تحليل التحليل الفني DECRYPTERS حول PAXG في رمز في 17/12/2025

DECRYPTERS

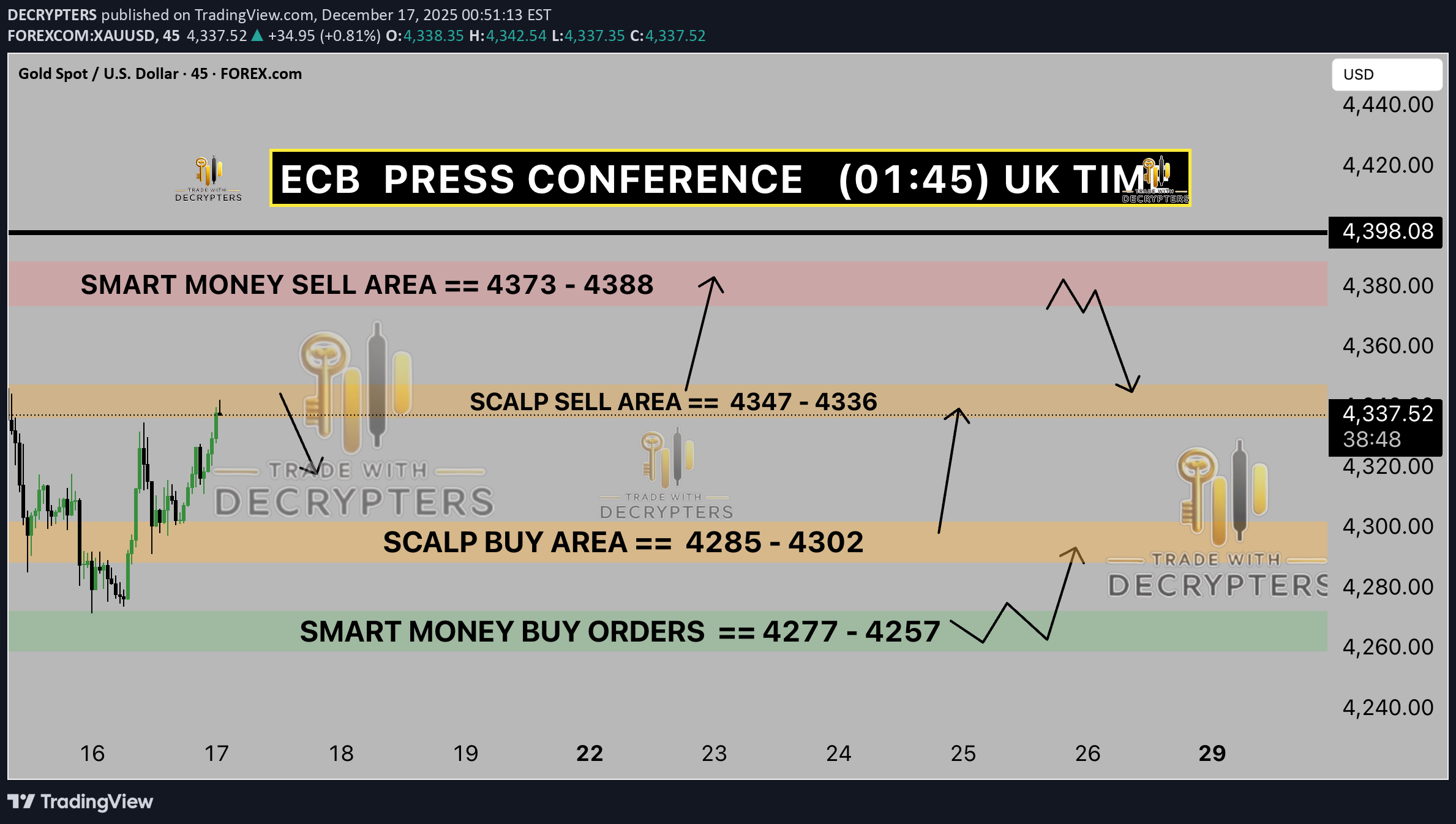

XAUUSD Gold Analysis: Bullish Above 4300 on Fed & CB Demand

XAUUSD GOLD ANALYSIS Gold Stays Resilient as Global Uncertainty and Central Bank Demand Intensify (December 17, 2025) Welcome back to Trade with DECRYPTERS 🔍📈 📊 Market Overview 🇺🇸 U.S. markets closed mixed on December 16 as a stronger than expected yet still weak November jobs report reinforced a slowing labor outlook and cooled expectations for aggressive Federal Reserve rate cuts in 2026. 📉 The Dow and S&P 500 declined for a third straight session, pressured by energy and healthcare stocks, while selective technology gains helped the Nasdaq edge higher. 🛢️ Oil prices fell to multi year lows, signaling softer global demand. 🟡 Gold traded volatile and eased slightly on profit taking, though rising unemployment continued to provide underlying support. Overall market conditions stayed restrained heading into year end, with focus shifting toward inflation data and upcoming Federal Reserve commentary. 🔑 Key Fundamentals 📈 Strong Trend Gold remains structurally bullish near record highs, up more than 60 percent year to date, and continues to hold above the 4300 level. 🏦 Central Bank Demand Ongoing reserve accumulation, with approximately 900 tonnes expected in 2025 from China, India, India, Turkey, and Poland, continues to provide a strong structural floor. 🏛️ Federal Reserve and Rates Multiple rate cuts in 2025, softer labor data, and lower real yields reduce the opportunity cost of holding gold. 💵 US Dollar Weakness The dollar index near 98.3 to 98.4 improves affordability for non US buyers and supports global gold demand. 📉 Bond Yields The US ten year Treasury yield near 4.19 percent remains capped by easing expectations, limiting competition from fixed income assets. 🔥 Inflation and Geopolitics Persistent inflation risks, tariffs, and global tensions continue to support safe haven demand. 📊 Investor Flows Gold ETF holdings remain near record levels around 3900 tonnes, while COMEX net long positioning remains bullish. 🌍 Geopolitical Landscape 🇺🇦 Russia and Ukraine Conflict Partial diplomatic progress exists, but ongoing fighting, rejected proposals, and sanctions driven funding pressures keep uncertainty elevated. Any peace agreement could cause short term pullbacks, yet lingering risks continue to support gold prices. 🇮🇱 Middle East Tensions Ceasefire progress in Gaza has reduced extreme volatility, but Iran Israel risks, proxy conflicts, and energy supply concerns keep gold supported as a hedge against broader escalation. 