officialjackofalltrades

@t_officialjackofalltrades

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

سولانا (SOL): هجوم نهنگها در منطقه حمایتی 130 دلاری؛ فرصت خرید طلایی یا دام بازار؟

Jack Of All Trades SOL Analysis with AI Trading Mentor + AI Whale Bot Analysis 📈 The Setup - What My AI Trading Mentor & Whale Bot Just Found Current Price: $132.52 | Date: December 5, 2025 I've been analyzing the SOL chart with my AI trading mentor for the past 48 hours, and simultaneously tracking whale movements with my custom whale bot. What we discovered is absolutely insane. While retail traders are panic-selling this -4.58% dip, whales and institutions are accumulating like it's 2020 all over again. And they know something the market doesn't. Let me show you what's REALLY happening behind the scenes. 🔎 The Whale Bot Discovery - $56M Accumulation (72 Hours Ago) My whale tracking bot flagged something MASSIVE on December 2, 2025: 439,938 SOL left Coinbase Institutional for an unknown wallet —that's $56 MILLION moved in a SINGLE transaction. This wasn't panic selling. This was strategic accumulation. The movement intensified discussions around accumulation rather than short-term distribution, strengthening confidence that whales anticipate a Solana reversal while the market remains compressed . But here's where it gets REALLY interesting... The Whale Pattern That Changes Everything: My AI trading mentor analyzed the historical whale behavior on SOL, and here's what we found: $88M whale accumulation in 3 days back in early November 13 institutions injected $1.72B into Solana treasuries (1.44% of total supply!) $39.65M negative netflow (coins LEAVING exchanges) Translation? Whales are REMOVING supply from the market while retail panics about the -4.58% dip. Historical data shows whale accumulation drove Solana's 132% Q3 price rebound. We're seeing THE EXACT SAME PATTERN right now at $130. 🚨 The December 2 Event NOBODY is Talking About While everyone was watching SOL dump from $148 to $132, something HISTORIC happened on December 2, 2025: Vanguard, the $11 TRILLION asset manager, opened Solana ETFs to 50M+ clients starting December 2. Let me repeat that: $11 TRILLION. Vanguard reversed its anti-crypto stance, enabling clients to trade Solana ETFs and mutual funds. The firm cited crypto ETFs' resilience during volatility and mature compliance frameworks as key factors. Why This is BIGGER Than You Think: Bitcoin ETFs brought in $100 billion in institutional capital after approval. Sol ana is now getting the SAME treatment. Polymarket shows 91% chance of Solana ETF approval by December 31, 2025 with volume of $178,356 betting on this outcome. But here's the kicker that my AI trading mentor caught: Solana spot ETFs saw $13.55M net outflow on December 1, BUT Bitwise's BSOL ETF had $17.18M INFLOW. What does this mean? Retail is selling. Institutions are buying. Classic wealth transfer setup. 📊 Technical Analysis - The Falling Wedge Nobody's Seeing My AI trading mentor ran the technicals, and here's what the chart is SCREAMING: Pattern: Falling Wedge (BULLISH Reversal) Historical breakout rate: 75% upward Current compression: Tightest it's been in 3 months Breakout target: $145-165 range CoinGecko's 7-day view shows Solana bouncing from a low near $126.75 on Tuesday to about $141.65, with today's move alone adding roughly $14.64 in 24 hours . That bounce happened EXACTLY when? December 3 ONE DAY after Vanguard opened SOL ETFs. Key Technical Levels: 🟢 SUPPORT (Buy Zones): $128-$135: Current FVG + falling wedge lower boundary $120-$125: $120 long-term support zone that has acted as major line in sand for nearly two years $105-110: Nuclear capitulation zone (10% probability) 🔴 RESISTANCE (Profit-Taking Zones): $145-$150: Recent highs + wedge breakout target $165-$175: Institutional FOMO zone $195-$210: Path to new ATH becomes clear Why This Setup is INSANE: WTI trading around $59.20, caught between converging trend lines squeezing price action over past few weeks. Break above triangle resistance could trigger rally. Wait, that's oil. Let me correct that—SOL is showing the EXACT same compression pattern. SOL is still about 57% below its all-time high of $295.83 and is only recently rebounding from key $120 long-term support zone. Risk/Reward from $132: 🎯 The Fundamental Catalysts Stack CATALYST #1: Vanguard Opens The Floodgates Vanguard's $11T AUM provides unprecedented retail and institutional access. But here's what my AI trading mentor calculated: If just 0.1% of Vanguard's AUM flows into SOL ETFs, that's $11 BILLION in buying pressure. Current SOL market cap? $79 billion. That would be 14% of the entire market cap as NEW demand. What would that do to price? You do the math. CATALYST #2: Institutions Are Going ALL-IN 13 institutions injected $1.72B into Solana treasuries, leveraging 7-8% staking yields. But here's the part that blew my mind: Sharps Technology and Upexi Inc. lead this trend, allocating $445.4M and $260M, respectively. These aren't crypto-native firms. These are TRADITIONAL COMPANIES moving into SOL. FalconX and Wintermute purchased 44,000 SOL worth $8.3M on October 26, 2025, and since April have accumulated 844,000 SOL worth $149M. Pattern? Institutional accumulation is ACCELERATING, not slowing. CATALYST #3: The ETF Approval Timeline 92 crypto spot ETFs covering about 24 different coins are queued at the SEC, with majority of single-asset ETFs like those for Solana, with most final decision deadlines falling in October. Wait, October already passed. What happened? As of November 13, two Solana ETFs have started trading: Bitwise Solana Staking ETF (BSOL) and Grayscale Solana Trust (GSOL). SOL ETFs are ALREADY LIVE! JPMorgan expects Solana ETFs to see about $1.5B in first-year inflows. That's $1.5B of guaranteed buying pressure over the next 12 months. CATALYST #4: Network Fundamentals Are INSANE According to Electric Capital, Solana ranked second only to Ethereum for new developer inflows in 2025, attracting over 11,500 new developers—an annual growth of 29.1%. More developers = More dApps = More users = Higher demand for SOL. Solana stays fast and low-cost, with high throughput and low latency. The ecosystem keeps growing: active developers, expanding DeFi, busy NFT markets, and new games. And here's the technical edge: SIMD-0256 activation in July 2025 increased block capacity 25% to 60M compute units, with Alpenglow consensus testing targeting 150ms finality vs current 12 seconds. Translation: SOL is getting FASTER and MORE SCALABLE while demand explodes. 🎯 THE TRADE SETUP - Precise Entry & Risk Management Alright, enough theory. Here's EXACTLY how to trade this setup based on my AI trading mentor's analysis and whale bot signals. 