sembol BTC hakkında analiz Teknik moonypto: Satın al (19.11.2025) önerilir

moonypto

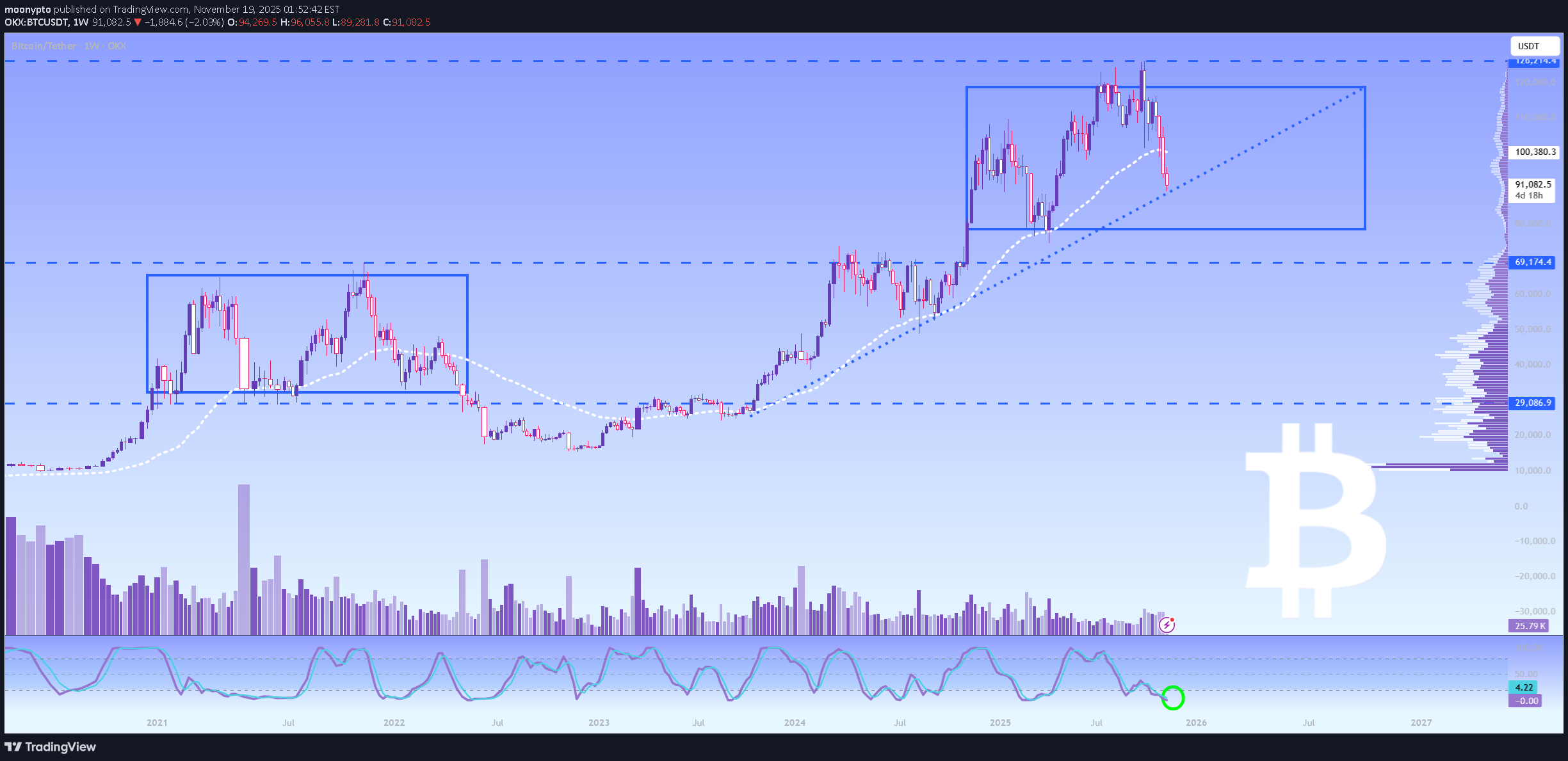

اصلاح یا خرس: نشانههای حیاتی بیت کوین در کف قیمت!

