03.12.2025 tarihinde sembol XRP hakkında Teknik officialjackofalltrades analizi

تلهی نهنگها: راز انباشت عظیم XRP در آستانه انفجار قیمت!

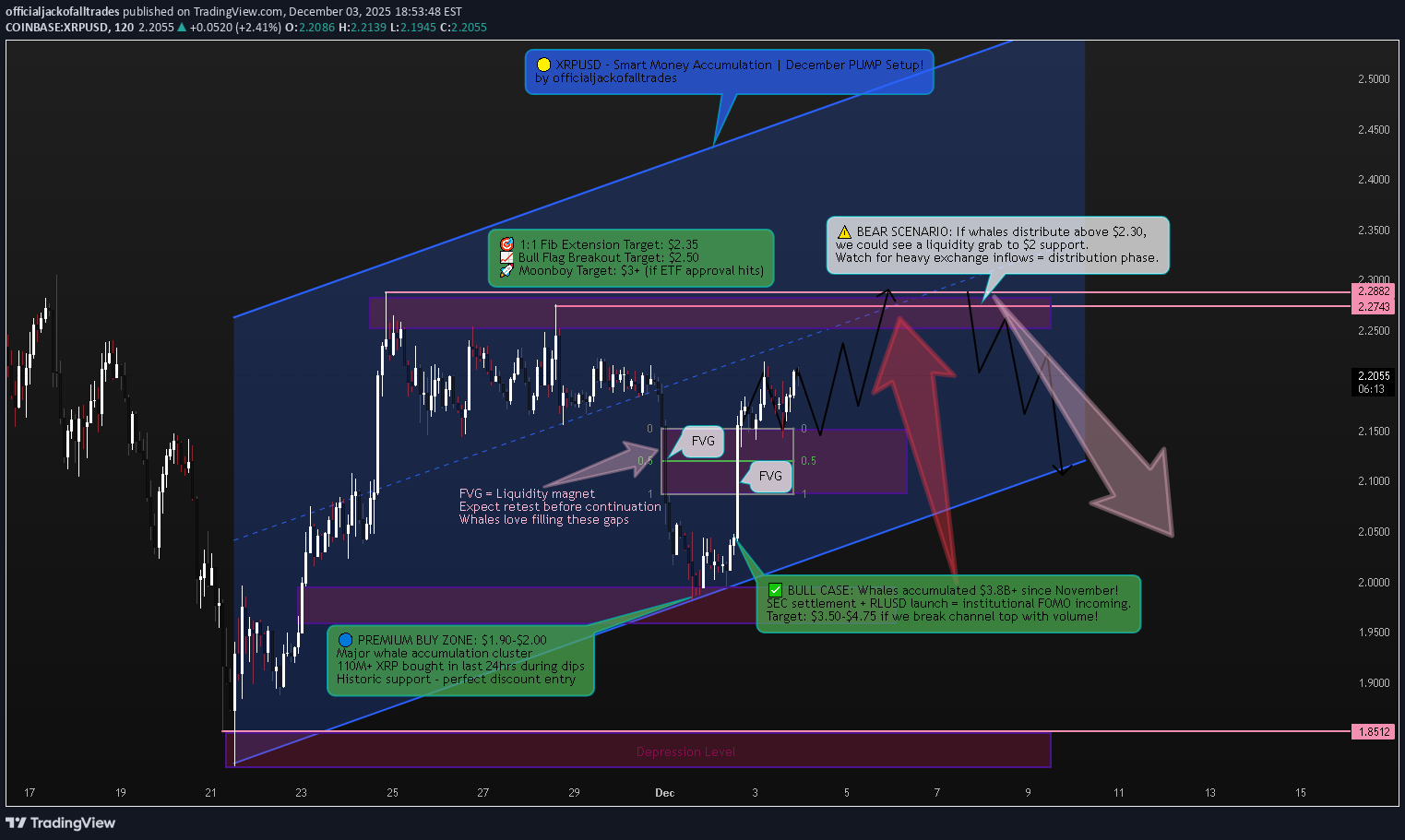

Market Context – The Perfect Storm for XRP | XRP is sitting at one of the most compelling risk/reward setups in crypto right now. After a historic 430% rally from early November that took XRP from $0.50 to a local peak of $2.87 on December 2, 2024, the asset has entered a healthy consolidation phase inside a rising channel between $1.95-$2.00 support and $2.62-$2.80 resistance. But here's what makes this different from your typical alt pump: the fundamentals are actually there. The surge followed Donald Trump's election victory in November 2024, which triggered expectations of more favorable US crypto policies. The SEC, under new pro crypto leadership, is nearing a final resolution with Ripple, with the SEC keeping $50 million from the previous $125 million fine and returning the rest. This removes years of regulatory overhang. Then came the game changer: Ripple launched its RLUSD stable coin globally on December 17, 2024 Business Wire, which is fully backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents Business Wire. This isn't just another stable coin it's enterprise grade infrastructure designed for cross border payments for Ripple's customers starting early next year FXStreet. Translation? XRP isn't speculation anymore. It's becoming institutional grade infrastructure. 🔎 Technical Framework – Smart Money Channeling Higher Current State: Rising channel accumulation phase with whale conviction Key Liquidity Zones: 🔴 Premium Liquidity Zone (Sell Opportunity): $2.62 - $2.80 (upper channel resistance + FVG cluster) This is where retail gets greedy and smart money distributes Historically, significant spikes in whale to exchange transactions align closely with XRP price peaks. 🟢 Discount Liquidity Zone (BUY ORIGIN): $1.90 - $2.00 (lower channel support + whale accumulation cluster) This support zone has consistently triggered rebounds since December 2024 In the last 24 hours alone, large holders accumulated an additional 110 million XRP. ⚖️ Equilibrium / Chop Zone: $2.20 - $2.40 (mid channel consolidation) Avoid blind entries here—wait for structural confirmation 🐋 WHALE ACTIVITY – The Real Story This is where it gets JUICY . While retail panicked during the recent pullback, whales went on an absolute buying spree: Ripple whales accumulated 160 million XRP worth around $380 million as of December 10, 2024 Large XRP investors added 590 million XRP worth $1.29 billion over a seven day period Between December 25 and December 28, XRP whales accumulated tokens worth $2.17 billion Let me repeat that: $2.17 BILLION in THREE DAYS . CryptoQuant data indicates whale activity over the past month reached unprecedented levels, multiples higher than any other period. This isn't retail FOMO—this is institutional positioning. Now here's the kicker: Whale order clusters near $1.80-$2.00 USD during 2025 show persistent large holder activity. Every time XRP dips to this zone, whales defend it aggressively. That's your signal. 