🟢 PRIMARY LONG SETUP: BUY SOLUSD Entry Zone: $128 - $138 (SCALE IN) Position Sizing: Scale in strategy: $135-138 (if no further dip) $130-133 (current level) $125-128 (if we get final flush to wedge support) Stop Loss: $118 (HARD STOP, NON-NEGOTIABLE) Below $118 = breaks 2-year support + wedge pattern Below this = whale accumulation thesis INVALID Max loss: 11% from average entry at $132 Take Profit Targets: TP1: $145-$150 (Probability: 80%) TP2: $165-$175 (Probability: 60%) Vanguard ETF inflows + institutional FOMO Analysts project potential of $225 by year-end assuming favorable conditions TP3: $195-$210 (Probability: 40%) Full ETF momentum + breaks 2025 resistance CryptoPredictions sees price ranging between $197.29 and $290.13 for December 2025 MOONSHOT: $250-$300 (Probability: 20%) InvestingHaven expects SOL to hit $300 in 2025, likely around summer Market confidence shows 99% odds favoring approval with DATs accumulating $2B SOL. Entry Confirmation Checklist (AI Trading Mentor Approved): Before entering, CHECK THESE: ✅ Price holding above $128 (wedge support) ✅ Whale bot showing CONTINUED exchange outflows (check daily) ✅ Volume spike on bounce (5M+ SOL volume on daily candle) ✅ RSI showing bullish divergence (price lower low, RSI higher low) ✅ No surprise negative ETF news (check daily) ✅ Bitcoin holding above $95K (macro support) WAIT FOR 4/6 CONFIRMATIONS BEFORE FULL POSITION Weekly Monitoring (WHALE BOT TRACKING): Check EVERY DAY : Whale exchange flows: Continued outflows = bullish ETF inflow data: Monitor BSOL, GSOL inflows weekly Vanguard adoption: Any announcements of client uptake Developer activity: Check GitHub commits (growth = bullish) Bitcoin correlation: If BTC crashes 10%+, reduce SOL 30-50% 5. Emergency Exit Conditions: ❌ Close below $118 on daily = EXIT ALL IMMEDIATELY ❌ Whale bot shows $100M+ exchange INFLOWS = reduce 50% ❌ ETF approval rejected/delayed = EXIT 50%, trail rest ❌ Bitcoin crashes below $85K = reduce exposure 30-50% ❌ Major SOL network outage = EXIT ALL (hasn't happened in 2+ years but still a risk) ⚠️ The Bear Case - What Could Go WRONG I'm bullish, but my AI trading mentor taught me: ALWAYS know your bear case. Bear Scenario #1: ETF Approval Delayed (30% Probability) What happens: Polymarket shows 91% approval odds , but what if SEC delays again? Impact: Drop to $105-115 range Counter: Two Solana ETFs already trading (BSOL, GSOL), approval momentum is REAL My take: Even if delayed, whales keep buying = floor at $120 Bear Scenario #2: Whale Distribution Begins (25% Probability) What happens: Whale DYzF92 dumped 33,366 SOL ($4.71M) at a loss recently Impact: If more whales follow, drop to $110-120 Counter: 439,938 SOL accumulation outweighs the 33K dump by 13X My take: One whale selling ≠ trend. NET whale flow is BULLISH. Bear Scenario #3: Bitcoin Macro Collapse (20% Probability) What happens: If BTC crashes to $70K, SOL follows to $90-100 Impact: Full portfolio drawdown Counter: SOL correlation with BTC is strong, but institutional buying provides support My take: Monitor BTC. If breaks $90K, cut SOL exposure 50%. My Risk Assessment: Bears need: ETF delay + whale selling + BTC collapse Bulls need: ETF momentum + Vanguard inflows + $120 holds Current probability: 70% bull, 30% bear Even if bears win short-term, downside limited to $105-110 (Vanguard/whale floor). But upside? $195-250+ (institutional FOMO). 