xmrx99

@t_xmrx99

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

xmrx99

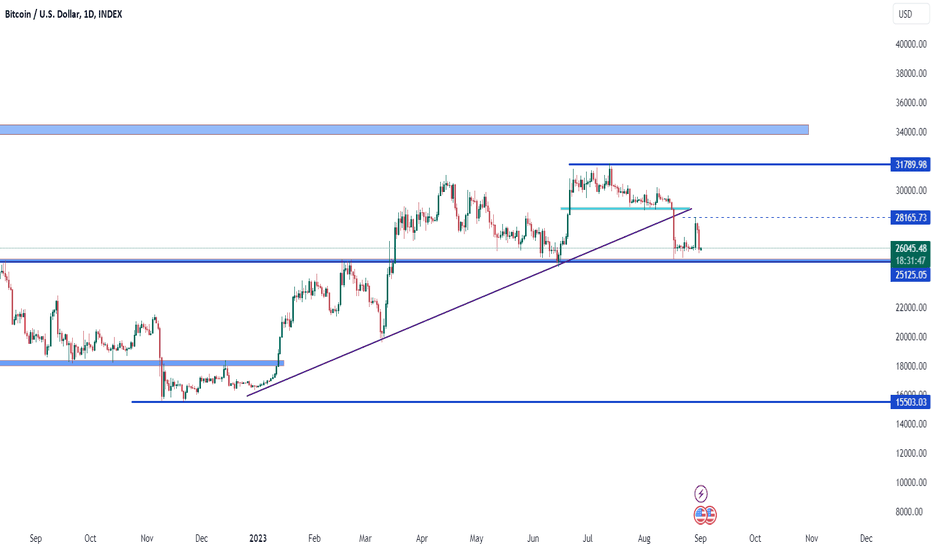

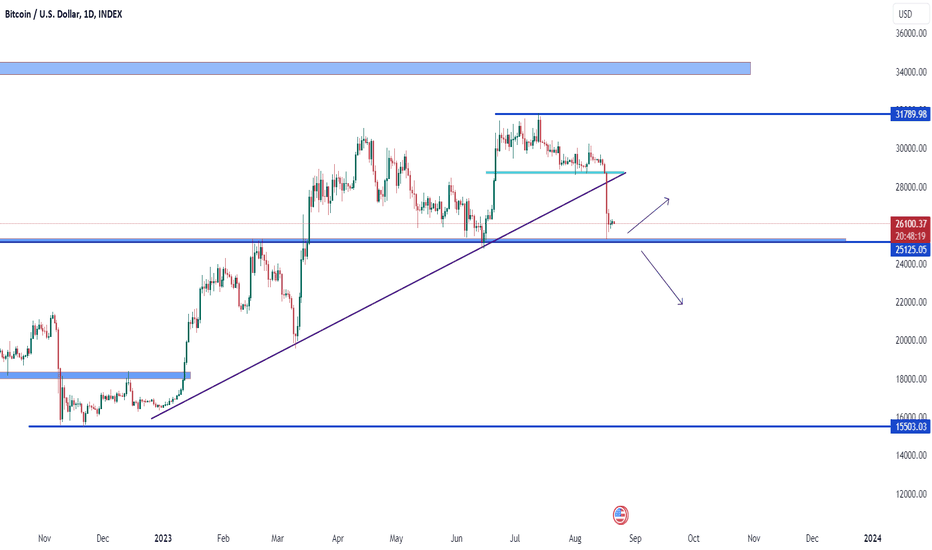

BITCOIN DAILY CHART Strong demand zone is 25000 zone If it sustain below this level than we can expect a painic selling. It is good that it is consolidating in a zone. will wait for breakdown