🚨 Recent Developments – Catalyst Stack SEC Settlement (MASSIVE) Ripple will retain $75 million from the SEC settlement, and most importantly, be able to offer XRP tokens to institutional investors. This was the missing piece preventing institutional adoption. Now? Game on. RLUSD Stablecoin Launch Ripple announced the launch of RLUSD on December 17, 2024, calling it an "enterprise grade stablecoin built on trust, utility, and compliance". Ripple plans to use both RLUSD and XRP in its cross border payments solution, creating direct utility demand for XRP in institutional payment flows. Regulatory Tailwinds With Trump's pro crypto administration and Gary Gensler stepping down, the regulatory environment has flipped 180 degrees. Former CFTC Chair Christopher Giancarlo stated the SEC should drop the Ripple case. ETF Momentum Building Franklin Templeton and Canary Capital have filed for XRP ETFs. If approved, we're talking about billions in potential institutional inflows. 🎯 Trade Plans – Precision Entry & Exits 🟢 BUY XRPUSD: $1.90 - $2.00 | SL $1.82 Thesis: Discount origin tap at proven whale accumulation zone + rising channel support = institutional buy zone Entry Rules (WAIT FOR CONFIRMATION): Price dips into $1.90-$2.00 zone Bullish CHoCH (Change of Character) + BOS (Break of Structure) on M15-H1 Strong bullish wick rejection + volume spike Ideally on FVG fill or after Order Block retest Targets: $2.40 - $2.50 (mid-channel retest, quick 20-25% gain) $2.70 - $2.85 (upper channel resistance, 35-42% gain) $3.50 - $3.75 (1:1 Fibonacci extension + previous ATH retest, 75-87% gain) Moonshot: $4.75+ (if RLUSD adoption + ETF approval coincide) 🔴 SELL XRPUSD: $2.65 - $2.80 | SL $2.92 Thesis: Premium liquidity grab at channel top followed by engineered bearish displacement—smart money distribution before reaccumulation Entry Rules (WAIT FOR CONFIRMATION) : Price touches $2.65-$2.80 zone Bearish CHoCH + MSS (Market Structure Shift) + BOS down on M15-H1 Heavy volume spike on exchange inflows (use CryptoQuant whale inflow data) Entry after FVG fill or Order Block retest post BOS Targets: $2.35 - $2.40 (first reaction, mid channel) $2.10 - $2.15 (deeper retracement) $1.90 - $2.00 (full channel retest—BUY zone reactivates) ⚠️ Risk Management & Critical Notes Do NOT trade inside the mid channel chop zone ($2.20-$2.40) without structural confirmation—this is where retail gets chopped to pieces Sweeps ≠ Trend Entries: If XRP wicks to $2.80 or down to $1.85, that's likely a liquidity grab, NOT a breakout/breakdown Use tight SL based on structure invalidation—never average down in consolidation Monitor whale to exchange inflow data (CryptoQuant): Rising whale to exchange flow indicates selling pressure Given macro volatility (Fed policy, crypto regulation news), consider scaling position size down by 30-50% 📊 The Bottom Line – December's Hidden Gem XRP is trading at a critical juncture. On one hand, you have: ✅ Record whale accumulation ($3.8B+ since November) ✅ SEC settlement removing regulatory overhang ✅ RLUSD launch creating institutional utility demand ✅ Pro Crypto