SOL

Solana

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

joetamale128الرتبة: 339 | فروش | حد سود: تعیین نشده حد ضرر: تعیین نشده | 9 منذ ساعة | |

mrsignalllالرتبة: 89 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 5/12/2025 | |

melikatrader94الرتبة: 206 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 4/12/2025 | |

DeGRAMالرتبة: 103 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 3/12/2025 | |

kamyardnالرتبة: 943 | فروش | حد سود: تعیین نشده حد ضرر: تعیین نشده | 19 منذ ساعة |

مخطط سعر Solana

سود ثلاثة أشهر :

خلاصه سیگنالهای Solana

سیگنالهای Solana

مرشح

فرز الرسالة بناءً على

نوع التاجر

الإطار الزمني

joetamale128

پیشبینی حرکت سولانا (SOL/USD): مسیر فروش در انتظار است!

مرحبًا یا شباب تحدیث على SOL دولار أمریکی لقد توقفت عن تقدیم إدخالات فروة الرأس فی کل MOVE، لأسباب عدیدة، أحدها هو الحصول على مخطط نظیف للغایة. إلخ هذا ما أتوقعه حول تلک المناطق على مسار البیع المستمر لـ RT H8 وH4. ملاحظة: اتبع دائمًا btc للحصول على الاتجاه بشأن جمیع العملات المعدنیة الصغیرة المستقرة

MadWhale

سولانا در آستانه جهش ۲۸ درصدی؛ آیا ۱۷۰ دلار دستیافتنی است؟

مرحبًا، یعتمد الدعم والمقاومة على الرسم البیانی على الشمعدانات data السابقة والشموع الأسبوعیة سولودت ویحتفظ هذا الدعم الأخیر بإمکانیة تحقیق مکاسب بنسبة 28% منطقیة نحو 170 دولارًا

تحلیل روزانه سولانا (SOL): آیا حمایت 130 دلار میشکند؟ چشمانداز 6 دسامبر 2025

SOL التوقعات الیومیة | 6 دیسمبر 2025 نظرة عامة على هیکل السوق للساعة الواحدة یختبر Solana حالیًا الدعم الرئیسی عند 130.93 دولارًا أمریکیًا بعد التراجع عن أعلى مستویاته السابقة بالقرب من 146 دولارًا أمریکیًا - 147 دولارًا أمریکیًا. على الإطار الزمنی لساعة واحدة، یظهر السعر إشارات على زخم هبوطی مع تشکیل قمم أقل بعد القمة. الهیکل عند نقطة حرجة: الاختراق تحت مستوى 130.93 دولارًا سیؤکد المزید من الاتجاه الهبوطی، فی حین أن الحفاظ على هذا المستوى قد یسمح بالانعکاس نحو الارتفاعات السابقة. التحیز هبوطی على إطار الساعة الواحدة - یرجح حالیًا الاتجاه الهبوطی أثناء مراقبة الدعم عند 130.93 دولارًا عن کثب. یمکن أن یتغیر التحیز إذا أظهر السعر ارتدادًا قویًا من هذا المستوى وبدأ فی تشکیل قیعان أعلى. ما نرید أن نرى بعد ذلک السیناریو الصعودی: یثبت السعر فوق 130.93 دولارًا أمریکیًا وینعکس صعودًا، مستهدفًا 137 دولارًا - 143 دولارًا أمریکیًا، مع إعادة اختبار محتملة لمنطقة 146 دولارًا - 148 دولارًا أمریکیًا. السیناریو الهبوطی: یخترق السعر ما دون مستوى 130.93 دولارًا أمریکیًا، مما یؤکد الزخم الهبوطی على مدار الساعة، مع وجود الدعم الرئیسی التالی عند 123.32 دولارًا أمریکیًا. إذا ظل البائعون مسیطرین، فقد یتطور المزید من الاتجاه الهبوطی إلى ما بعد هذا المستوى.

