AERO

Aerodrome Finance

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

coinpediamarketsRank: 31942 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 1/8/2026 |

Price Chart of Aerodrome Finance

سود 3 Months :

سیگنالهای Aerodrome Finance

Filter

Sort messages by

Trader Type

Time Frame

coinpediamarkets

$AERO/USDT Quick Analysis (1D)

A AERO/USDT is pulling back into a well-defined buying zone ($0.5364–$0.5186) after a prolonged decline, suggesting a potential bullish reaction area rather than further downside continuation. If the price comes to the entry area around $0.5378, a long setup becomes valid. Bias: Bullish rebound from demand Entry Area: ~$0.5378 (inside buying support) Invalidation: Clean break below $0.4878 (structure failure) Target 1: $0.6515 (near-term resistance / liquidity) Target 2: $0.7878 (major resistance / range high)Trade is Activated

Bogbee

AERO - Near Bottom?

Aerodrome is approaching April lows. It's likely the price may fall closer to the lows or even create new lows, however selling is getting exhaustive. I believe we may see a return to the VAL of April's volume profile before we see more downside and true bottom. This is how I'm trading that assumption.More strong selling.. Adding to position. Looking for support to hold.closed 75%Cost basis was averaged down to .41514 and profits taken at .52+ for 25% profit

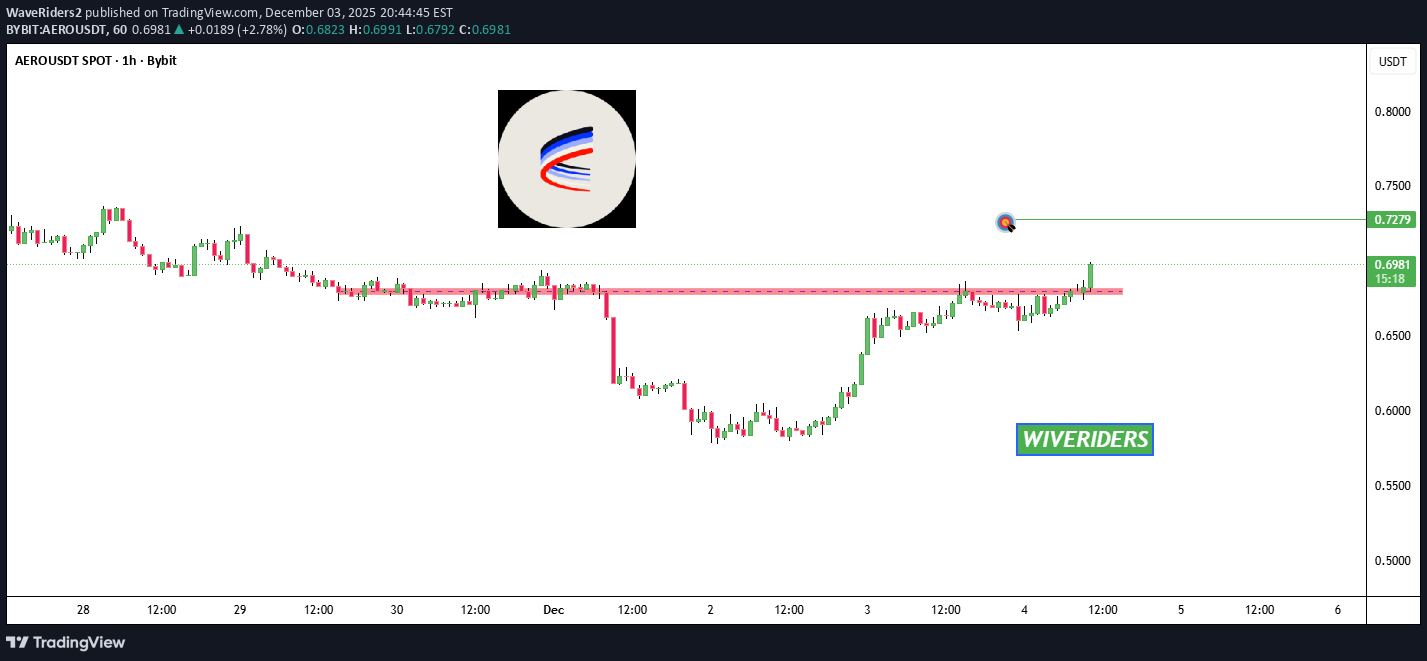

WaveRiders2

WaveRiders2

WaveRiders2

WaveRiders2

ElliottWavePro

سقوط آزاد آیرودروم (AERO): پایان بازی و رسیدن به کف قیمتی ۰.۴۱ دلار!

🔻 AERODROME (AERO) – Bearish Elliott Wave Breakdown AERO is moving exactly in line with a large W–X–Y–X–Z corrective pattern 📉, and price is now rolling over from the latest B-wave rejection. This breakdown strongly suggests the final Z-wave C-leg is unfolding, with bearish momentum strengthening and every bounce getting weaker 🚫📈. The structure continues to respect corrective symmetry, and the market has failed to reclaim key B-wave Fib zones — classic bearish continuation behavior. The downside roadmap is clear and Fibonacci levels now become the key magnets 🎯👇: 🔹 1.382 extension → ~$0.4985 🔹 1.618 extension → ~$0.4094 Both align perfectly with typical Z-wave depth and prior corrective proportions. No bullish divergence, no impulsive reversal signs, and no reclaim of lost structure — meaning sellers still have full control 🟥💪. As long as AERO continues printing lower highs + lower lows, the bearish bias stays firmly intact. This makes the $0.50 → $0.41 zone the main expectation area for a potential macro bottom or reaction bounce 📌. Until then, trend remains down, momentum favors sellers, and the Fib cluster below is the primary target zone. ⚠️ Bias: Bearish 🎯 Targets: $0.50 → $0.41

ElliottWavePro

صعود فضایی AERO: آیا کف قیمتی شکل گرفته است؟

Aero is now resting on a long term trendline. The counts tell me that this is potential bottom.Price went below Y what I believed as end of correction. Will recount once I get clarity.

sladkamala123

AERO: راز رسیدن به قیمت 1.60 USDT چیست؟ (تحلیل صعودی کلیدی)

Bullish Scenario For the uptrend to continue, the following must happen: Hold support at 0.83 or 0.5577 Break above: 1.00 1.2113 (the key signal for a trend reversal) Targets in a bullish continuation: Target 1 → 1.00 USDT Target 2 → 1.21 USDT Target 3 → 1.40 USDT Target 4 → 1.60 USDT (only in a strong bullish trend)

WaveRiders2

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.