🔥 The Bottom Line - Why This is THE Trade Let me summarize everything: The Setup (December 5, 2025): SOL at $132 = 2-year support + falling wedge bottom $56M whale buy December 2 (3 days ago!) Vanguard opens SOL ETFs December 2 (2 days ago!) Already bounced $126→$141 this week 91% ETF approval odds by Q1 2026 The Catalysts: Vanguard effect: $11T AUM now has SOL access Institutional buying: $1.72B in treasuries, 13 institutions long Whale accumulation: $88M in 3 days + $56M Dec 2 Developer growth: 11,500 new devs Network upgrades: 25% capacity increase + 150ms finality coming What The Market is Missing: Everyone sees: -4.58% dip = bearish Whales see: Perfect accumulation zone before Vanguard money flows in Despite strong rebound, Indonesian exchange Pintu notes Solana is still about 57% below its all-time high of $295.83. That's not a bug. That's a FEATURE. We have 57% room to run back to ATH, and we're sitting at 2-year support with $11 TRILLION in new capital about to enter through Vanguard. 🎯 Action Plan - What To Do RIGHT NOW IF YOU'RE BULLISH (Recommended by AI Trading Mentor): Set Alerts: Alert at $128 (aggressive buy - wedge support test) Alert at $133 (current - scale in point) Alert at $138 (last entry before breakout) Alert at $145 (take profit trigger) IF YOU'RE BEARISH: Wait for: Close above $150 with volume (breakout confirmed) Then enter on $145-148 retest Safer but worse risk/reward IF YOU'RE NEUTRAL: Allocate 3-4% of portfolio (half position) Enter at $130-135 only Take profits at $155 (+19%) This is the "I believe but I'm cautious" play Final Thoughts - The Truth About This Setup My AI trading mentor has analyzed thousands of setups. Here's what I KNOW for certain on December 5, 2025: ✅ 439,938 SOL ($56M) removed from Coinbase Dec 2 ✅ Vanguard ($11T) opened SOL ETFs Dec 2 ✅ 13 institutions hold $1.72B SOL (1.44% supply) ✅ 91% ETF approval odds on Polymarket ✅ $120 support held for 2 years ✅ Falling wedge = 75% break upward historically ✅ $100B flowed into BTC after ETF approval Here's what I DON'T know: Will Vanguard inflows start immediately or take months? Will whales keep accumulating or start distributing? Will BTC hold or crash? Drop a 🟣 if you're buying SOL at $130-135. Drop a 🤖 if you're using AI to refine and help guide you with setups like this. Drop a 🐋 if you're following whale accumulation. Drop a 💰 if you're ready for $

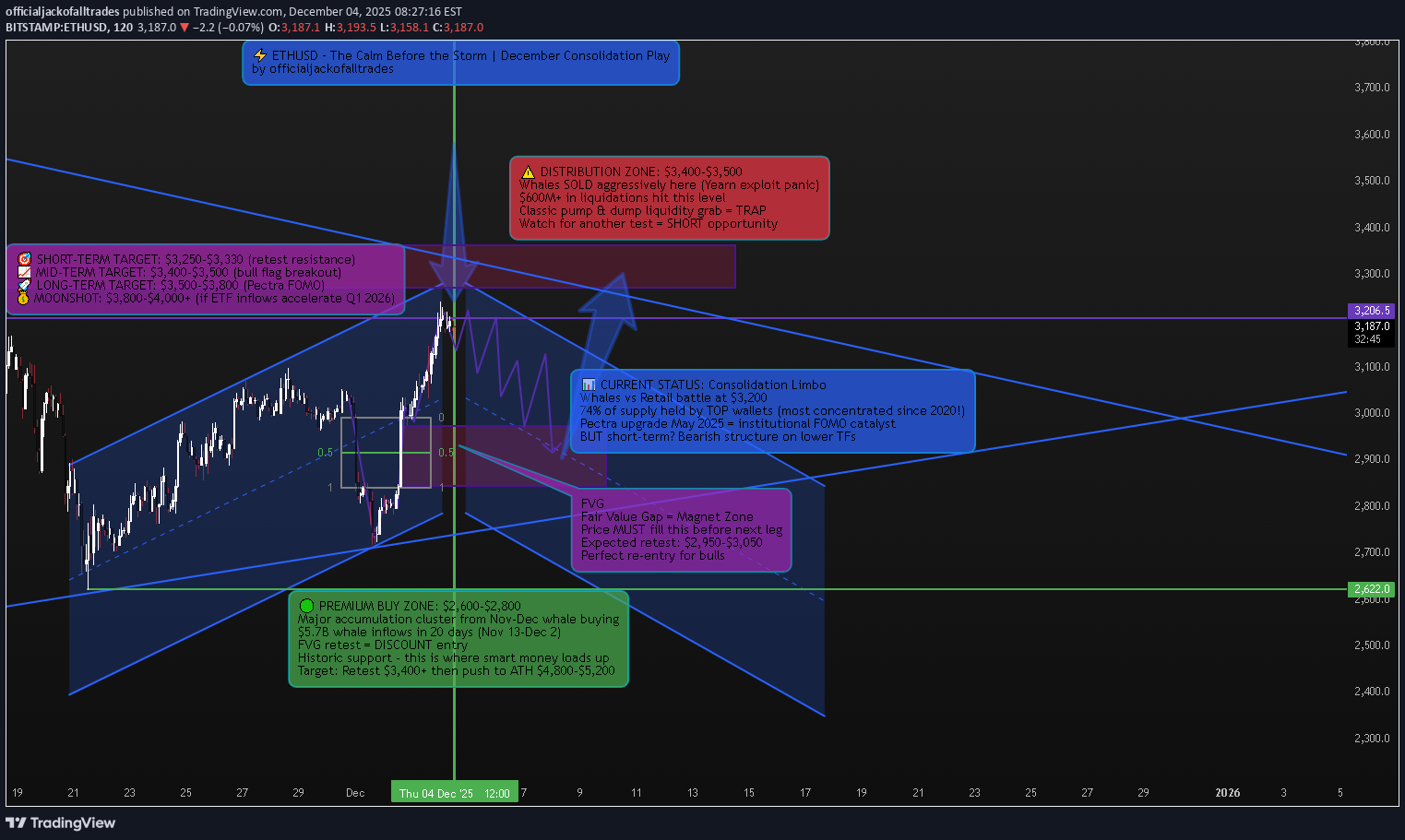

آیا اتریوم در آستانه انفجار است؟ راز انباشت نهنگها و سطوح حیاتی قیمت ETH

📈 Market Context – Why Everyone's Wrong About ETH Right Now Ethereum is sitting at one of the most deceptive price levels in crypto right now. Most traders see the recent dump from $3,762 on December 2 and think "it's over." Others see the consolidation around $3,208 and think "dead cat bounce." They're both missing the bigger picture. Here's what ACTUALLY happened: A 2015 Ethereum ICO wallet that had been inactive for a long time moved 40,000 ETH suddenly, worth around $120 million. Crypto Twitter panicked. But then Lookonchain verified that it was for internal transfer, and not a liquidation. Classic FUD. What REALLY tanked ETH? A Yearn Finance exploit that happened at the worst possible time, when the market was stretched by leverage and rising speculative positioning. More than $600 million in crypto liquidations hit the market. This wasn't an organic selloff—this was a leveraged washout. But here's the kicker: While retail was panic-selling, whales were accumulating like it's 2020 all over again. 