xmrx99

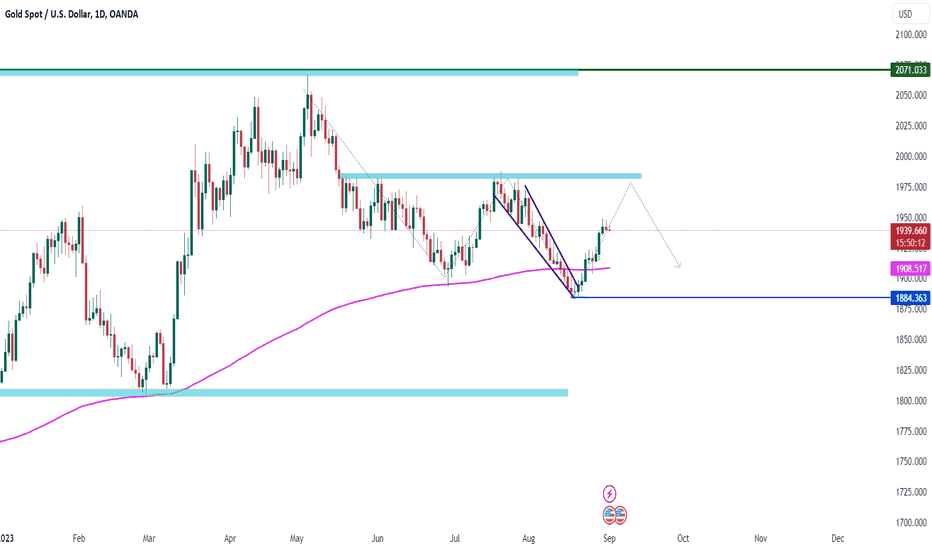

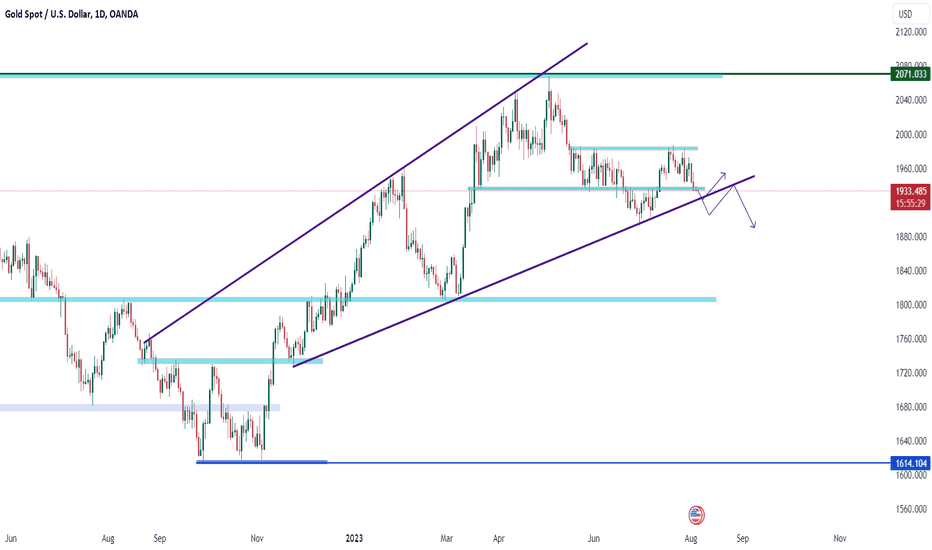

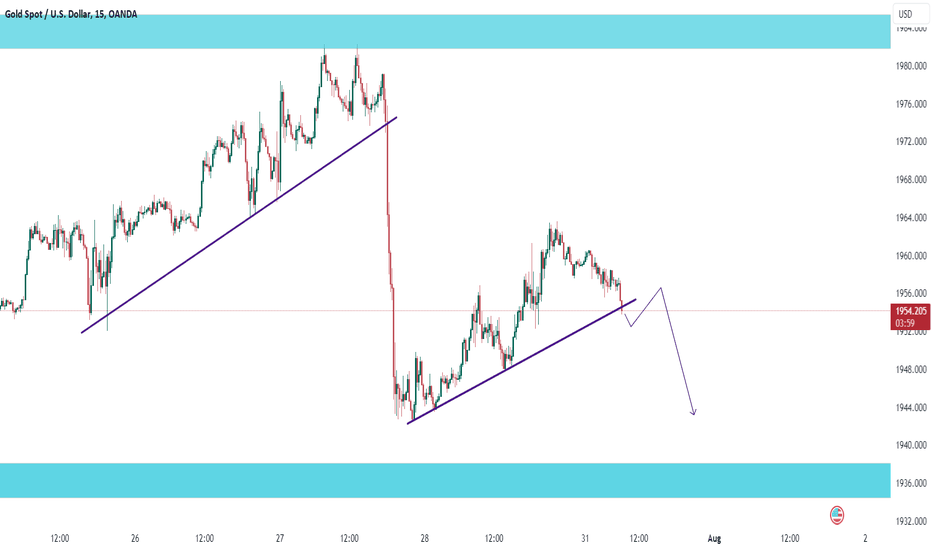

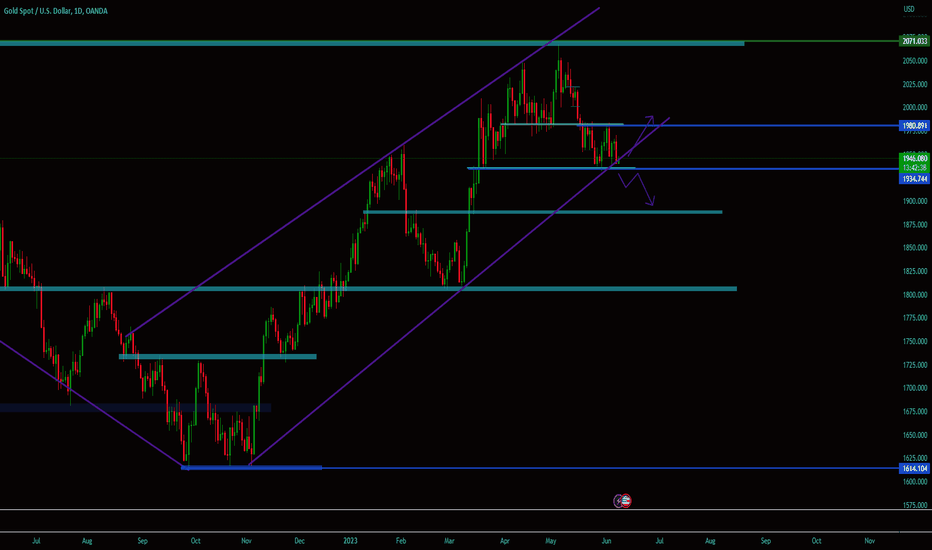

DAy chart of GOLD where it breaksout the falling wedge pattern we had also discussed this in previous post. and we get a good upper side momentum now as of now GOLD is weak if it comes near to 1980 then we will try to find sell opportunity

xmrx99