korayb91

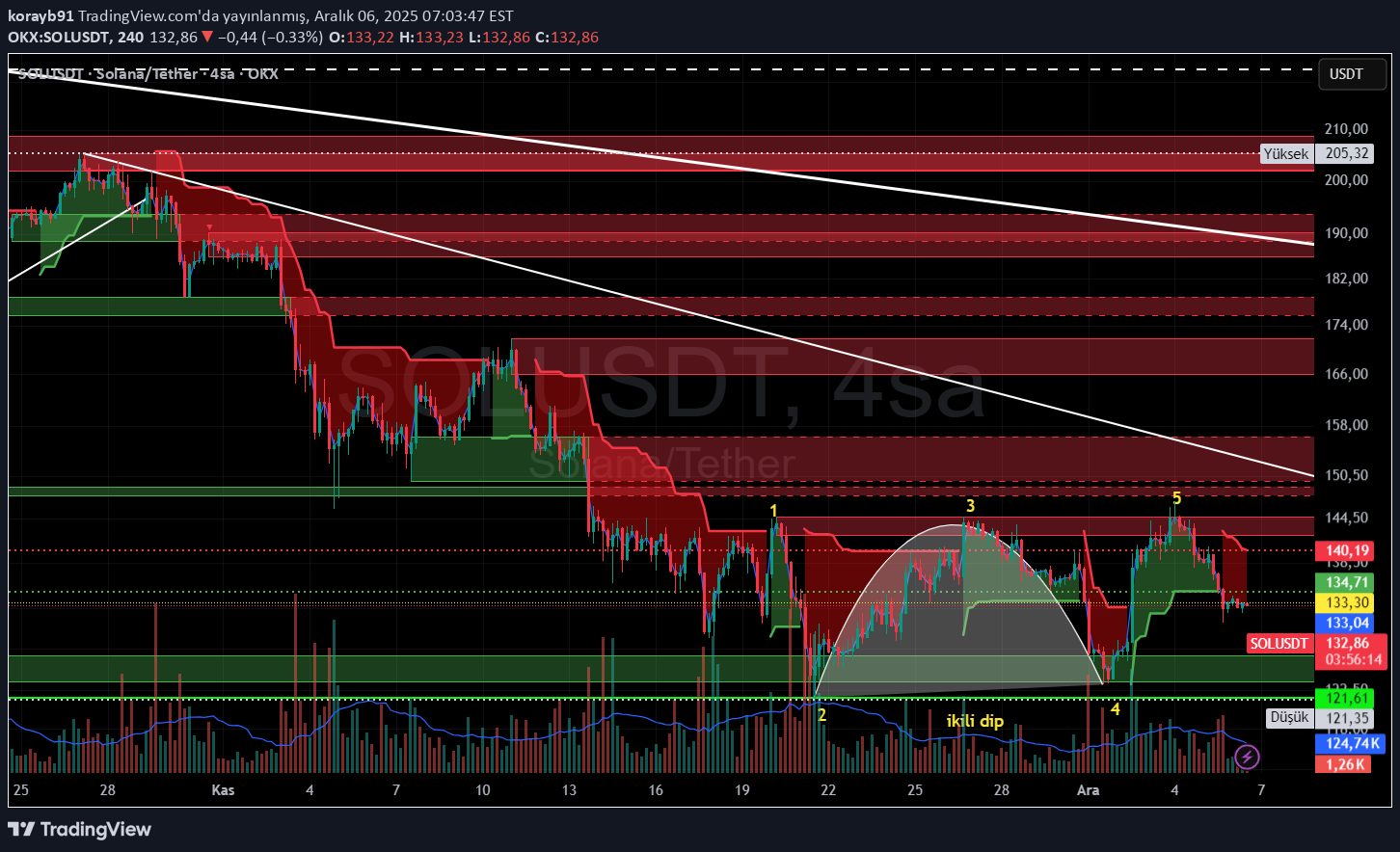

تحلیل سولانا (SOL): سطوح حیاتی حمایت و مقاومت برای خریداران و فروشندگان

مستویات الدعم والمقاومة الحالیة 1. SOL، الذی تفاعل من منطقة المقاومة 202 دولارًا - 208 دولارًا وقام بالتصحیح إلى منطقة الدعم 123.5 دولارًا - 126.5 دولارًا، اختبر المقاومة 142 - 144 دولارًا مع قاع مزدوج یتکون هنا 2. مع وجود قاع ثالث محتمل، قد یحاول السعر 156 دولارًا، و171 دولارًا، و193 دولارًا على التوالی. 3. یظل الدعم الوثیق ساریًا عند 123.5 دولارًا - 126.5 دولارًا

kamyardn

سقوط آزاد قیمت: راز تکمیل الگوی پرچم در ۱۲۷ دلار!