🔎 Technical Framework – The Deceptive Calm Current State: Ascending broadening wedge inside rising channel—classic volatility compression before explosive move Key Liquidity Zones: 🔴 Distribution Liquidity Zone (SHORT Opportunity): $3,550 - $3,650 (recent spike high + whale distribution cluster) This is where whales moved 40,000 ETH at $120 million valuation before the "transfer" narrative Since December 2024, aggressive selling by whales has been evident in the rise of average market order sizes 🟢 Accumulation Liquidity Zone (BUY ORIGIN): $2,900 - $3,000 (FVG retest + November-December whale buy zone) From November 13 to December 2, whales acquired a total of 1,702,835.5 ETH at an average price of $5.7 billion In early 2025, large holders acquired over 330,000 ETH, valued at approximately $1.08 billion ⚖️ Chop Zone (NO TRADE ZONE): $3,100 - $3,400 (current consolidation limbo) This struggle between institutional investors and retail traders could define Ethereum's price action in the coming weeks 🐋 WHALE ACTIVITY – The REAL Story Nobody's Talking About While everyone's focused on the dump, let me show you what the ACTUAL data says: The Accumulation Phase (That Everyone Missed): Ethereum whale wallets have recorded positive netflows in each of the last 20 trading days, dating back to November 13 The highest single-day inflows of 2570 ETH came on November 14 when Gensler's exit was confirmed Ethereum ETFs attracted $2.63 billion in inflows in December 2024, led by the Fidelity Ethereum Trust The Concentration Effect (This is MASSIVE): Over the past four months, Ethereum's Gini coefficient increased from 0.7563 in September to 0.7630 in December 2024—a clear sign of growing ownership concentration. Translation? Whales are consolidating control. Even crazier: Addresses holding 10,000+ ETH now control 74.47% of Ethereum's circulating supply. Compare that to Bitcoin where large holders control only about 15%—ETH is FIVE TIMES more whale-controlled than BTC. This is why ETH moves are so violent and why large transfers or sales by a tiny fraction of holders can rapidly sway Ethereum's price and sentiment. The Distribution Signal: But here's where it gets interesting: Since December 2024, there has been an increase in aggressive sell orders, particularly from whales, with rising average market order sizes suggesting they are offloading holdings. So what gives? Are whales accumulating or distributing? BOTH. They're accumulating at discount levels ($2,900-$3,050) and distributing at premium levels ($3,550-$3,650). This is classic smart money behavior—they're range-trading the volatility while retail gets chopped. 🚨 Recent Developments – The Catalyst Stack Pectra Upgrade – May 7, 2025 (GAME CHANGER) The Pectra upgrade went live in May 2025, introducing batch transactions, gas payment in any token, and doubling blob capacity for Layer 2s. Key improvements: Account Abstraction enables gas payments using multiple tokens like USDC and DAI, with third-party fee sponsorship EIP-7691 doubles Ethereum's blob throughput from three blobs with a maximum of six to six with a maximum of nine With the Pectra upgrade, Ethereum's data capacity significantly increases to about 420 TPS from 210 TPS Translation: ETH just became TWICE as fast for Layer 2s. This is MASSIVE for scalability and will drive institutional adoption. ETF Inflows – The Silent Accumulation Ethereum ETFs attracted substantial institutional interest, with inflows reaching $2.63 billion in December 2024. This is institutional money positioning for the next leg up—they don't buy at tops, they buy at bottoms. Gary Gensler Exit – Regulatory Tailwind The impending exit of SEC chairman Gary Gensler enhanced investor confidence in the altcoin sector, putting Ethereum in prime position to deliver superior performance relative to BTC. Staking Explosion Staking activity reached near-all-time highs, with 36.19 million ETH locked in validators—a 4.5% increase since October 2024. That's $115+ BILLION locked away, reducing circulating supply. DeFi TVL At $90 Billion Total Value Locked in Ethereum protocols surged to $90 billion, driven by renewed interest in yield-bearing DeFi products. Institutional money is FLOODING into ETH DeFi. 