تحليل التحليل الفني ICHIMOKUontheNILE حول PAXG في رمز في 8/11/2025

ICHIMOKUontheNILE

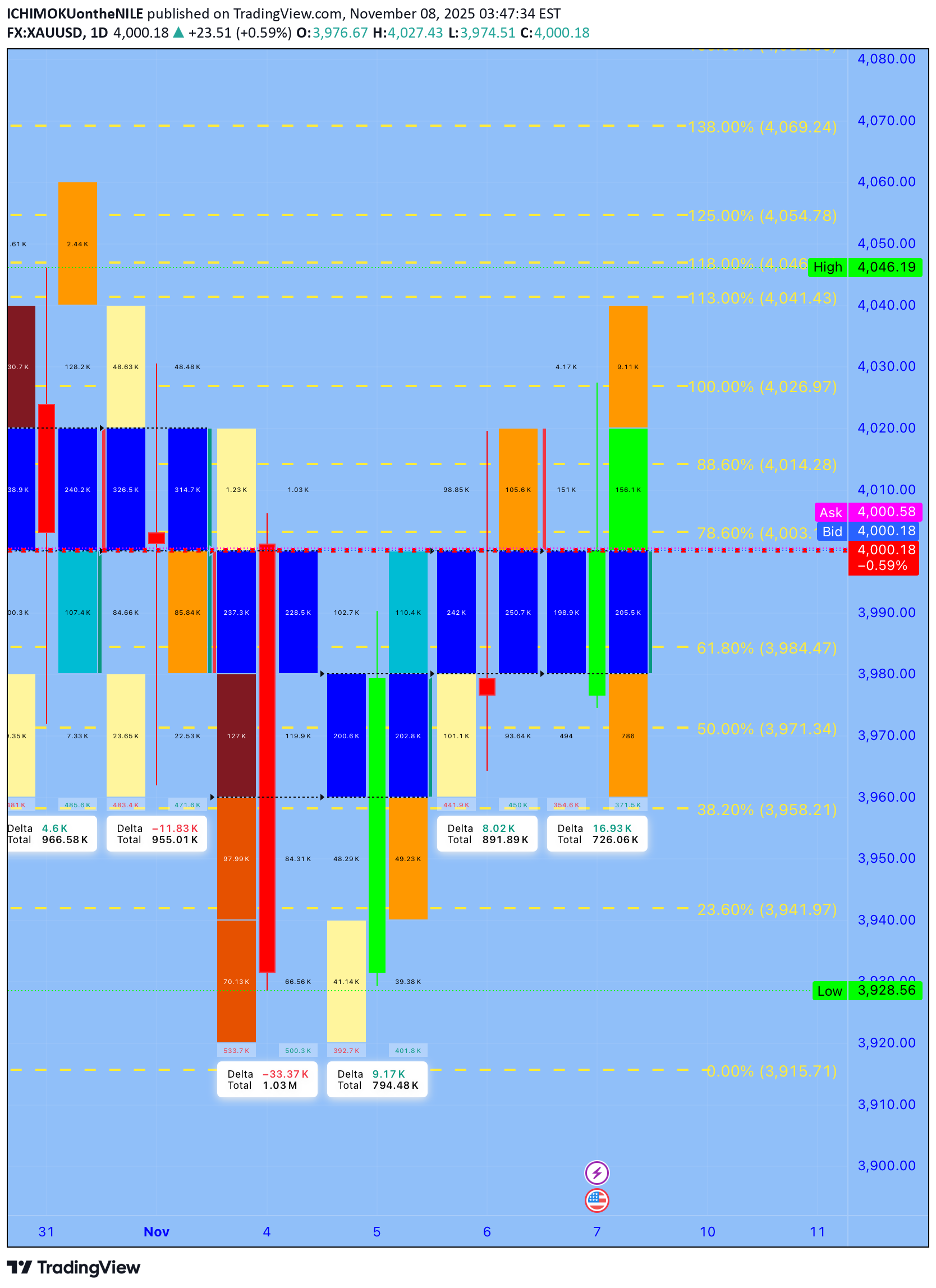

تحلیل هفتگی طلا (XAUUSD): نقشه راه حرکت قیمت در محدوده 4000 دلار!