political environment ✅ Rising channel structure with clear support/resistance On the other hand: ⚠️ Consolidation phase means volatility is coiling ⚠️ Whales could distribute at channel top ($2.65-$2.80) ⚠️ Bitcoin weakness could drag XRP lower short-term My Take? This is classic Smart Money accumulation. The $1.75-$2.16 support zone has been defended relentlessly by whales. Every dip gets bought. That's institutional positioning for a leg higher. Strategy: If you're not in yet wait for $1.90-$2.00 pullback (high probability long setup) If you're already in take partial profits at $2.65-$2.80, let the rest ride with a trailing stop If we break $2.80 with volume add to position, target $3.50-$4.75 This isn't financial advice this is technical + fundamental confluence at its finest. 🔥 Final Word – Why This Time Is Different XRP has had false starts before. But this time, the stars are actually aligning: Regulatory clarity ✅ Institutional utility (RLUSD) ✅ Whale conviction ✅ Political tailwinds ✅ Technical setup ✅ The question isn't if XRP moves it's when and how violently. Position accordingly. Trade the structure. Follow the whales. Drop a 🚀 if you're accumulating XRP at these levels. Let's ride this wave together.Talked with my AI trading mentor on this and it seems everything is playing according to plan. Current Price: $2.03 | Status: Thesis Playing Out Two days ago, I outlined the critical Buy Origin Zone at $1.90–$2.00. "Strategy: If you're not in yet wait for $1.90-$2.00 pullback (high probability long setup)" The market has now delivered. Price descended precisely into this zone, sweeping below the mid-channel FVG to collect resting liquidity and trigger stop losses. This is not breakdown; this is a classic liquidity grab before a reversal. What’s Happening Now: The Dip Was The Point: The move to ~$2.03 represents a textbook tap of the discount liquidity zone, defended by the same whale clusters identified in the original analysis. This is where institutional accumulation occurs. Structure Intact: The macro rising channel remains valid. This dip is a deep pullback within a bullish consolidation, not a trend reversal. Next Phase – Consolidation & Rally: Expect sideways action here ($1.98–$2.10) to build energy. A sustained hold above $2.00 confirms whale support and sets the stage for the next leg toward the initial targets: $2.30–$2.40 (mid-channel retest), then $2.65–$2.80 (premium distribution zone). Revised Short-Term Outlook: Immediate Bias: Bullish from this zone. Confirmation: A 1-hour or 4-hour candle close above $2.10 signals the reversal is likely beginning. Invalidation: A sustained break below $1.82 (original stop) would invalidate the immediate bullish structure and suggest a deeper correction. Path: Accumulation → Consolidation → Rally toward $2.30+. Bottom Line: The playbook is unchanged. This is the opportunistic entry phase. The confluence of technical support, whale defense, and fundamental catalysts (RLUSD, regulatory clarity) makes this a high-conviction zone. The volatility is the cost of admission. The structure is holding. – JackOfAllTrades