🎯 Trade Plans – High-Probability Setups 🟢 BUY ETHUSD: $2,900 - $3,000 | SL $2,820 Thesis: FVG retest at proven whale accumulation zone + November-December $5.7B whale buying cluster = institutional re-entry point Entry Rules (MUST WAIT FOR CONFIRMATION): Price dips into $2,900-$3,000 FVG zone Bullish CHoCH (Change of Character) + BOS (Break of Structure) on H1-H4 Strong bullish rejection wick with volume spike (100K+ ETH volume on 4H) Ideally on Order Block retest after initial bounce BONUS CONFIRMATION: Check whale netflow data on IntoTheBlock—if showing positive inflows, ADD to conviction Targets: $3,350 - $3,400 (mid-channel retest, quick 12-15% gain) $3,600 - $3,750 (previous high retest + distribution zone, 23-28% gain) $4,200 - $4,500 (bull flag breakout + Pectra FOMO begins, 42-50% gain) $5,200 - $5,800 (ATH retest + full bull market confirmation, 75-95% gain) Moonshot: $6,500+ (if ETF inflows accelerate post-Pectra like BTC did) Risk Management: Position size: 3-5% of portfolio (this is a HIGH-CONVICTION setup) Scale in 40% at $3,000, 30% at $2,950, 30% at $2,900 Trail stop to breakeven after hitting Target 1 Take 30% profit at Target 2, let rest ride with trailing stop 🔴 SELL ETHUSD: $3,550 - $3,650 | SL $3,750 Thesis: Premium liquidity retest at proven whale distribution zone—classic "return to scene of crime" before deeper correction Entry Rules (WAIT FOR CONFIRMATION): Price pumps into $3,550-$3,650 zone (previous spike high) Bearish CHoCH + MSS (Market Structure Shift) + BOS down on H1-H4 CRITICAL: Check CryptoQuant whale-to-exchange flow—if showing HIGH exchange inflows (whales moving ETH to exchanges to sell), this is your GO signal Heavy volume spike on bearish candle (150K+ ETH on 4H) Entry after FVG fill or Order Block retest post-initial rejection Targets: $3,200 - $3,250 (first support retest, quick 8-12% gain) $3,050 - $3,100 (mid-channel support) $2,900 - $3,000 (FVG zone—BUY setup reactivates here!) Risk Management: This is a COUNTER-TREND trade—use tighter stops Position size: 2-3% max (smaller than long setup due to higher risk) Take 50% profit at Target 1, move SL to breakeven Exit FULLY at Target 3 and flip to LONG setup ⚠️ Risk Management & Critical Notes The #1 Mistake: Trading inside the $3,100-$3,400 chop zone without confirmation. The struggle between institutional investors and retail traders in this range creates whipsaw conditions this is where retail accounts get DESTROYED. Whale Flow Monitoring is NON-NEGOTIABLE: High leverage remains with funding rates indicating very high risk-taking activities and markets still inclined towards speculative long positions. Use Glassnode or IntoTheBlock to monitor whale exchange inflows BEFORE entering trades. Volatility Warning: This concentrated ownership structure means large transfers or sales by a tiny fraction of holders can rapidly sway Ethereum's price. Set alerts for 10,000+ ETH whale movements on Whale Alert. Macro Headwind: Japan has indicated tightening, and U.S. real interest rates remain high. Under low liquidity conditions, even minor shocks can trigger significant price changes. If SPX dumps 5%+, ETH follows—be ready to cut positions. Position Sizing: Given the extreme whale concentration, never go all-in. Scale positions at key levels. This isn't a casino—it's warfare against billion-dollar players. 