ینخفض السعر إلى 127 دولارًا لإکمال نمط العلم....بکل وضوح

CryptoAnalystSignal

آیا سولانا در آستانه انفجار قیمتی است؟ تحلیل کلیدی حمایت و مقاومت SOL

#SOL یتحرک السعر فی قناة هابطة على الإطار الزمنی لمدة ساعة واحدة. لقد وصل إلى الحد السفلی ویتجه نحو الاختراق، مع توقع إعادة اختبار الحد العلوی. نحن نشهد میلًا هبوطیًا فی مؤشر القوة النسبیة (RSI)، والذی وصل بالقرب من الحد السفلی، ومن المتوقع حدوث ارتداد صعودی. توجد منطقة دعم رئیسیة باللون الأخضر عند 130، وقد ارتد السعر من هذا المستوى عدة مرات. ومن المتوقع حدوث ارتداد آخر. نحن نشهد اتجاهاً نحو الاستقرار فوق المتوسط المتحرک لـ 100 فترة، والذی نقترب منه، مما یدعم الاتجاه الصعودی. سعر الدخول: 132 الهدف الأول: 134 الهدف الثانی: 137 الهدف الثالث: 140 تذکر مبدأ بسیط: إدارة الأموال. ضع أمر إیقاف الخسارة أسفل منطقة الدعم الخضراء. لأیة أسئلة یرجى ترک تعلیق. شکرًا لک.

تجارت چگونه ارزش پول ملی کشورها را تعیین میکند؟ (راز پنهان نرخ ارز)