📘 EDUCATIONAL ONLY — NOT FINANCIAL ADVICE All times Africa/Cairo (UTC+2). Report time: Sat, 08 Nov 2025 — 10:09 🟡 YALLA XAUMO — GOLD (XAUUSD) | Weekly Institutional — COMPREHENSIVE (Approved Protocol) Spot ref: 4,000.18 • GC1 (front): 4,009.8 • GC2 (next): 4,043.3 → Term spread (XCM): +0.84% → Contango — GC futures curve explainer — • Contango → GC2 > GC1 (normal upward curve; storage/carry is priced in; not bearish by itself). • Backwardation → GC2 < GC1 (near-term demand/supply stress; often bullish spot impulse). • Term spread (%) → (GC2 − GC1) / GC1 × 100 → shows curve slope/steepness. ──────────────────────────────────────────────────────────────────── 1) SNAPSHOT & MAP (W1 focus, using your attached GC1/GC2 & XAUMO boards) • State: Balanced / Sideways around 4,000 handle (POC ≈ 4,000–4,001). • Boxed range (cash): 3,976–4,027 (VA Low ≈ 3,988–3,990; VA High ≈ 4,010–4,012). • Immediate inflection: 4,010 (accept above → 4,027/4,034), 3,996 (accept below → 3,983/3,976). • Weekly VWAP bias: flat-to-slightly up; value building near 4,000. 2) XGM GATE MAP (where the week tends to open) • Above 4,010 gate → bullish distribution to 4,027 → 4,034/4,043. • Below 3,996 gate → bearish rotation to 3,983 → 3,976 → 3,965. • Inside 3,996–4,010 → fade the extremes back to POC (4,000 ±). 3) GC FUTURES STRUCTURE (Daily) • GC1 ~4,009.8, GC2 ~4,043.3 → mild contango (+0.84%) consistent with carry; no squeeze signal by structure alone. • Basis vs spot ~ +0.24% (spot 4,000.18) → curve not pressuring immediate spot dislocation. 4) FIB-KICKER / VOLUME MATRIX (from your boards) • Pullback magnets: 61.8% ≈ 4,004; 88.6% ≈ 4,010. • Extension magnets: 118% ≈ 4,031–4,034; 138–150% ≈ 4,056–4,075 (stretch if RVOL expands). • Volume note: rotation pockets inside 3,996–4,010; outside requires RVOL > 1.1 to sustain. 5) ICHIMOKU REGIME TABLE (directional read) • 4H: Bullish continuation, “retracement in progress.” • 1H: Mixed / tactical bearish on dips; flips bullish only above 4,012–4,016 acceptance. • 15m/5m: Buy-the-pullback bias into 4,010 when momentum > EMA(9/21). 6) VALUE MAP (POC/VAL/VAH/VWAP) • POC ~ 4,000–4,001 • VAL ~ 3,988–3,990 • VAH ~ 4,010–4,012 • WVWAP ~ flat ≈ 4,001 • Interpretation: Acceptance above VAH unlocks 4,027/4,034; failure at VAH reverts to POC then VAL. 7) XAUMO TREND MAP (confidence %) • Weekly: Sideways-up (58%) • 4H: Gentle up (55%) • 1H: Neutral→up only above 4,012 (48% below / 56% above) • 15m: Up on RVOL>1 / EMA9>EMA21 (60%) 8) KICKER PROJECTIONS (what good looks like) • Bull path: Probe 4,004 → reclaim 4,010 → build above → 4,027 → 4,034/4,043. • Bear path: Lose 3,996 → 3,988 → 3,983/3,976 → stretch 3,965 if RVOL>1.2. 9) SESSION BIAS TABLE (London/NY execution tips) • London Open (LO): Fade early sweep toward 3,996/3,988, target mean (4,000) or VAH (4,010) if momentum confirms. • pre-NY: If VAH holds support, squeeze to 4,027; if VAH rejects, short back to 4,000 → 3,996. • NY Main: Break-and-hold above 4,012 tends to run stops to 4,027/4,034; miss = chop back to 4,000. 