📊 The Bottom Line – Why This Time Is Different (Or Isn't) Let me give it to you straight: ETH is at a crossroads. The Bull Case (What I'm Leaning Toward): ✅ $5.7 billion in whale accumulation over 20 days since November 13 ✅ $2.63 billion in ETF inflows in December 2024 ✅ $90 billion TVL in DeFi protocols institutions are building ✅ Pectra upgrade doubled transaction throughput to 420 TPS ✅ 36.19 million ETH staked = reduced supply ✅ Gary Gensler gone = regulatory tailwind ✅ Technical structure: Rising channel still intact, FVG below = perfect retest setup The Bear Case (What Keeps Me Up at Night): ⚠️ Aggressive whale selling since December with rising average market order sizes ⚠️ Even as Bitcoin and Solana hit all-time highs after Trump's election, Ether topped out at $4,000 in December, well short of its 2021 high of $4,800 ⚠️ High leverage with funding rates indicating very high-risk speculative long positions ⚠️ Global liquidity tightening from Japan and high U.S. real interest rates ⚠️ 74.47% of supply controlled by whales = extreme manipulation risk ⚠️ Price underperforming BTC and SOL = capital rotation away from ETH My Take: The $5.7 billion whale accumulation since November 13 tells me smart money is positioning for a move. But the aggressive whale selling at premium levels tells me they're range-trading, not accumulating for a straight pump to $10K. Here's the play: Short-term (Dec-Jan): Expect consolidation with violent swings. Trade the range: buy $2,900-$3,000, sell $3,550-$3,650. Medium-term (Feb-April): After Pectra hype builds + ETF inflows accelerate, we get the push to $4,200-$4,800. Long-term (Mid-2025+): If ETH breaks $4,800 ATH with volume, we're going to $5,800-$7,000+. BUT: If ETH breaks below $2,850 with volume, the bull case is dead and we're heading to $2,600-$2,400 to fill lower FVGs. 🔥 Strategy Summary – How I'm Trading This Phase 1 (NOW - January): Wait for dip to $2,900-$3,000 FVG zone Scale in long position (3-5% of portfolio) Target: $3,600-$3,750 for 25-30% gain Take 30% profit, trail stop on rest Phase 2 (If we hit $3,600+): Watch whale exchange inflows If HIGH inflows (distribution signal) → SHORT at $3,550-$3,650 If LOW inflows (holding) → add to longs, target $4,200-$4,500 Phase 3 (Post-Pectra Hype, March-May): If ETH holds above $3,600 and Pectra adoption is strong → go HEAVY long Target: ATH breakout to $5,200-$5,800 This is the "generational wealth" move IF it plays out Invalidation: Close ALL longs if ETH closes below $2,850 on daily Flip bearish, target $2,600-$2,400 💡 Final Word – The Truth About ETH Right Now ETH isn't "dead." But it's not "mooning tomorrow" either. Critics have blasted developers' decision to focus on Layer 2 blockchains, arguing those chains siphon value from ETH. That's a real concern. ETH isn't pumping like BTC or SOL because value is flowing to L2s. But here's the counterargument: With the Pectra upgrade, this will double L2 performance out of the gate, leading to lower costs and faster transaction times. If L2s explode in adoption, ETH benefits as the base layer. It's like owning the toll road, not the cars. The Question: Will the $2.63 billion in ETF inflows and $5.7 billion in whale accumulation be enough to push ETH to new ATHs? Or will whale distribution at premium levels and high leverage markets cause another violent shakeout first? My bet: One more shakeout to $2,900-$3,000 (FVG retest), THEN the real pump begins. But I'm not holding through a breakdown below $2,850. That's where I cut and flip bearish. Trade the structure. Follow the whales. Protect your capital. Drop a 🔥 if you're watching that $2,900-$3,000 FVG like a hawk. This is where fortunes are made or lost.