Wen chaos swallowed the horizon and hope thinned to a whisper, the MoonMaster returned Wall Street’s sharks carved through the weak, painting the crypto ocean in blood, believing the tide belonged to them, But they forgot the oldest law of War : “In the darkest waters, the unseen Whales decides the battle” So step aside , let me show you the move that decides what happens next.. Hitting rock bottom kinda sucks in the moment, but the cool part is there’s literally nowhere to go but up. That’s where I think crypto is right now. In under two months the Fear & Greed Index went from “BTC to 1M $” greed straight into the Extreme Fear “Ponzi goes to 0 $” We haven’t seen it this low since the Terra/Luna mess dragged everything down in 2022!(good old days) It’s not a fun place to be, I get it.. But that old silver lining thing still applies: once you’re scraping the bottom, the only direction left is up.. Doesn’t mean we instantly flip to Moonboy mode,history says we rarely stay in Extreme Fear for more than a month. We’ve been parked here since November 10, so if the past is any guide, we should climb out sometime in the next couple three weeks. Yeah, we’ll probably just go from “Extreme Fear” to regular old “Fear.” Not exactly party time. It doesn’t scream “new all-time highs tomorrow.” Fair. But a lousy mood in the market doesn’t rule out decent strength over the next few months. Think back to 2021 that insane bull run where you could basically throw a dart at the token list and make money. What people forget is we spent May, June, and half of July bouncing between Fear and Extreme Fear… and then Bitcoin still went on to double in like three or four months and hit brand new highs. Point is: this stretch feels awful, and we might have more short-term pain (another dip, more sideways chop, whatever) But sentiment is basically as low as it gets, so we can’t really sink much further on that front. History gives us two useful nuggets: We’re probably out of Extreme Fear in 2-3 weeks. Crappy sentiment right now doesn’t kill the chance of new highs in the medium term.. That’s why Coinglass colors Extreme Fear green and Extreme Greed red. Old Warren Buffett line still works: be fearful when others are greedy and greedy when others are fearful. On a similar “this looks ugly but isn’t automatically the end” note Bitcoin closed below its 50-week moving average this past Sunday. Weekly closes under the 50 week SMA aren’t what you want to see. Do it a few times in a row and it can get ugly, But it’s not a guaranteed death sentence. Sometimes it’s the start of a bear market, sometimes it’s just a speed bump before new highs.. 2020: spent two months below it, then Bitcoin went up 16x 2021: closed below it, then ripped to fresh all time highs Early 2022: closed below it… and yeah, that one did mark the top The big difference? 2020 and 2021 had oceans of new money flooding into the system from all the stimulus. People had cash burning holes in their pockets, and a chunk of it found its way into crypto. So we’re treating this 50 week close the same way we’re treating the sentiment bottom: not great, but not fatal, and history says new highs are still very possible in the medium term. Why are we even here, though? The “reasons” feel kinda weak compared to past blow-ups. Trump floated 100% tariffs on China market freaked for a minute, then he walked it back pretty fast. We’ve seen that movie before and usually shrug it off. Government shutdown fears? Sure, but shutdowns don’t have a super consistent track record of tanking risk assets. Sometimes yes, sometimes no.. So what’s actually moving the needle? Probably a combo of things, with the main one being institutional outflows plus way too much leverage in the system. Crypto loves leverage some platforms still let you trade 100x! Put up $1k and you control $100k. Price moves 1% in your favor and you double your money. Moves 1% against you and you’re wiped out, your position gets forcibly closed, and that creates a cascade of buying or selling depending on which way people were leaning. That’s why small price moves lately have felt like a chainsaw massacre.. One bright spot in all the bleeding: the miners. You’d expect miners to be panic-selling everything they dig up, but the data actually looks pretty calm and strategic. Wen price was flying from Oct... well, from October 10 to late October, miners were net buyers adding 800+ BTC a day on average. Once we rolled over in early November, they flipped to net selling (about 830 BTC a day for a week or so), which makes sense they’ve got bills to pay and electricity isn’t free But here’s the encouraging part: over the last 30 days they’ve sold on only 11 days and bought on 19. Total sold vs. total accumulated is basically break-even (6,048 sold, 6,467 bought). The heaviest selling day was November 6 when price was still more than $102k locking in fat profits And the last seven days? They’ve been net buyers again, adding 777 BTC even though price is 12-13% lower than a month ago. Their 30 day net position is back in positive territory. Translation: the weak hand miners who had to sell already did. The selling pressure from that crowd looks mostly done, and they’re starting to accumulate again at these levels. Wait MoonMaster, why are some of them selling? They’re switching to AI.. When miners flip from distribution back to accumulation near lows, it’s usually one of the earlier signs that the worst of the supply overhang is behind us. So yeah, the chart looks rough, sentiment is in the gutter, and we’re probably not out of the woods yet. But almost every signal that actually matters for the next few months,sentiment extreme, miners cleaning house and turning buyers, historical precedent after these setups is flashing the same message: This is the part where it hurts, but it’s also the part where the next leg up gets set up.. Why is BlackRock selling? They loaded at 16K–20K, so taking profits now is the smart move, they never chase dreams. But then why is Tom Lee loading ETH? He’s always thinking long-term, betting on the future. ETH is AI money, so if you’re not trading with 100x leverage in 10 seconds, having a longnterm vision makes perfect sense.. Wen Michael Burry leaves the game, Peter Thiel dumps NVDA, and Buffett loading GOOG, you need to be careful, In this phase of the bull market, you can lose all your easy profit.BTC got a boost after dovish Fed comments pushed December rate-cut odds to 75%, giving the market some relief. Price action is still bearish after a 30%+ drop, but derivatives show mixed sentiment: traders remain defensive yet still hold heavy year-end Call exposure at major strikes. Max Pain sits at 104k, and record-high options OI makes it more meaningful. Perp markets have reset with negative funding, reducing the risk of another wipeout. Thanksgiving week will reveal whether Friday’s rebound holds, with focus on US-session selling pressure and whether ETF flows start to flip positive. Key data this week: PPI, Retail Sales, Jobless Claims, and Core PCE.Bitcoin is stabilising in the high $80Ks as broader risk sentiment improves, not because of crypto-specific catalysts. Markets now see an 85% chance of a December rate cut, but macro signals remain mixed inflation is still sticky while labour data continues to soften. AI driven momentum is cooling, with widening credit spreads and rising Nvidia inventories raising doubts about the sustainability of AI capex. At the same time, crypto ETFs are seeing persistent outflows, and MicroStrategy faces renewed scrutiny as its stock appears on MSCI’s delisting watchlist. Options markets show cautious positioning: demand for downside protection stays firm, implied volatility is slipping, and BTC’s correlation with AI equities is climbing. For now, rallies toward the mid-$90Ks are likely capped by ETF-related supply, while $80K–$82K remains a key support zone. Overall, crypto continues to trade as a barometer of broader market risk appetite.