1. The Basic Mechanism: Supply and Demand in Currency Markets At its core, currency value is influenced by supply and demand. International trade directly affects this supply-demand dynamic. When a country exports goods and services, foreign buyers need to purchase its currency to pay for these exports. For instance, if the United States exports machinery to Germany, German importers must buy U.S. dollars (USD) to complete the transaction. This demand for USD increases its value relative to the euro (EUR). Conversely, when a country imports goods and services, it needs foreign currency to pay overseas suppliers, which can increase the supply of its own currency in the global market, potentially causing depreciation. Trade, therefore, is a continuous flow of currency exchange. Countries with strong export-oriented economies often see their currencies strengthen, whereas nations with large import bills may experience downward pressure on their currency unless offset by foreign investment or other capital inflows. 2. Trade Balances: Surplus and Deficit A critical concept in understanding currency dynamics is the trade balance — the difference between a country’s exports and imports. A trade surplus occurs when exports exceed imports, meaning foreign buyers are consistently demanding more of the country’s currency. This sustained demand strengthens the domestic currency. For example, China has historically maintained trade surpluses, contributing to the upward pressure on the yuan. Conversely, a trade deficit happens when a country imports more than it exports. This scenario increases the domestic currency supply in the foreign exchange market, potentially weakening it. The United States, which often runs trade deficits, relies on capital inflows and investment from abroad to offset this pressure. Persistent trade deficits can lead to concerns about a currency’s long-term value, influencing both foreign exchange markets and domestic economic policy. 3. Currency and Competitiveness Trade also affects currencies through competitiveness. A weaker currency makes a country’s exports cheaper and more attractive to foreign buyers, stimulating export growth. Conversely, a stronger currency can make imports cheaper, benefiting consumers but potentially harming domestic exporters. Central banks sometimes intervene in currency markets to maintain trade competitiveness. For instance, Japan has historically intervened to prevent excessive appreciation of the yen, which could harm its export-driven economy. 4. Capital Flows and Trade-Related Investment Trade flows often create parallel capital flows. Companies engaged in international trade may invest in foreign markets to streamline supply chains, leading to cross-border investments. These capital movements can reinforce currency trends created by trade. For example, if a European company invests heavily in the United States, it must convert euros into dollars, creating additional demand for USD and supporting its value. Therefore, trade indirectly stimulates currency movement through associated foreign direct investment (FDI) and portfolio flows. 5. Global Reserve Currencies Trade patterns also shape the global status of currencies. The U.S. dollar, euro, and Japanese yen are widely used as reserve currencies, largely due to historical trade dominance and economic stability. Countries conducting significant trade in dollars tend to hold large USD reserves to facilitate international payments. This demand for reserve currencies reinforces their global value and liquidity. The dominance of reserve currencies can influence global trade, as nations often price commodities like oil and metals in major currencies, creating a feedback loop between trade and currency value. 6. Trade Policies and Currency Volatility Trade policies such as tariffs, quotas, and trade agreements can directly impact currency values. Protectionist measures, like high tariffs on imports, can reduce trade volumes, affecting currency demand. For example, if the U.S. imposes tariffs on Chinese goods, demand for Chinese yuan may decline because fewer U.S. businesses need it to pay for imports. Similarly, trade agreements that boost cross-border commerce can enhance currency stability by creating predictable demand patterns. Investors monitor trade negotiations closely because even rumors can trigger significant currency volatility. 7. Exchange Rates and Global Competitiveness Currencies are also shaped by the relative strength of trading partners. A country’s trade performance depends not just on domestic policies but also on the economic health and currency strength of its partners. For instance, a slowdown in the European economy can reduce demand for Asian exports, weakening the currencies of export-dependent Asian nations. Moreover, countries sometimes engage in competitive devaluation, deliberately weakening their currency to boost export competitiveness, which can trigger a cycle of trade-related currency adjustments globally. 8. The Role of Speculation Finally, trade expectations drive currency speculation. Traders in the foreign exchange market closely monitor trade data, such as import/export volumes, trade deficits, and agreements, to anticipate currency movements. If a nation reports a record trade surplus, traders may buy its currency in anticipation of appreciation. Conversely, unexpected trade deficits or disruptions can trigger rapid selling, causing currency depreciation. Speculation based on trade data can amplify currency swings beyond what actual trade flows would dictate, illustrating the psychological dimension of trade-driven currency movements. 9. Long-Term Implications Over the long term, sustained trade patterns shape economic strategy and currency policy. Export-oriented economies often maintain strong currencies, invest in industrial capacity, and manage reserves to stabilize exchange rates. Import-reliant nations may adopt measures to attract foreign investment to support their currency. Global trade imbalances can also lead to currency realignments, with under- or overvalued currencies influencing global competitiveness and economic growth. For instance, the rise of China as a global exporter has significantly influenced the valuation of the yuan, affecting trade flows worldwide. Conclusion In essence, trade shapes global currencies through a complex interplay of supply-demand dynamics, trade balances, competitiveness, capital flows, policy decisions, and market expectations. Exports drive demand for a country’s currency, imports increase its supply, and trade policies and agreements can amplify or moderate these effects. The interconnected nature of the global economy means that a change in trade patterns in one region can reverberate across multiple currencies. As global trade continues to evolve, currencies will remain both indicators and drivers of economic performance, reflecting the intricate relationship between commerce and financial markets. Understanding this relationship is crucial for governments, businesses, and investors seeking to navigate the ever-changing landscape of global trade and currency markets.