🇺🇸🇨🇳 United States and China Frictions Trade disputes, tariffs, and Taiwan related tensions reinforce global uncertainty. Historically, such periods have been supportive for gold demand. 🌐 De Dollarization and Global Risk Central bank diversification and the shift toward a multipolar system continue to strengthen long term structural demand for gold. ⚖️ Risk On and Risk Off Snapshot 🟡 Gold remains resilient near 4320 to 4325 and continues to hold above the 4300 level. 📉 US ten year yields around 4.15 to 4.16 percent support non yielding assets like gold. 💵 The dollar index near 98.2 to 98.3 remains at multi month lows, boosting gold demand. 📈 Equities stay elevated with the S&P 500 near 6800, while gold has decoupled from equities in 2025. 📊 Volatility remains subdued with the VIX near 15 to 16, supporting trend stability. 👥 Labor market softening with unemployment near 4.6 percent adds mild risk off support. 📌 Overall implication Risk off conditions favor upside. Risk on recoveries or rebounds in the dollar and yields may trigger temporary pullbacks, but downside remains limited. 📰 Key Insights from Credible Sources 📉 Ultra low interest rate expectations remain bullish for gold through reduced real yields and a weaker dollar. 🟡 Speculation around revaluing US gold reserves continues to support long term bullish sentiment and monetary reset narratives. 🏦 Discussions around transparency and audits of US gold reserves have coincided with strong upside momentum in prices. 🌍 Tariff driven stagflation and recession risks reinforce gold’s role as a hedge, with historical outperformance during trade uncertainty. 🏛️ A dovish Federal Reserve bias indirectly supports gold through easier financial conditions. ✅ Conclusion 🟡 Gold continues to maintain a structurally bullish bias above the 4300 level, supported by policy uncertainty, softer labor conditions, and persistent geopolitical risks. Central bank accumulation, dollar weakness, and capped bond yields continue to outweigh short term profit taking pressure. 📈 While easing geopolitical tensions or renewed risk on sentiment could trigger temporary corrections, downside remains limited under the current macro framework. Gold’s decoupling from traditional intermarket relationships in 2025 highlights its evolving role as a strategic hedge. The broader outlook favors sustained strength into year end and 2026. 🙌 Support the Analysis 👍 Like the post 💬 Comment your key levels 📈 Share your charts with the community Let’s grow together 🚀 Best Regards M. Moiz Khattak Founder 🟡 TRADE WITH DECRYPTERS 📊