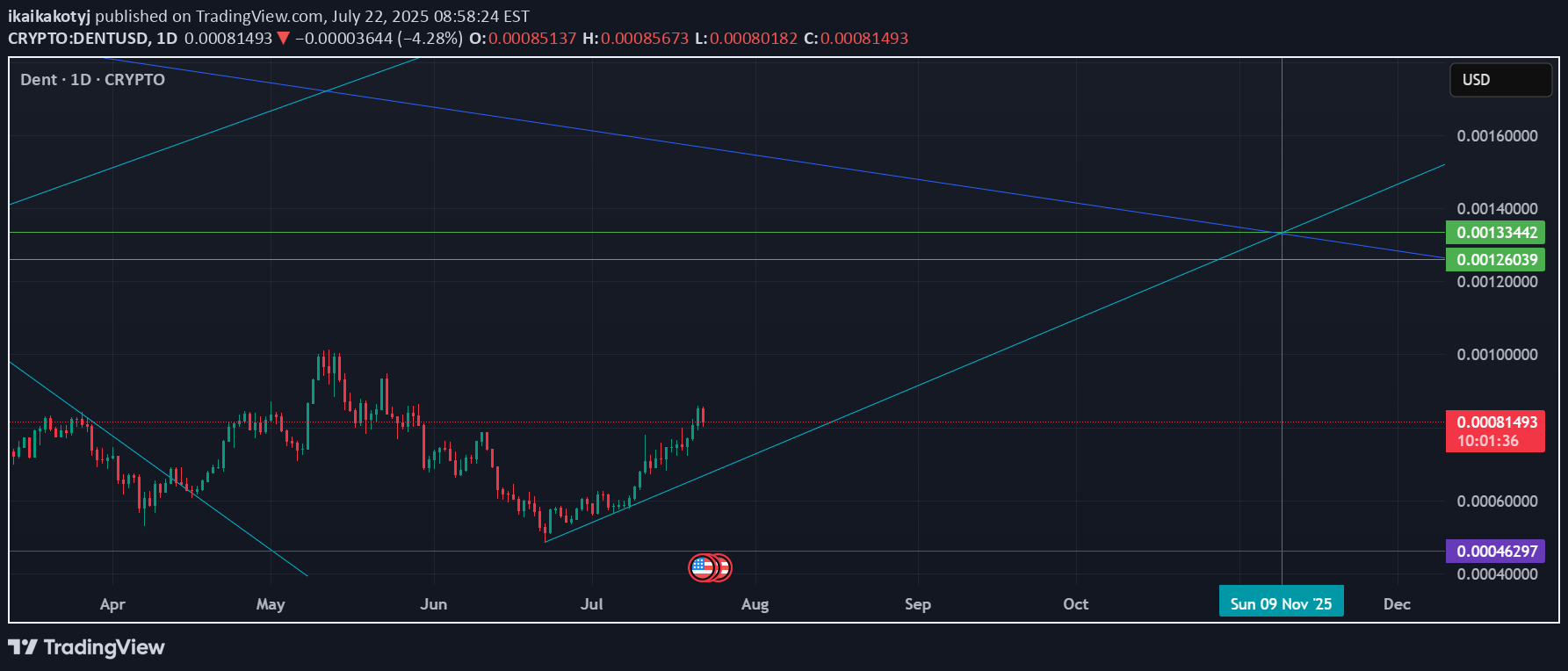

Dent token - 10000% in 90 days? - January 2026

Ticker : DENTUSDT (DENT) Timeframe : 8 day chart Core thesis Dent has been in a long, joyless downtrend the kind that makes you wonder if “utility token” is just crypto for “emotional damage”. Price has now fallen back into a major historical support band (blue zone), while the weekly and above RSI sits at 26, matching the washed out reading seen around March 2020. Seller exhaustion + multi year support + RSI in basement can set up a mean reversion rally no one expects. Such rallies are energetic, just as before, for one simple reason: Sellers have left the chat. Future selling will now be from buyers on this day forth. This is a high risk, speculative idea built on the assumption that the market’s finished throwing DENT in a the bin (for now). But there’s something else, something else now shown in this idea, which I’ll leave for discussion elsewhere. In the meantime: Key levels Support (base zone) $0.00020 – $0.00024: The current weekly demand area / base. Bulls want to see price hold and build here (ideally a higher low). If this zone holds, it becomes the risk-defined entry point. Invalidation Meaningful weekly close below ~$0.00020 (and especially a clean breakdown to fresh lows). If this fails, the “base” is just a trapdoor. Resistance targets These are profit-taking / reaction zones, not fairy-tale endpoints. T1: ~$0.00058 – $0.00064 (1st Resistance) First serious overhead supply. If we can’t reclaim this, the move is just a dead-cat bounce doing dead-cat things. T2: ~$0.00189 (2nd Resistance) Major level from prior structure. If price gets here, expect volatility and sellers to reappear like they’ve been summoned. T3: ~$0.022 (3rd Resistance / “Crypto Is Back” Level) The big historical ceiling. Could it happen? Sure, so could I become a ballet dancer. This is the stretch target for a full mania-style rotation, not the base case. Conclusions DENT is sitting on a key long-term support band with weekly RSI at extreme oversold (~26) values, a setup that can precede sharp mean-reversion rallies in beaten-down tokens. The trade is simple: hold the base = bounce potential toward $0.00058, then $0.00189 if momentum really flips. But don’t confuse a relief rally with redemption. If price loses $0.00020, this bullish idea is invalid and you move on because loyalty is for dogs, not downtrends. Ww ===================================================== Disclaimer This is not financial advice. It’s a technical opinion on a chart. Basically me looking at squiggly lines and pretending they have feelings. Nothing here is guaranteed, nothing here is a “signal,” and if you treat it like one, that’s on you. Crypto can move 30% because someone tweeted an emoji. It can also drop 90% while you’re making a cup of tea. Manage your risk, size properly, use stops that respect volatility and assume you’re wrong by default because markets don’t care about your hopes, your timeline, or your rent. I may hold a position at any time, and this idea can be invalidated without warning. If you lose money, don’t message me like I stole it. You clicked the buttons.Active on publication.