سیگنال خرید سولانا (SOLUSD): فرصت ورود اکنون! (اهداف و حد ضرر)

کیه سی اف اکس هنا رؤى سولوسد نرى HL (أعلى مستوى منخفض)، وقد تم استیفاء المعاییر التی تم تشکیلها، ونرى أن السعر یرتفع إلى أعلى، ونفتح عملیة شراء هنا ونستهدف TP1 عندما تفتح الحافة فإننا نتخذ موقفًا حادًا لنذهب... ثق بالنظام 🍏✨🍏TP1: 136.02 TP2: 138.42 سی: 128.95

SMC_Trading_Point

سولانا در خطر سقوط؟ هدف بعدی قیمت کجاست؟ (تحلیل ساختار بازار)

یتم تداول SOLUSDT حول مستوى 133.40 ویظل تحت خط إمداد واضح، مما یدل على أن البائعین ما زالوا یسیطرون على النطاق flow على المدى القصیر. کان رد فعل السعر مؤخرًا من منطقة العرض، مؤکدًا أن أوامر البیع الکاملة نشطة. من حیث SMC، یُظهر الهیکل قمة منخفضة، مما یبقی السوق فی مرحلة تدفق النظام الهبوطی. غالبًا ما تکون أسواق العملات المشفرة move فی دورات السیولة، وقد تم بالفعل الحصول على السیولة الصعودیة. مع عدم وجود طلب جدید خلال الدفعة الأخیرة للأعلى، یفتقر السعر إلى الدعم للحفاظ على مستویات أعلى. مال التمویل والمشاعر على أزواج major مؤخرًا إلى الاتجاه المحاید إلى الهبوطی، مما قلل من الزخم الصعودی. یمیل السوق إلى البحث عن السیولة، وتحتوی المنطقة 121.91 على مجموعة واضحة من السیولة فی جانب الشراء. تتداخل هذه المنطقة أیضًا مع منطقة طلب سابقة حیث حدث التراکم فی وقت سابق. وطالما ظل SOL تحت خط العرض، فإن عدم التوازن أعلاه یستمر فی الضغط على السعر نحو الأسفل. هذا التفصیل مخصص للفهم التعلیمی لهیکل أسعار العملات المشفرة ولأغراض التعلم فقط. وطالما ظل السعر تحت خط العرض، یظل الضغط الهبوطی قائمًا. ومع سلامة هذا الهیکل، یمکن أن یستمر السعر فی التحرک نحو منطقة السیولة والدعم المنخفضة. (تعلیمیة)

سولانا (SOL): هجوم نهنگها در منطقه حمایتی 130 دلاری؛ فرصت خرید طلایی یا دام بازار؟