Hey traders this is the 1 hourly timeframe chart of Bitcoin where first it falls down almost 10% in day but now it is trying to hold 26000 zone but if it breaks then 25000 and below this level it will start Boom Boom.

xmrx99

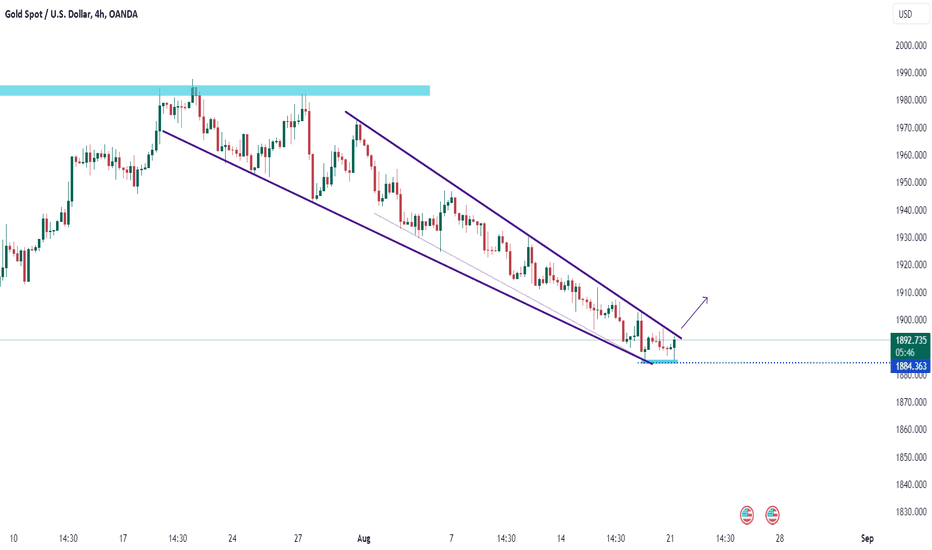

Overall according to view of global sentiments GOLD is weak Now it making a base will wait if it breaks down this level then more fall will come. 1900 level for upper side 1884 level for downside

