تحلیل تکنیکال Magister_Arcanvm درباره نماد BTC : توصیه به خرید (۱۴۰۴/۴/۲۶)

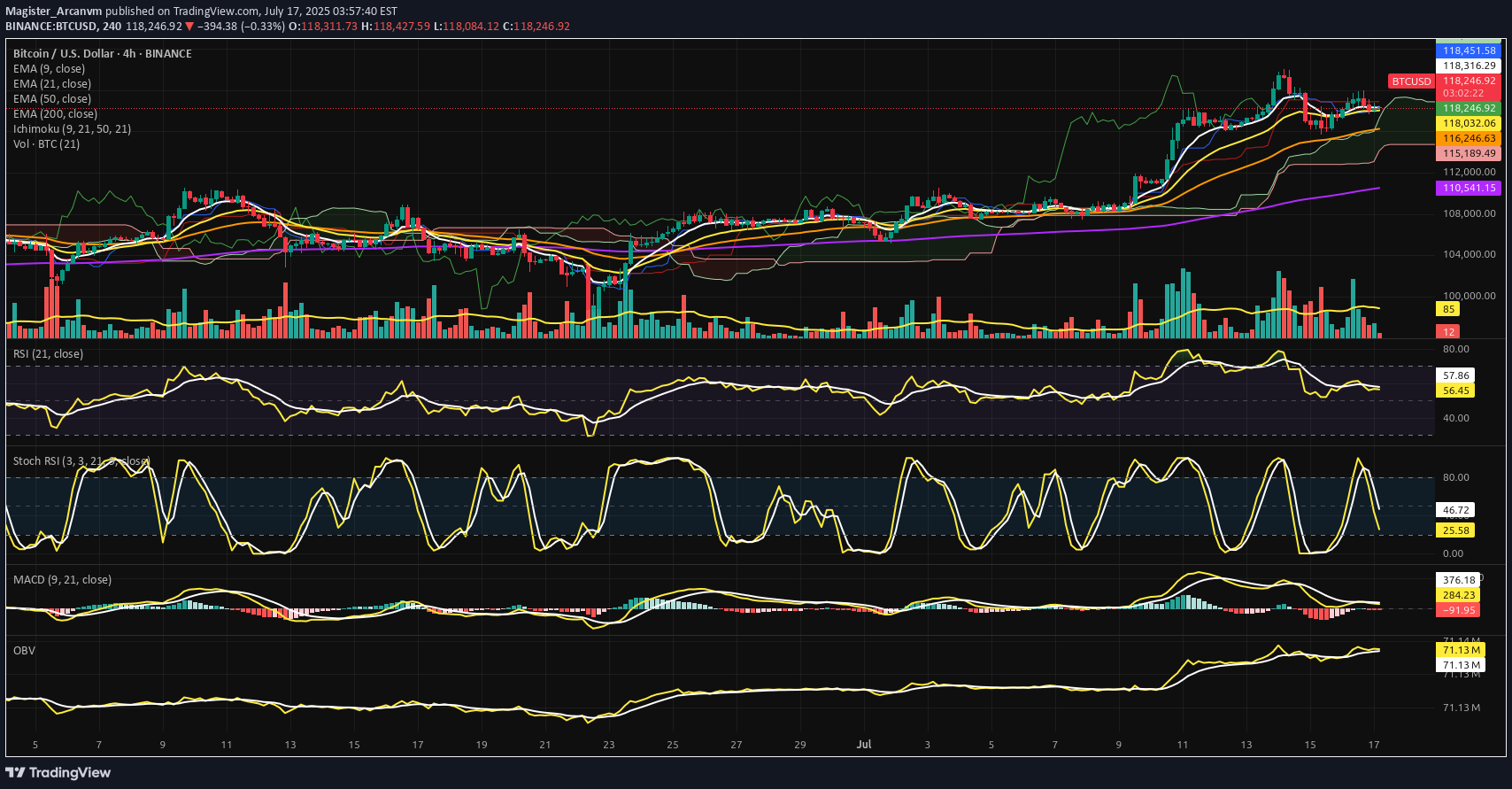

⊣ ⟁ BTC/USD - BINANCE - (CHART: 4H) - (July 17, 2025). ◇ Analysis Price: $118,099.62. ⊣ ⨀ I. Temporal Axis - Strategic Interval – (4H): ▦ EMA9 - (Exponential Moving Average - 9 Close): ∴ EMA9 is currently positioned at $118,286.83, marginally above the current price of $118,099.62; ∴ The slope of the EMA9 has begun to turn sideways-to-downward, indicating loss of short-term acceleration; ∴ The price has crossed below EMA9 within the last two candles, suggesting an incipient rejection of immediate bullish continuation. ✴️ Conclusion: Short-term momentum has weakened, positioning EMA 9 as immediate dynamic resistance. ⊢ ▦ EMA21 - (Exponential Moving Average - 21 Close): ∴ EMA21 is measured at $118,018.67, positioned slightly below both price and EMA9, indicating a recent tightening of trend structure; ∴ The slope of EMA21 remains positive, preserving the medium-range bullish structure intact; ∴ EMA21 has been tested multiple times and held as support since July 15 - confirming tactical reliability as dynamic floor. ✴️ Conclusion: EMA21 stands as a critical pivot zone; any sustained breach would denote structural stress. ⊢ ▦ EMA50 - (Exponential Moving Average - 50 Close): ∴ EMA50 is currently located at $116,240.85, well below current price action; ∴ The curve maintains a healthy positive inclination, affirming preservation of broader intermediate trend; ∴ No contact or proximity to EMA50 over the last 20 candles - indicating strong bullish detachment and buffer zone integrity. ✴️ Conclusion: EMA50 confirms medium-term bullish alignment; not yet challenged. ⊢ ▦ EMA200 - (Exponential Moving Average - 200 Close): ∴ EMA200 stands at $110,539.69, forming the base of the entire 4H structure; ∴ The gradient is gradually rising, reflecting accumulation over a long time horizon; ∴ The distance between price and EMA200 reflects extended bullish positioning, yet also opens risk for sharp reversion if acceleration collapses. ✴️ Conclusion: Long-term structure remains bullish; early signs of overextension exist. ⊢ ▦ Ichimoku Cloud - (9, 21, 50, 21): ∴ Price is currently above the Kumo (cloud), placing the pair within a bullish regime; ∴ Tenkan-sen (conversion) and Kijun-sen (base) lines show narrowing separation, suggesting momentum compression; ∴ Senkou Span A > Span B, and the cloud ahead is bullishly twisted, though thinning - indicating potential vulnerability despite structural advantage. ✴️ Conclusion: Bullish regime intact, but loss of momentum and cloud compression warrant caution. ⊢ ▦ Volume + EMA21: ∴ Current volume for the latest candle is 3 BTC, compared to the EMA21 of 84 BTC; ∴ This indicates an extremely low participation phase, often associated with distribution zones or indecisive consolidation; ∴ Previous impulsive candles (July 15) reached well above 100 BTC - the current contraction is stark and strategically significant. ✴️ Conclusion: Absence of volume threatens trend continuation; energy depletion apparent. ⊢ ▦ RSI - (21) + EMA9: ∴ RSI (21) is positioned at 55.73, marginally above neutral zone; ∴ EMA 9 of RSI is 57.71, crossing downward against RSI - bearish micro signal; ∴ No divergence is present versus price action - oscillator confirms current