CryptoNuclear

DENT/USDT – Major Accumulation Phase at Critical Support!

Main Structure On the weekly timeframe, DENT/USDT shows a prolonged bearish trend since 2021, followed by a long sideways accumulation phase from 2022 until today. Price is now sitting again at the critical historical support zone (0.00042 – 0.00063), a key “basement” level where buyers have repeatedly stepped in. Key resistance levels: 0.00097 → first pivot resistance 0.00150 → psychological resistance, early trend confirmation 0.00194 → major validation of bullish reversal 0.00374 – 0.00466 → strong historical resistance, mid-term target 0.00734 – 0.01716 → long-term reversal targets --- 📈 Bullish Scenario 1. Rebound from Basement Support Holding above 0.00042 – 0.00063 would confirm an accumulation / double bottom structure. A weekly close above 0.00097 with strong volume would be the first bullish confirmation. 2. Upside Targets Target 1: 0.00150 (+100% from current price) Target 2: 0.00194 If momentum sustains, the move could extend to 0.0037 – 0.0046 3. Additional Confirmation Look for volume spikes on breakout. Watch RSI for potential bullish divergence on new lows. --- 📉 Bearish Scenario 1. Breakdown of Key Support A weekly close below 0.00042 would invalidate the 2-year accumulation base. This could trigger new lower lows and potentially a capitulation phase. 2. Bearish Consequences Longs near the basement may face large stop-loss triggers. Market could enter a deeper consolidation or distribution zone. --- 🔍 Price Structure & Pattern Range-bound Accumulation: DENT has moved sideways for almost 3 years, forming a potential base. Lower Highs: Macro structure remains bearish until a weekly higher high above 0.00194 is confirmed. Critical Zone: The 0.00042 – 0.00063 range is the “life support” for bulls. A breakdown would flip sentiment to strongly bearish. --- 🎯 Conclusion DENT is at a make-or-break level: Bullish case: Holding the basement support could trigger a strong rebound, especially above 0.00097, with targets toward 0.00150 and 0.00194. Bearish case: A breakdown below 0.00042 ends the multi-year accumulation and risks deeper lows. For traders, risk management is essential: Aggressive entries can be taken near support with tight stops. Conservative traders may wait for confirmation above 0.00097 or 0.00150. --- #DENTUSDT #DENT #CryptoAnalysis #Altcoins #Accumulation #SupportResistance #BullishScenario #BearishScenario #CryptoTrading

SatochiTrader

DENT'/USDT UPDATE Confirmation after $0,00093

DENT/USDT UPDATE DENT is showing signs of strength, but we need confirmation. Key level to watch: $0.00093 ✅ A clear breakout and hold above $0.00093 could trigger further upside momentum. ⚠️ Until then, price remains in a consolidation zone and risk of pullback is present. Plan: Wait for confirmation above $0.00093 before re-entering longs. Next resistance levels to monitor: $0.00105 – $0.00120 Support remains around $0.00085 – $0.00080 Conclusion: Break and retest of $0.00093 will be the bullish signal for continuation.