10) CROSS-ASSET HEATMAP (from your watchlist snapshot) • VIX ~19 (calm-ish but reactive) • US30 +0.09% • NASDAQ −0.35% • XAU/EUR +0.44% • Read: Mild equity softness + steady VIX = supportive on dips if DXY doesn’t spike. 11) LIQUIDITY MAP (where stops likely sit) • Tops: 4,012–4,016 (acceptance flip), 4,027, 4,034/4,043. • Bottoms: 3,996, 3,988, 3,983, 3,976, 3,965. 12) ECON-AWARE NOTES (weekly posture) • With curve in mild contango and cash boxed at 4,000, news shocks likely decide who wins 3,996 vs 4,010. • Plan: Execute technicals; expand size only when RVOL > 1.1 and ADX (LTF) rises. 13) EXECUTION CHECKLIST [ ] HTF bias aligned? (Weekly/4H not fighting your 15m idea) [ ] Above/below gate (4,010 / 3,996) decided? [ ] RVOL > 1.1 and 9>21 EMA on entry TF? [ ] SL1 = structure + ATR(15m)×0.6; SL2 (tailgate) trails behind EMA21/VWAP band [ ] Partial at TP1; move SL1 to BE once +0.75R; trail SL2 14) TRADE SCENARIOS (examples; educational only) A) Swing (weekly box breakout) • Long 4,012–4,016 acceptance, SL1 4,004, SL2 trail 21-EMA(15m) • TP1 4,027, TP2 4,034 (runner 4,043) • Probability: 62% if RVOL > 1.1 and 1H flips up • Alt (reversal): Short 3,996 break & hold, SL1 4,004, TP1 3,988, TP2 3,976 (prob 55%) B) Edge-Fade (inside the box) • Short 4,010–4,012 rejection (bear wick / delta stall), SL1 4,016, TP1 4,000, TP2 3,996 • Long 3,988–3,996 absorption, SL1 3,983, TP1 4,000, TP2 4,010 • Probability: 58% while range persists; stand down when RVOL expands >1.2 C) Scalping (5m→15m calibrated) • Long on pullback to 4,001–4,004 with EMA9>21 & RVOL line up, SL1 3,997, TP1 4,008, TP2 4,012 • Short on fail back under 3,999 with EMA9<21, SL1 4,003, TP1 3,994, TP2 3,990 • Use SL2 tailgate once +0.6R; max hold 3–5 bars D) Continuation (momentum burst) • Above 4,027 with footprint expansion → quick run 4,034 then 4,043 • Below 3,983 with RVOL>1.3 → 3,976 then test 3,965 • Manage with SL2 trailing behind micro-swings 15) RISK MANAGEMENT (XAUMO style) • Position tiering: ½ size inside 3,996–4,010; full size only after acceptance outside the box with RVOL>1.1. • SL1 = structure+ATR buffer; SL2 = tailgate trail. If TP1 hit → lock BE, trail for TP2. • No add-ons if ADX(15m) falling and RVOL<1.0. ──────────────────────────────────────────────────────────────────── ARABIC QUICK SUMMARY (ملخص عربی) • السوق متوازن حوالین 4000. البوابة لفوق 4010–4012، وتحت 3996. • سیناریو الشراء: تثبیت فوق 4012 → 4027 ثم 4034/4043. • سیناریو البیع: کسر 3996 → 3988 ثم 3976. • إدارة المخاطرة: SL1 هیکل + ATR، و SL2 تریل ورا EMA/VWAP. خُد جزء عند TP1 وحرک الباقی BE. FRENCH QUICK SUMMARY (Résumé) • Marché neutre autour de 4000. Portes: 4010–4012 (haussier) / 3996 (baissier). • Achat: acceptance > 4012 → 4027 puis 4034/4043. • Vente: rupture < 3996 → 3988 puis 3976. • Risque: SL1 structure + ATR, SL2 suiveur; prendre TP1 puis basculer BE. 🏆 Winners trade with XAUMO