04.12.2025 tarihinde sembol ETH hakkında Teknik officialjackofalltrades analizi

آیا اتریوم در آستانه انفجار است؟ راز انباشت نهنگها و سطوح حیاتی قیمت ETH

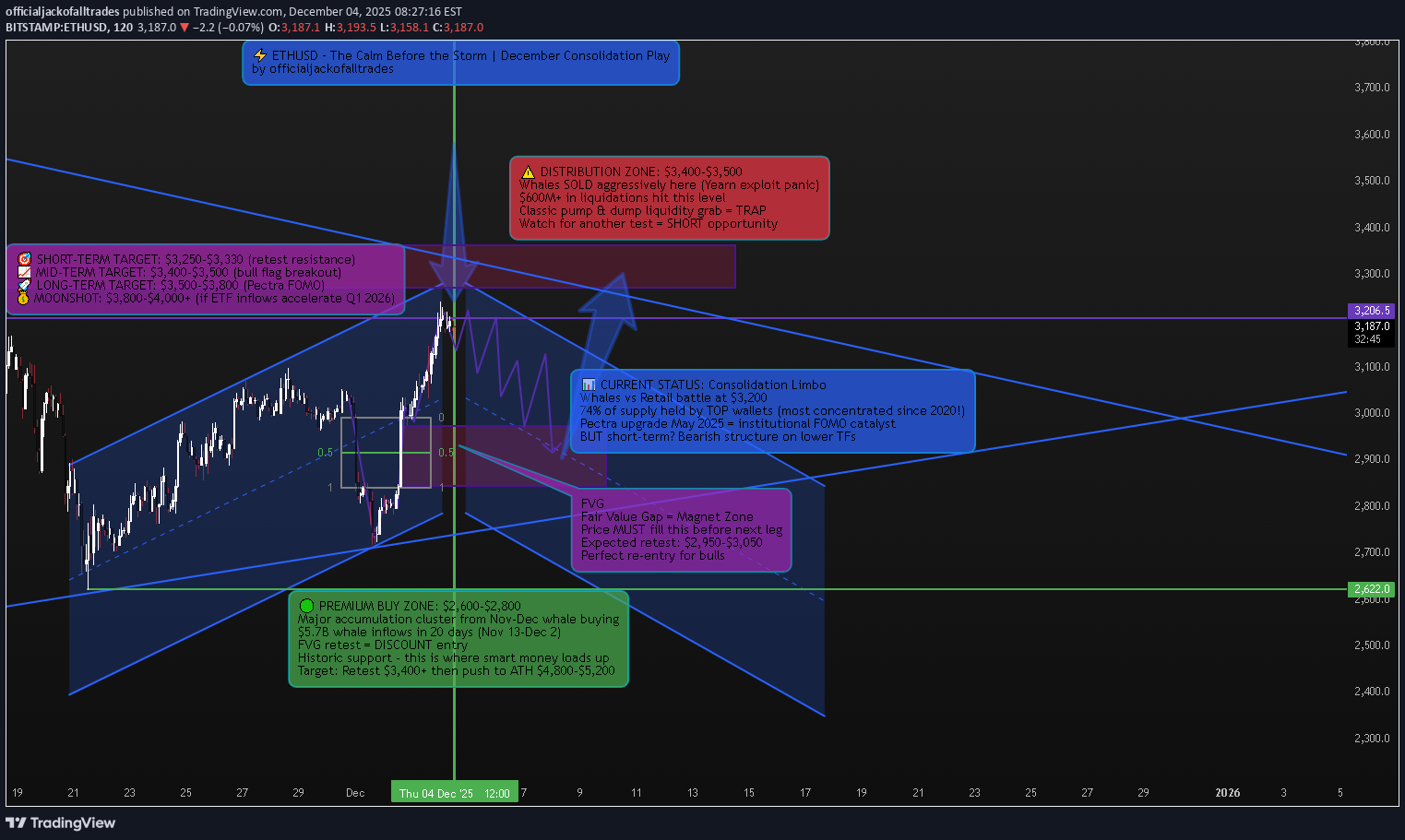

📈 Market Context – Why Everyone's Wrong About ETH Right Now Ethereum is sitting at one of the most deceptive price levels in crypto right now. Most traders see the recent dump from $3,762 on December 2 and think "it's over." Others see the consolidation around $3,208 and think "dead cat bounce." They're both missing the bigger picture. Here's what ACTUALLY happened: A 2015 Ethereum ICO wallet that had been inactive for a long time moved 40,000 ETH suddenly, worth around $120 million. Crypto Twitter panicked. But then Lookonchain verified that it was for internal transfer, and not a liquidation. Classic FUD. What REALLY tanked ETH? A Yearn Finance exploit that happened at the worst possible time, when the market was stretched by leverage and rising speculative positioning. More than $600 million in crypto liquidations hit the market. This wasn't an organic selloff—this was a leveraged washout. But here's the kicker: While retail was panic-selling, whales were accumulating like it's 2020 all over again. 🔎 Technical Framework – The Deceptive Calm Current State: Ascending broadening wedge inside rising channel—classic volatility compression before explosive move Key Liquidity Zones: 🔴 Distribution Liquidity Zone (SHORT Opportunity): $3,550 - $3,650 (recent spike high + whale distribution cluster) This is where whales moved 40,000 ETH at $120 million valuation before the "transfer" narrative Since December 2024, aggressive selling by whales has been evident in the rise of average market order sizes 🟢 Accumulation Liquidity Zone (BUY ORIGIN): $2,900 - $3,000 (FVG retest + November-December whale buy zone) From November 13 to December 2, whales acquired a total of 1,702,835.5 ETH at an average price of $5.7 billion In early 2025, large holders acquired over 330,000 ETH, valued at approximately $1.08 billion ⚖️ Chop Zone (NO TRADE ZONE): $3,100 - $3,400 (current consolidation limbo) This struggle between institutional investors and retail traders could define Ethereum's price action in the coming weeks 🐋 WHALE ACTIVITY – The REAL Story Nobody's Talking About While everyone's focused on the dump, let me show you what the ACTUAL data says: The Accumulation Phase (That Everyone Missed): Ethereum whale wallets have recorded positive netflows in each of the last 20 trading days, dating back to November 13 The highest single-day inflows of 2570 ETH came on November 14 when Gensler's exit was confirmed Ethereum ETFs attracted $2.63 billion in inflows in December 2024, led by the Fidelity Ethereum Trust The Concentration Effect (This is MASSIVE): Over the past four months, Ethereum's Gini coefficient increased from 0.7563 in September to 0.7630 in December 2024—a clear sign of growing ownership concentration. Translation? Whales are consolidating control. Even crazier: Addresses holding 10,000+ ETH now control 74.47% of Ethereum's circulating supply. Compare that to Bitcoin where large holders