stagnation rather than exhaustion. ✴️ Conclusion: RSI losing strength above neutral; lacks momentum for breakout, but no capitulation. ⊢ ▦ Stoch RSI - (3,3,21,9): ∴ %K is 21.44, %D is 45.34 - both pointing downward, in deacceleration phase; ∴ Recent rejection from overbought zone without full reset into oversold - signaling weak bullish thrust; ∴ Historical cycles show rhythmical reversals near current levels, but only with supportive volume, which is absent now. ✴️ Conclusion: Short-term momentum failed to sustain overbought breakout - micro-correction expected. ⊢ ▦ MACD - (9, 21): ∴ MACD line is at -104.80, Signal line at 268.16 - large separation, histogram deeply negative; ∴ The bearish crossover occurred with declining volume, implying fading momentum rather than aggressive sell-off; ∴ No bullish divergence formed yet - continuation of correction remains technically favored. ✴️ Conclusion: MACD confirms trend exhaustion; no reversal in sight. ⊢ ▦ OBV + EMA 9: ∴ OBV is 71.13M, perfectly aligned with its EMA9 - indicating equilibrium in volume flow; ∴ No directional bias in accumulation or distribution - flatlining suggests passive environment; ∴ Prior OBV uptrend has stalled since July 15 - reinforcing narrative of hesitation. ✴️ Conclusion: Institutional flow is neutral; no aggressive positioning detected. ⊢ 🜎 Strategic Insight - Technical Oracle: The current price structure presents a classic post-impulse compression configuration within a preserved bullish environment. Despite the higher timeframe alignment, multiple short-term indicators exhibit tactical dissonance and signs of momentum decay. This inconsistency reflects a market caught between structural optimism and tactical hesitation. ♘ Key strategic signals - Structural Alignment: ∴ All major EMA's (9, 21, 50, 200) remain stacked in bullish order with no bearish crossovers imminent; ∴ Price remains above the Ichimoku Cloud and above EMA50 - both confirming structural dominance by buyers. ♘ Momentum Degradation: ∴ RSI (21) is drifting below its EMA9, weakening the momentum required for further upside continuation; ∴ Stochastic RSI has rolled over aggressively, failing to reach oversold before reversing - mid-cycle weakness is confirmed. ♘ Volume Collapse: ∴ The current volume profile is critically weak - 3 Bitcoin against an average of 84 Bitcoins (EMA21); ∴ Price attempting to sustain above EMA's with no conviction signals distribution or passivity. ♘ MACD & OBV: ∴ MACD histogram remains deep in negative territory, and no bullish crossover is visible; ∴ OBV is flat - neither accumulation nor distribution dominates, leaving directional thrust suspended. ✴️ Oracle Insight: ∴ The technical field is Structurally Bullish, but Tactically Compressed. ∴ No breakout should be expected unless volume decisively returns above baseline (84 Bitcoins EMA); ∴ Below $117,800, the structure risks transition into a corrective phase; ∴ Above $118,450, potential trigger zone for bullish extension if accompanied by volume surge. ♘ Strategic posture: ∴ Wait-and-observe regime activated; ∴ No entry condition satisfies both structure and momentum at present; ∴ Tactical neutrality is advised until confirmation. ⊢ ∫ II. On-Chain Intelligence - (Source: CryptoQuant): ▦ Exchange Reserve - (All Exchanges): ∴ The total Bitcoin reserves held on all