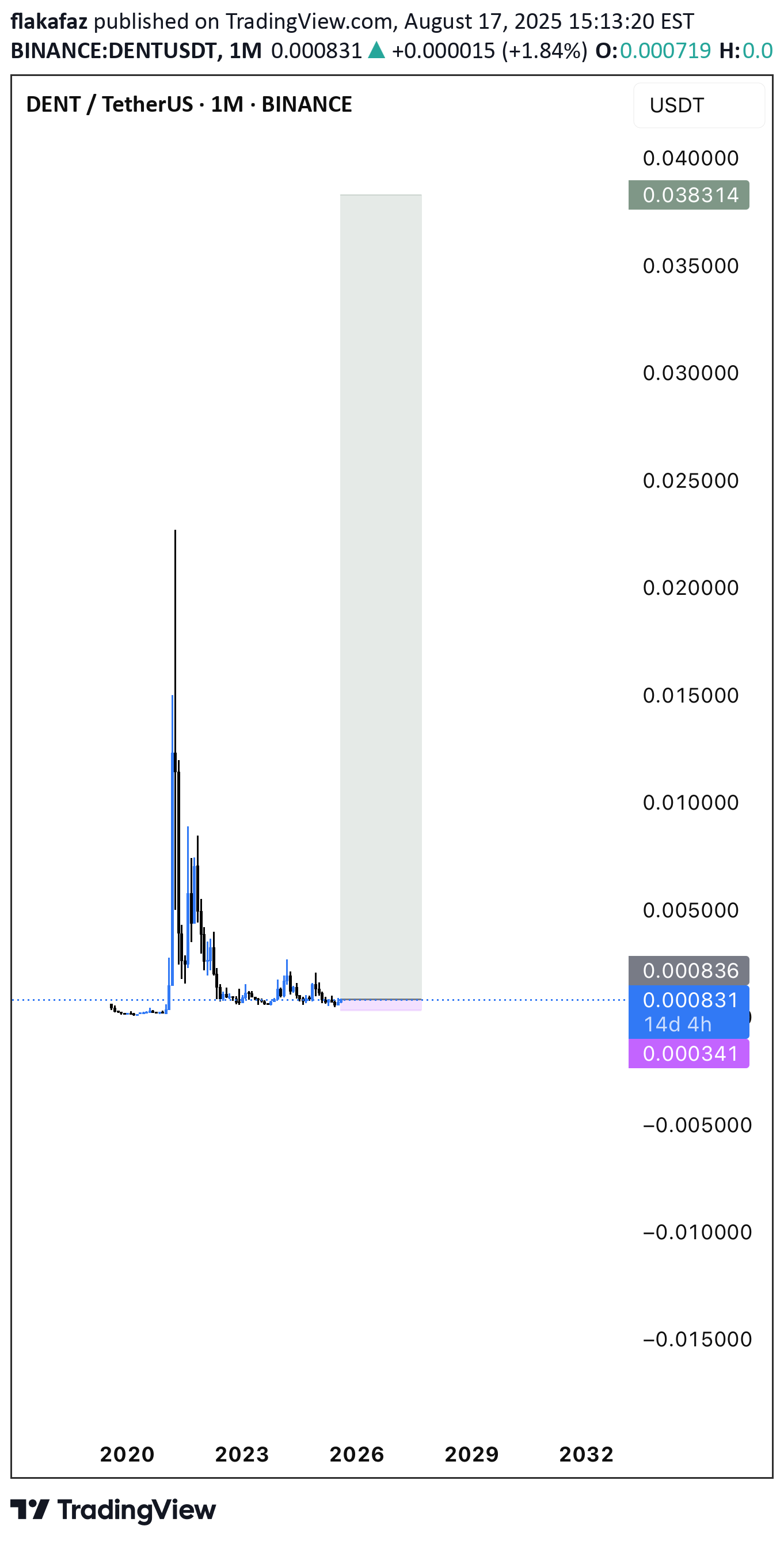

flakafaz

Eyes on the Dent :soon 0.05$

I think dent will go much higher during 2025 bull run. 5cents incoming.

Thebitcoin37

DENTUSDT TRADE SETUP.

DENTUSDT – 15m Chart Market Structure: Clear bullish shift in order flow (CHOCH), signaling buyers in control. Liquidity Sweep: Price took out sell-side liquidity (SSL) before reversing, removing weak hands. Smart Money POI: Retraced into a confluence zone — Demand Zone + Fair Value Gap (FVG) — a high-probability buy area. Reaction: Strong bullish rally from POI confirms institutional participation and potential continuation. 📌 Bias: Bullish – Favouring long setups until structure shifts.

ElfAlgorithms

DENT-Short

It is useful to gradually Short, I suggest you keep your risk low in a critical area. All shares are within the scope of training, do not get involved if you cannot make your risk account ...