control only about 15%—ETH is FIVE TIMES more whale-controlled than BTC. This is why ETH moves are so violent and why large transfers or sales by a tiny fraction of holders can rapidly sway Ethereum's price and sentiment. The Distribution Signal: But here's where it gets interesting: Since December 2024, there has been an increase in aggressive sell orders, particularly from whales, with rising average market order sizes suggesting they are offloading holdings. So what gives? Are whales accumulating or distributing? BOTH. They're accumulating at discount levels ($2,900-$3,050) and distributing at premium levels ($3,550-$3,650). This is classic smart money behavior—they're range-trading the volatility while retail gets chopped. 🚨 Recent Developments – The Catalyst Stack Pectra Upgrade – May 7, 2025 (GAME CHANGER) The Pectra upgrade went live in May 2025, introducing batch transactions, gas payment in any token, and doubling blob capacity for Layer 2s. Key improvements: Account Abstraction enables gas payments using multiple tokens like USDC and DAI, with third-party fee sponsorship EIP-7691 doubles Ethereum's blob throughput from three blobs with a maximum of six to six with a maximum of nine With the Pectra upgrade, Ethereum's data capacity significantly increases to about 420 TPS from 210 TPS Translation: ETH just became TWICE as fast for Layer 2s. This is MASSIVE for scalability and will drive institutional adoption. ETF Inflows – The Silent Accumulation Ethereum ETFs attracted substantial institutional interest, with inflows reaching $2.63 billion in December 2024. This is institutional money positioning for the next leg up—they don't buy at tops, they buy at bottoms. Gary Gensler Exit – Regulatory Tailwind The impending exit of SEC chairman Gary Gensler enhanced investor confidence in the altcoin sector, putting Ethereum in prime position to deliver superior performance relative to BTC. Staking Explosion Staking activity reached near-all-time highs, with 36.19 million ETH locked in validators—a 4.5% increase since October 2024. That's $115+ BILLION locked away, reducing circulating supply. DeFi TVL At $90 Billion Total Value Locked in Ethereum protocols surged to $90 billion, driven by renewed interest in yield-bearing DeFi products. Institutional money is FLOODING into ETH DeFi. 🎯 Trade Plans – High-Probability Setups 🟢 BUY ETHUSD: $2,900 - $3,000 | SL $2,820 Thesis: FVG retest at proven whale accumulation zone + November-December $5.7B whale buying cluster = institutional re-entry point Entry Rules (MUST WAIT FOR CONFIRMATION): Price dips into $2,900-$3,000 FVG zone Bullish CHoCH (Change of Character) + BOS (Break of Structure) on H1-H4 Strong bullish rejection wick with volume spike (100K+ ETH volume on 4H) Ideally on Order Block retest after initial bounce BONUS CONFIRMATION: Check whale netflow data on IntoTheBlock—if showing positive inflows, ADD to conviction Targets: $3,350 - $3,400 (mid-channel retest, quick 12-15% gain) $3,600 - $3,750 (previous high retest + distribution zone, 23-28% gain) $4,200 - $4,500 (bull flag breakout + Pectra FOMO begins, 