exchanges continue a sharp and uninterrupted decline, now at ~2.4M BTC, down from over 3.4M in mid-2022; ∴ This downtrend has accelerated particularly after January 2025, with a visible drop into new lows - no accumulation rebound observed; ∴ Historically, every prolonged depletion of exchange reserves correlates with structural bullish setups, as supply becomes increasingly illiquid. ✴️ Conclusion: On-chain supply is structurally diminishing, confirming long-term bullish regime intact - mirrors technical EMA alignment. ⊢ ▦ Fund Flow Ratio - (All Exchanges): ∴ Current Fund Flow Ratio stands at 0.114, which is well below historical danger thresholds seen near 0.20-0.25 during local tops; ∴ The ratio has remained consistently low throughout the 2025 uptrend, indicating that on-chain activity is not directed toward exchange-based selling; ∴ Spikes in this indicator tend to precede local corrections - but no such spike is currently present, reinforcing the notion of non-threatening capital flow. ✴️ Conclusion: Capital is not rotating into exchanges for liquidation - volume weakness seen in 4H chart is not linked to sell intent. ⊢ ▦ Miners' Position Index - (MPI): ∴ The MPI sits firmly below the red threshold of 2.0, and currently ranges in sub-neutral levels (~0.5 and below); ∴ This suggests that miners are not engaging in aggressive distribution, and are likely retaining Bitcoin off-exchange; ∴ Sustained low MPI readings during price advances confirm alignment with institutional and long-term accumulation behavior. ✴️ Conclusion: Miner behavior supports structural strength - no mining-induced supply pressure present at this stage. ⊢ 🜎 Strategic Insight - On-Chain Oracle: ∴ Across the three strategic indicators, no on-chain evidence supports short-term weakness; ∴ Supply is declining - (Exchange Reserve ↓); ∴ Funds are not preparing for exit - (Flow Ratio stable); ∴ Miners are not selling - (MPI subdued). ✴️ This constellation reinforces the thesis of Structural Bullishness with Tactical Compression, and suggests that any pullback is not backed by foundational stress. ⊢ 𓂀 Stoic-Structural Interpretation: ∴ The multi-timeframe EMA stack remains intact and aligned - (9 > 21 > 50 > 200); ∴ Price floats above Ichimoku Cloud, and above EMA21 support, confirming elevated positioning within a macro bull channel; ∴ On-chain metrics confirm supply contraction, miner retention, and absence of fund rotation toward exchanges - structure remains sovereign; ∴ RSI - (21) slips under its EMA9 with low amplitude, indicating absence of energetic flow; ∴ Stoch RSI fails to reset fully and points downward - suggesting premature momentum decay; ∴ MACD histogram remains negative, while volume is significantly beneath EMA baseline (3 BTC vs 84 BTC); ∴ Price faces resistance at Kijun-sen ($118.451), acting as tactical ceiling; no breakout signal detected. ⊢ ✴️ Interpretatio Finalis: ∴ Structural integrity remains unshaken - the architecture is bullish; ∴ Tactically, however, the battlefield is fogged - silence reigns in volume, hesitation in oscillators; ∴ A true continuation requires volume resurrection and resolution above $118,450. Until then, neutrality governs the edge. ⊢ ⧉ Cryptorvm Dominvs · ⚜️ MAGISTER ARCANVM ⚜️ · Vox Primordialis ⌬ - Wisdom begins in silence. Precision unfolds in strategy - ⌬ ⧉ ⊢