xmrx99

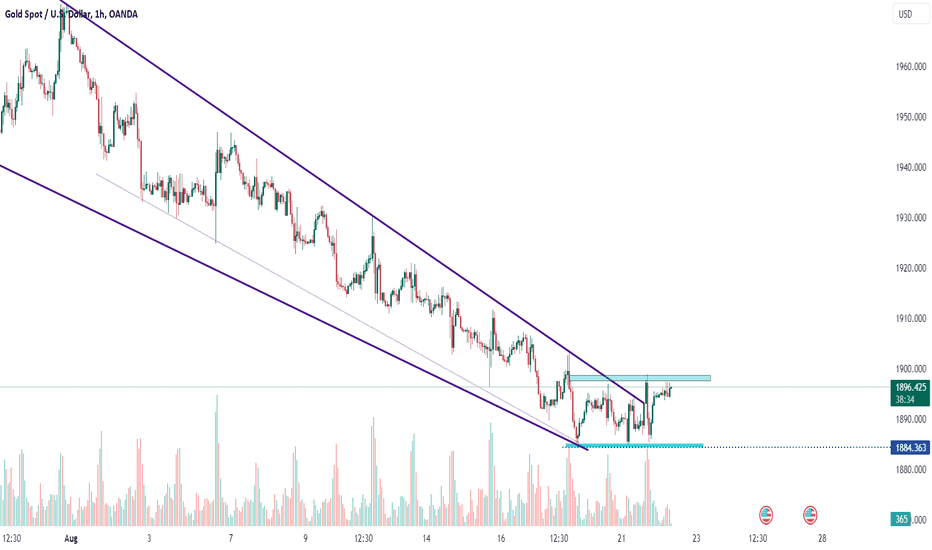

4 hourly timeframe chart of Gold It's making falling wedge pattern which indicate a bullish viewe if it breaks this channel and sustain above the breakout level we should wait for a good breakout then we can go for long side position.

xmrx99

BITCOIN DAILY CHART Strong demand zone is 25000 zone If it sustain below this level than we can expect a painic selling. It is good that it is consolidating in a zone. will wait for breakdown

xmrx99

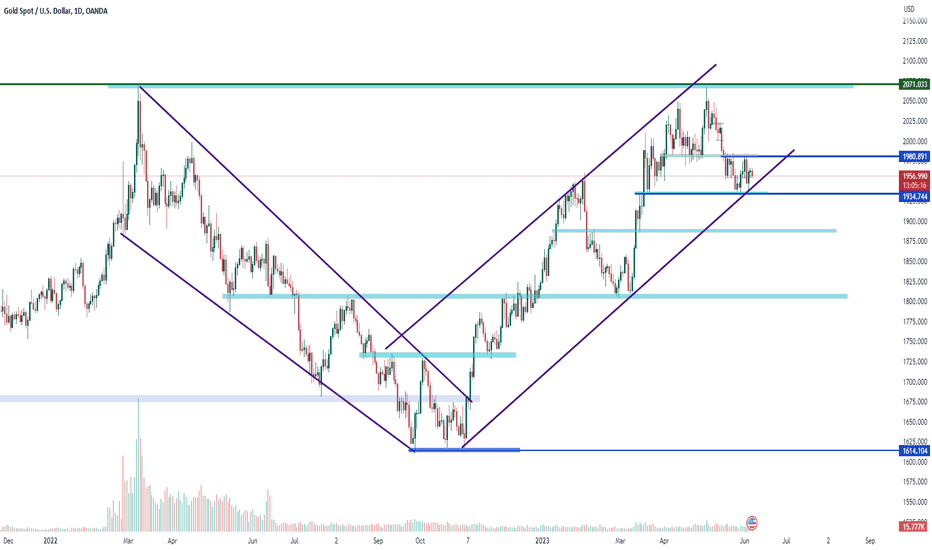

Hey guys this is the day chart of GOLD where it is looking weak and also it is following a rising wedge pattern if it breaks down this pattern than we can expect more weak ness in the gold Strong resistance is 1986

xmrx99

Gold is looking weak as of price action analysis it can again comes towards it last swing low 1940 XAUUSD

xmrx99

XAUUSD Gold strong supply zone is 1980 and strong demand zone is 1930 breakout and sustain above or below these level can give a good momentum

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.