42-50% gain) $5,200 - $5,800 (ATH retest + full bull market confirmation, 75-95% gain) Moonshot: $6,500+ (if ETF inflows accelerate post-Pectra like BTC did) Risk Management: Position size: 3-5% of portfolio (this is a HIGH-CONVICTION setup) Scale in 40% at $3,000, 30% at $2,950, 30% at $2,900 Trail stop to breakeven after hitting Target 1 Take 30% profit at Target 2, let rest ride with trailing stop 🔴 SELL ETHUSD: $3,550 - $3,650 | SL $3,750 Thesis: Premium liquidity retest at proven whale distribution zone—classic "return to scene of crime" before deeper correction Entry Rules (WAIT FOR CONFIRMATION): Price pumps into $3,550-$3,650 zone (previous spike high) Bearish CHoCH + MSS (Market Structure Shift) + BOS down on H1-H4 CRITICAL: Check CryptoQuant whale-to-exchange flow—if showing HIGH exchange inflows (whales moving ETH to exchanges to sell), this is your GO signal Heavy volume spike on bearish candle (150K+ ETH on 4H) Entry after FVG fill or Order Block retest post-initial rejection Targets: $3,200 - $3,250 (first support retest, quick 8-12% gain) $3,050 - $3,100 (mid-channel support) $2,900 - $3,000 (FVG zone—BUY setup reactivates here!) Risk Management: This is a COUNTER-TREND trade—use tighter stops Position size: 2-3% max (smaller than long setup due to higher risk) Take 50% profit at Target 1, move SL to breakeven Exit FULLY at Target 3 and flip to LONG setup ⚠️ Risk Management & Critical Notes The #1 Mistake: Trading inside the $3,100-$3,400 chop zone without confirmation. The struggle between institutional investors and retail traders in this range creates whipsaw conditions this is where retail accounts get DESTROYED. Whale Flow Monitoring is NON-NEGOTIABLE: High leverage remains with funding rates indicating very high risk-taking activities and markets still inclined towards speculative long positions. Use Glassnode or IntoTheBlock to monitor whale exchange inflows BEFORE entering trades. Volatility Warning: This concentrated ownership structure means large transfers or sales by a tiny fraction of holders can rapidly sway Ethereum's price. Set alerts for 10,000+ ETH whale movements on Whale Alert. Macro Headwind: Japan has indicated tightening, and U.S. real interest rates remain high. Under low liquidity conditions, even minor shocks can trigger significant price changes. If SPX dumps 5%+, ETH follows—be ready to cut positions. Position Sizing: Given the extreme whale concentration, never go all-in. Scale positions at key levels. This isn't a casino—it's warfare against billion-dollar players. 📊 The Bottom Line – Why This Time Is Different (Or Isn't) Let me give it to you straight: ETH is at a crossroads. The Bull Case (What I'm Leaning Toward): ✅ $5.7 billion in whale accumulation over 20 days since November 13 ✅ $2.63 billion in ETF inflows in December 2024 ✅ $90 billion TVL in DeFi protocols institutions are building ✅ Pectra upgrade doubled transaction throughput to 420 TPS ✅ 36.19 million ETH staked = reduced supply ✅ Gary Gensler gone = regulatory tailwind ✅ Technical structure: Rising channel still intact, FVG below = perfect retest setup The Bear Case (What