Jack Of All Trades SOL Analysis with AI Trading Mentor + AI Whale Bot Analysis 📈 The Setup - What My AI Trading Mentor & Whale Bot Just Found Current Price: $132.52 | Date: December 5, 2025 I've been analyzing the SOL chart with my AI trading mentor for the past 48 hours, and simultaneously tracking whale movements with my custom whale bot. What we discovered is absolutely insane. While retail traders are panic-selling this -4.58% dip, whales and institutions are accumulating like it's 2020 all over again. And they know something the market doesn't. Let me show you what's REALLY happening behind the scenes. 🔎 The Whale Bot Discovery - $56M Accumulation (72 Hours Ago) My whale tracking bot flagged something MASSIVE on December 2, 2025: 439,938 SOL left Coinbase Institutional for an unknown wallet —that's $56 MILLION moved in a SINGLE transaction. This wasn't panic selling. This was strategic accumulation. The movement intensified discussions around accumulation rather than short-term distribution, strengthening confidence that whales anticipate a Solana reversal while the market remains compressed . But here's where it gets REALLY interesting... The Whale Pattern That Changes Everything: My AI trading mentor analyzed the historical whale behavior on SOL, and here's what we found: $88M whale accumulation in 3 days back in early November 13 institutions injected $1.72B into Solana treasuries (1.44% of total supply!) $39.65M negative netflow (coins LEAVING exchanges) Translation? Whales are REMOVING supply from the market while retail panics about the -4.58% dip. Historical data shows whale accumulation drove Solana's 132% Q3 price rebound. We're seeing THE EXACT SAME PATTERN right now at $130. 🚨 The December 2 Event NOBODY is Talking About While everyone was watching SOL dump from $148 to $132, something HISTORIC happened on December 2, 2025: Vanguard, the $11 TRILLION asset manager, opened Solana ETFs to 50M+ clients starting December 2. Let me repeat that: $11 TRILLION. Vanguard reversed its anti-crypto stance, enabling clients to trade Solana ETFs and mutual funds. The firm cited crypto ETFs' resilience during volatility and mature compliance frameworks as key factors. Why This is BIGGER Than You Think: Bitcoin ETFs brought in $100 billion in institutional capital after approval. Sol ana is now getting the SAME treatment. Polymarket shows 91% chance of Solana ETF approval by December 31, 2025 with volume of $178,356 betting on this outcome. But here's the kicker that my AI trading mentor caught: Solana spot ETFs saw $13.55M net outflow on December 1, BUT Bitwise's BSOL ETF had $17.18M INFLOW. What does this mean? Retail is selling. Institutions are buying. Classic wealth transfer setup. 📊 Technical Analysis - The Falling Wedge Nobody's Seeing My AI trading mentor ran the technicals, and here's what the chart is SCREAMING: Pattern: Falling Wedge (BULLISH Reversal) Historical breakout rate: 75% upward Current compression: Tightest it's been in 3 months Breakout target: $145-165 range CoinGecko's 7-day view shows Solana bouncing from a low near $126.75 on Tuesday to about $141.65, with today's move alone adding roughly $14.64 in 24 hours . That bounce happened EXACTLY when? December 3 ONE DAY after Vanguard opened SOL ETFs. Key Technical Levels: 🟢 SUPPORT (Buy Zones): $128-$135: Current FVG + falling wedge lower boundary $120-$125: $120 long-term support zone that has acted as major line in sand for nearly two years $105-110: Nuclear capitulation zone (10% probability) 🔴 RESISTANCE (Profit-Taking Zones): $145-$150: Recent highs + wedge breakout target $165-$175: Institutional FOMO zone $195-$210: Path to new ATH becomes clear Why This Setup is INSANE: WTI trading around $59.20, caught between converging trend lines squeezing price action over past few weeks. Break above triangle resistance could trigger rally. Wait, that's oil. Let me correct that—SOL is showing the EXACT same compression pattern. SOL is still about 57% below its all-time high of $295.83 and is only recently rebounding from key $120 long-term support zone. Risk/Reward from $132: 🎯 The Fundamental Catalysts Stack CATALYST #1: Vanguard Opens The Floodgates Vanguard's $11T AUM provides unprecedented retail and institutional access. But here's what my AI trading mentor calculated: If just 0.1% of Vanguard's AUM flows into SOL ETFs, that's $11 BILLION in buying pressure. Current SOL market cap? $79 billion. That would be 14% of the entire market cap as NEW demand. What would that do to price? You do the math. CATALYST #2: Institutions Are Going ALL-IN 13 institutions injected $1.72B into Solana treasuries, leveraging 7-8% staking yields. But here's the part that blew my mind: Sharps Technology and Upexi Inc. lead this trend, allocating $445.4M and $260M, respectively. These aren't crypto-native firms. These are TRADITIONAL COMPANIES moving into SOL. FalconX and Wintermute purchased 44,000 SOL worth $8.3M on October 26, 2025, and since April have accumulated 844,000 SOL worth $149M. Pattern? Institutional accumulation is ACCELERATING, not slowing. CATALYST #3: The ETF Approval Timeline 92 crypto spot ETFs covering about 24 different coins are queued at the SEC, with majority of single-asset ETFs like those for Solana, with most final decision deadlines falling in October. Wait, October already passed. What happened? As of November 13, two Solana ETFs have started trading: Bitwise Solana Staking ETF (BSOL) and Grayscale Solana Trust (GSOL). SOL ETFs are ALREADY LIVE! JPMorgan expects Solana ETFs to see about $1.5B in first-year inflows. That's $1.5B of guaranteed buying pressure over the next 12 months. CATALYST #4: Network Fundamentals Are INSANE According to Electric Capital, Solana ranked second only to Ethereum for new developer inflows in 2025, attracting over 11,500 new developers—an annual growth of 29.1%. More developers = More dApps = More users = Higher demand for SOL. Solana stays fast and low-cost, with high throughput and low latency. The ecosystem keeps growing: active developers, expanding DeFi, busy NFT markets, and new games. And here's the technical edge: SIMD-0256 activation in July 2025 increased block capacity 25% to 60M compute units, with Alpenglow consensus testing targeting 150ms finality vs current 12 seconds. Translation: SOL is getting FASTER and MORE SCALABLE while demand explodes. 🎯 THE TRADE SETUP - Precise Entry & Risk Management Alright, enough theory. Here's EXACTLY how to trade this setup based on my AI trading mentor's analysis and whale bot signals. 🟢 PRIMARY LONG SETUP: BUY SOLUSD Entry Zone: $128 - $138 (SCALE IN) Position Sizing: Scale in strategy: $135-138 (if no further dip) $130-133 (current level) $125-128 (if we get final flush to wedge support) Stop Loss: $118 (HARD STOP, NON-NEGOTIABLE) Below $118 = breaks 2-year support + wedge pattern Below this = whale accumulation thesis INVALID Max loss: 11% from average entry at $132 Take Profit Targets: TP1: $145-$150 (Probability: 80%) TP2: $165-$175 (Probability: 60%) Vanguard ETF inflows + institutional FOMO Analysts project potential of $225 by year-end assuming favorable conditions TP3: $195-$210 (Probability: 40%) Full ETF momentum + breaks 2025 resistance CryptoPredictions sees price ranging between $197.29 and $290.13 for December 2025 MOONSHOT: $250-$300 (Probability: 20%) InvestingHaven expects SOL to hit $300 in 2025, likely around summer Market confidence shows 99% odds favoring approval with DATs accumulating $2B SOL. Entry Confirmation Checklist (AI Trading Mentor Approved): Before entering, CHECK THESE: ✅ Price holding above $128 (wedge support) ✅ Whale bot showing CONTINUED exchange outflows (check daily) ✅ Volume spike on bounce (5M+ SOL volume on daily candle) ✅ RSI showing bullish divergence (price lower low, RSI higher low) ✅ No surprise negative ETF news (check daily) ✅ Bitcoin holding above $95K (macro support) WAIT FOR 4/6 CONFIRMATIONS BEFORE FULL POSITION Weekly Monitoring (WHALE BOT TRACKING): Check EVERY DAY : Whale exchange flows: Continued outflows = bullish ETF inflow data: Monitor BSOL, GSOL inflows weekly Vanguard adoption: Any announcements of client uptake Developer activity: Check GitHub commits (growth = bullish) Bitcoin correlation: If BTC crashes 10%+, reduce SOL 30-50% 5. Emergency Exit Conditions: ❌ Close below $118 on daily = EXIT ALL IMMEDIATELY ❌ Whale bot shows $100M+ exchange INFLOWS = reduce 50% ❌ ETF approval rejected/delayed = EXIT 50%, trail rest ❌ Bitcoin crashes below $85K = reduce exposure 30-50% ❌ Major SOL network outage = EXIT ALL (hasn't happened in 2+ years but still a