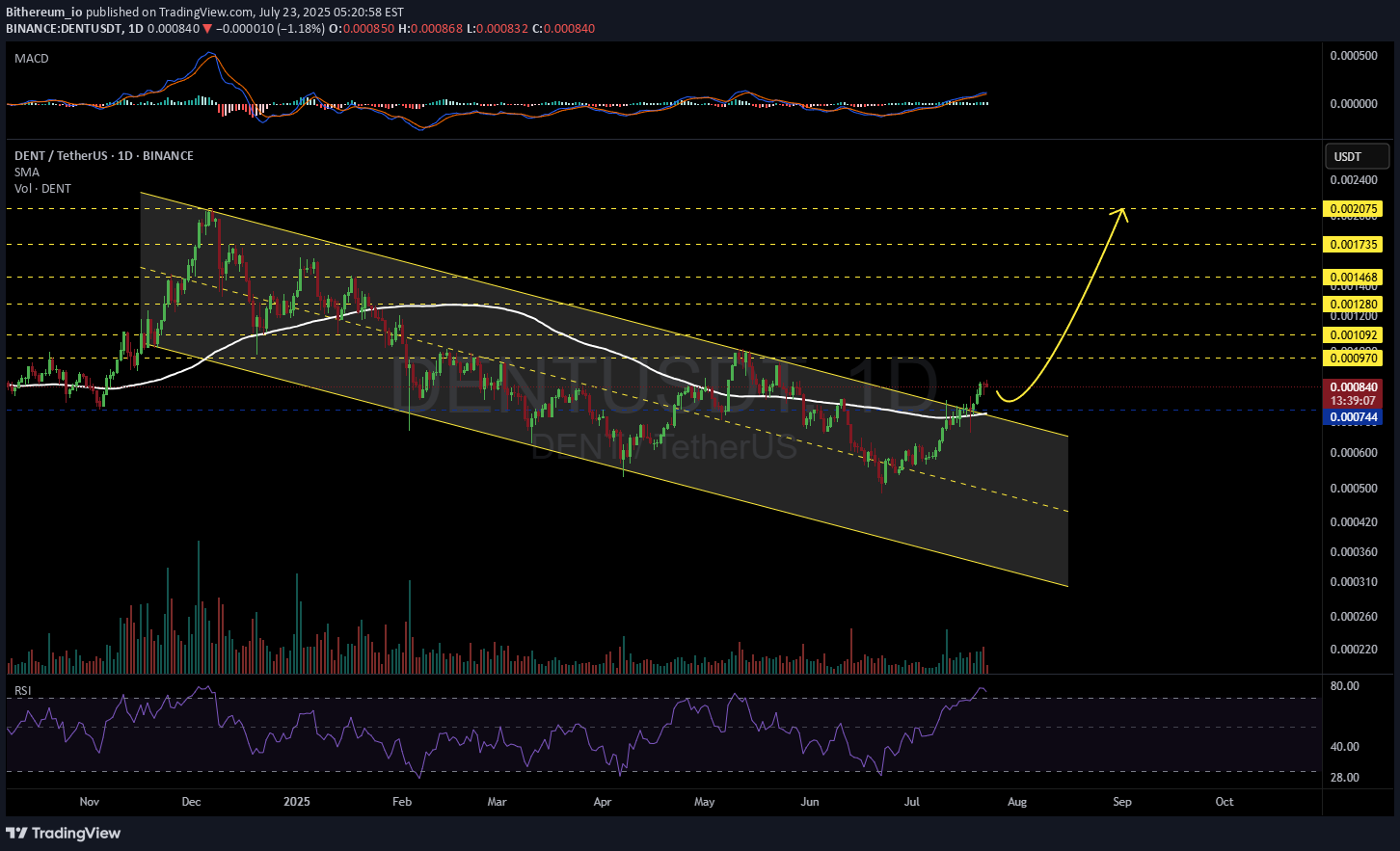

Bithereum_io

DENTUSDT 1D

#DENT has broken above the descending channel resistance and all of the moving averages on the daily chart. It is currently in the RSI overbought zone, and a correction with a retest of the descending channel is possible. Consider buying near the daily SMA100 and the support level at $0.000744. In case of a successful bounce, the targets are: 🎯 $0.000970 🎯 $0.001092 🎯 $0.001280 🎯 $0.001468 🎯 $0.001735 🎯 $0.002075 ⚠️ Always use a tight stop-loss and practice proper risk management.

DENT

Public Charting DENT and trying to find the next liquidity magnet

Kapitalist01

18:13

Investment is not recommended. To get -time transactions, time analysis study approaches the permanent and daily support resistance zones. Momentum also finds a price direction (around 15:56). The region is composed of regions between 10 and 17:15.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.