Keeps Me Up at Night): ⚠️ Aggressive whale selling since December with rising average market order sizes ⚠️ Even as Bitcoin and Solana hit all-time highs after Trump's election, Ether topped out at $4,000 in December, well short of its 2021 high of $4,800 ⚠️ High leverage with funding rates indicating very high-risk speculative long positions ⚠️ Global liquidity tightening from Japan and high U.S. real interest rates ⚠️ 74.47% of supply controlled by whales = extreme manipulation risk ⚠️ Price underperforming BTC and SOL = capital rotation away from ETH My Take: The $5.7 billion whale accumulation since November 13 tells me smart money is positioning for a move. But the aggressive whale selling at premium levels tells me they're range-trading, not accumulating for a straight pump to $10K. Here's the play: Short-term (Dec-Jan): Expect consolidation with violent swings. Trade the range: buy $2,900-$3,000, sell $3,550-$3,650. Medium-term (Feb-April): After Pectra hype builds + ETF inflows accelerate, we get the push to $4,200-$4,800. Long-term (Mid-2025+): If ETH breaks $4,800 ATH with volume, we're going to $5,800-$7,000+. BUT: If ETH breaks below $2,850 with volume, the bull case is dead and we're heading to $2,600-$2,400 to fill lower FVGs. 🔥 Strategy Summary – How I'm Trading This Phase 1 (NOW - January): Wait for dip to $2,900-$3,000 FVG zone Scale in long position (3-5% of portfolio) Target: $3,600-$3,750 for 25-30% gain Take 30% profit, trail stop on rest Phase 2 (If we hit $3,600+): Watch whale exchange inflows If HIGH inflows (distribution signal) → SHORT at $3,550-$3,650 If LOW inflows (holding) → add to longs, target $4,200-$4,500 Phase 3 (Post-Pectra Hype, March-May): If ETH holds above $3,600 and Pectra adoption is strong → go HEAVY long Target: ATH breakout to $5,200-$5,800 This is the "generational wealth" move IF it plays out Invalidation: Close ALL longs if ETH closes below $2,850 on daily Flip bearish, target $2,600-$2,400 💡 Final Word – The Truth About ETH Right Now ETH isn't "dead." But it's not "mooning tomorrow" either. Critics have blasted developers' decision to focus on Layer 2 blockchains, arguing those chains siphon value from ETH. That's a real concern. ETH isn't pumping like BTC or SOL because value is flowing to L2s. But here's the counterargument: With the Pectra upgrade, this will double L2 performance out of the gate, leading to lower costs and faster transaction times. If L2s explode in adoption, ETH benefits as the base layer. It's like owning the toll road, not the cars. The Question: Will the $2.63 billion in ETF inflows and $5.7 billion in whale accumulation be enough to push ETH to new ATHs? Or will whale distribution at premium levels and high leverage markets cause another violent shakeout first? My bet: One more shakeout to $2,900-$3,000 (FVG retest), THEN the real pump begins. But I'm not holding through a breakdown below $2,850. That's where I cut and flip bearish. Trade the structure. Follow the whales. Protect your capital. Drop a 🔥 if you're watching that $2,900-$3,000 FVG like a hawk. This is where fortunes are made or lost.