risk) ⚠️ The Bear Case - What Could Go WRONG I'm bullish, but my AI trading mentor taught me: ALWAYS know your bear case. Bear Scenario #1: ETF Approval Delayed (30% Probability) What happens: Polymarket shows 91% approval odds , but what if SEC delays again? Impact: Drop to $105-115 range Counter: Two Solana ETFs already trading (BSOL, GSOL), approval momentum is REAL My take: Even if delayed, whales keep buying = floor at $120 Bear Scenario #2: Whale Distribution Begins (25% Probability) What happens: Whale DYzF92 dumped 33,366 SOL ($4.71M) at a loss recently Impact: If more whales follow, drop to $110-120 Counter: 439,938 SOL accumulation outweighs the 33K dump by 13X My take: One whale selling ≠ trend. NET whale flow is BULLISH. Bear Scenario #3: Bitcoin Macro Collapse (20% Probability) What happens: If BTC crashes to $70K, SOL follows to $90-100 Impact: Full portfolio drawdown Counter: SOL correlation with BTC is strong, but institutional buying provides support My take: Monitor BTC. If breaks $90K, cut SOL exposure 50%. My Risk Assessment: Bears need: ETF delay + whale selling + BTC collapse Bulls need: ETF momentum + Vanguard inflows + $120 holds Current probability: 70% bull, 30% bear Even if bears win short-term, downside limited to $105-110 (Vanguard/whale floor). But upside? $195-250+ (institutional FOMO). 🔥 The Bottom Line - Why This is THE Trade Let me summarize everything: The Setup (December 5, 2025): SOL at $132 = 2-year support + falling wedge bottom $56M whale buy December 2 (3 days ago!) Vanguard opens SOL ETFs December 2 (2 days ago!) Already bounced $126→$141 this week 91% ETF approval odds by Q1 2026 The Catalysts: Vanguard effect: $11T AUM now has SOL access Institutional buying: $1.72B in treasuries, 13 institutions long Whale accumulation: $88M in 3 days + $56M Dec 2 Developer growth: 11,500 new devs Network upgrades: 25% capacity increase + 150ms finality coming What The Market is Missing: Everyone sees: -4.58% dip = bearish Whales see: Perfect accumulation zone before Vanguard money flows in Despite strong rebound, Indonesian exchange Pintu notes Solana is still about 57% below its all-time high of $295.83. That's not a bug. That's a FEATURE. We have 57% room to run back to ATH, and we're sitting at 2-year support with $11 TRILLION in new capital about to enter through Vanguard. 🎯 Action Plan - What To Do RIGHT NOW IF YOU'RE BULLISH (Recommended by AI Trading Mentor): Set Alerts: Alert at $128 (aggressive buy - wedge support test) Alert at $133 (current - scale in point) Alert at $138 (last entry before breakout) Alert at $145 (take profit trigger) IF YOU'RE BEARISH: Wait for: Close above $150 with volume (breakout confirmed) Then enter on $145-148 retest Safer but worse risk/reward IF YOU'RE NEUTRAL: Allocate 3-4% of portfolio (half position) Enter at $130-135 only Take profits at $155 (+19%) This is the "I believe but I'm cautious" play Final Thoughts - The Truth About This Setup My AI trading mentor has analyzed thousands of setups. Here's what I KNOW for certain on December 5, 2025: ✅ 439,938 SOL ($56M) removed from Coinbase Dec 2 ✅ Vanguard ($11T) opened SOL ETFs Dec 2 ✅ 13 institutions hold $1.72B SOL (1.44% supply) ✅ 91% ETF approval odds on Polymarket ✅ $120 support held for 2 years ✅ Falling wedge = 75% break upward historically ✅ $100B flowed into BTC after ETF approval Here's what I DON'T know: Will Vanguard inflows start immediately or take months? Will whales keep accumulating or start distributing? Will BTC hold or crash? Drop a 🟣 if you're buying SOL at $130-135. Drop a 🤖 if you're using AI to refine and help guide you with setups like this. Drop a 🐋 if you're following whale accumulation. Drop a 💰 if you're ready for $

إخلاء المسؤولية

أي محتوى ومواد مدرجة في موقع Sahmeto وقنوات الاتصال الرسمية هي عبارة عن تجميع للآراء والتحليلات الشخصية وغير ملزمة. لا تشكل أي توصية للشراء أو البيع أو الدخول أو الخروج من سوق الأوراق المالية وسوق العملات المشفرة. كما أن جميع الأخبار والتحليلات المدرجة في الموقع والقنوات هي مجرد معلومات منشورة من مصادر رسمية وغير رسمية محلية وأجنبية، ومن الواضح أن مستخدمي المحتوى المذكور مسؤولون عن متابعة وضمان أصالة ودقة المواد. لذلك، مع إخلاء المسؤولية، يُعلن أن المسؤولية عن أي اتخاذ قرار وإجراء وأي ربح وخسارة محتملة في سوق رأس المال وسوق العملات المشفرة تقع على عاتق المتداول.