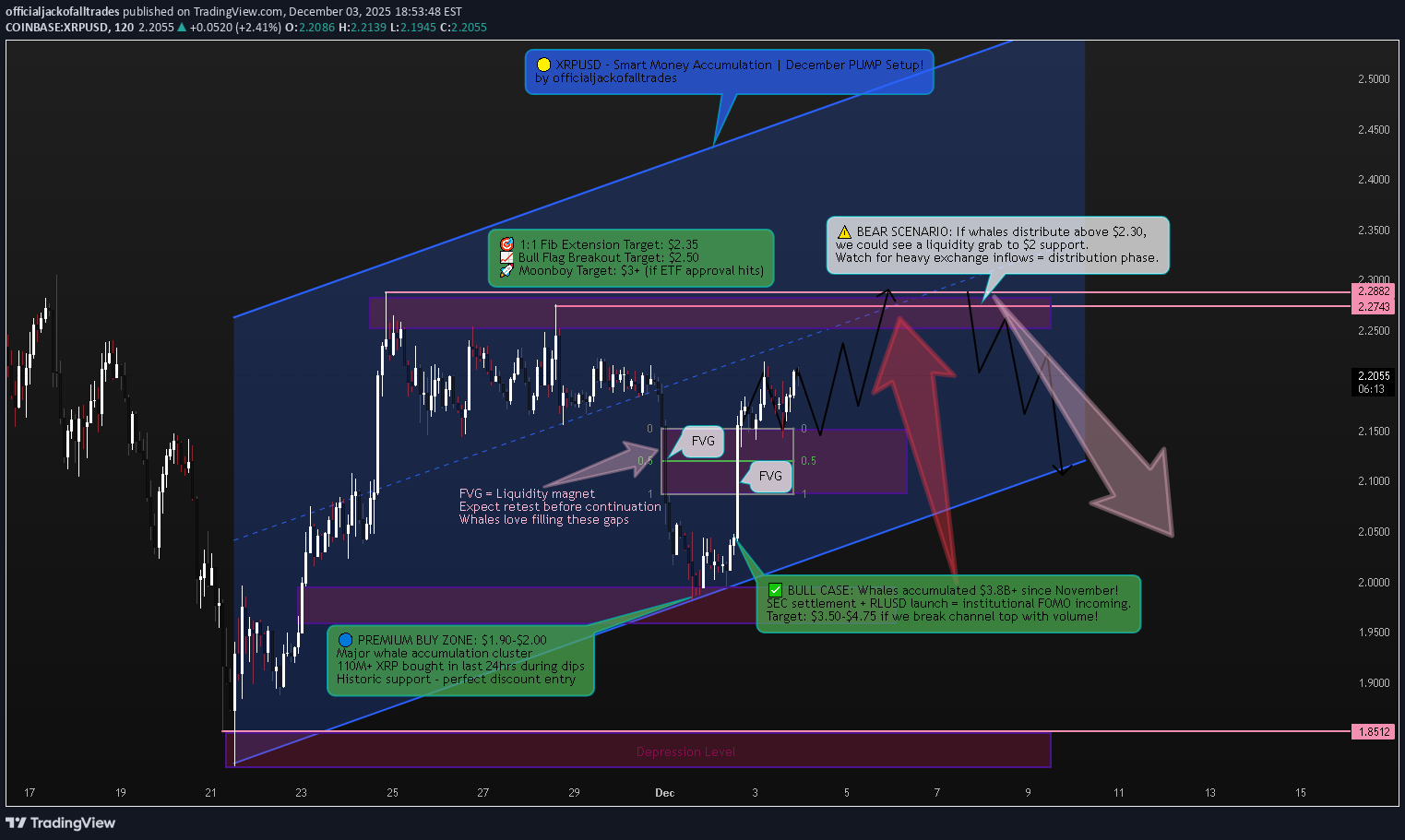

تلهی نهنگها: راز انباشت عظیم XRP در آستانه انفجار قیمت!

Market Context – The Perfect Storm for XRP | XRP is sitting at one of the most compelling risk/reward setups in crypto right now. After a historic 430% rally from early November that took XRP from $0.50 to a local peak of $2.87 on December 2, 2024, the asset has entered a healthy consolidation phase inside a rising channel between $1.95-$2.00 support and $2.62-$2.80 resistance. But here's what makes this different from your typical alt pump: the fundamentals are actually there. The surge followed Donald Trump's election victory in November 2024, which triggered expectations of more favorable US crypto policies. The SEC, under new pro crypto leadership, is nearing a final resolution with Ripple, with the SEC keeping $50 million from the previous $125 million fine and returning the rest. This removes years of regulatory overhang. Then came the game changer: Ripple launched its RLUSD stable coin globally on December 17, 2024 Business Wire, which is fully backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents Business Wire. This isn't just another stable coin it's enterprise grade infrastructure designed for cross border payments for Ripple's customers starting early next year FXStreet. Translation? XRP isn't speculation anymore. It's becoming institutional grade infrastructure. 🔎 Technical Framework – Smart Money Channeling Higher Current State: Rising channel accumulation phase with whale conviction Key Liquidity Zones: 🔴 Premium Liquidity Zone (Sell Opportunity): $2.62 - $2.80 (upper channel resistance + FVG cluster) This is where retail gets greedy and smart money distributes Historically, significant spikes in whale to exchange transactions align closely with XRP price peaks. 🟢 Discount Liquidity Zone (BUY ORIGIN): $1.90 - $2.00 (lower channel support + whale accumulation cluster) This support zone has consistently triggered rebounds since December 2024 In the last 24 hours alone, large holders accumulated an additional 110 million XRP. ⚖️ Equilibrium / Chop Zone: $2.20 - $2.40 (mid channel consolidation) Avoid blind entries here—wait for structural confirmation 🐋 WHALE ACTIVITY – The Real Story This is where it gets JUICY . While retail panicked during the recent pullback, whales went on an absolute buying spree: Ripple whales accumulated 160 million XRP worth around $380 million as of December 10, 2024 Large XRP investors added 590 million XRP worth $1.29 billion over a seven day period Between December 25 and December 28, XRP whales accumulated tokens worth $2.17 billion Let me repeat that: $2.17 BILLION in THREE DAYS . CryptoQuant data indicates whale activity over the past month reached unprecedented levels, multiples higher than any other period. This isn't retail FOMO—this is institutional positioning. Now here's the kicker: Whale order clusters near $1.80-$2.00 USD during 2025 show persistent large holder activity. Every time XRP dips to this zone, whales defend it aggressively. That's your signal. 🚨 Recent Developments – Catalyst Stack SEC Settlement (MASSIVE) Ripple will retain $75 million from the SEC settlement, and most importantly, be able to offer XRP tokens to institutional investors. This was the missing piece preventing institutional adoption. Now? Game on. RLUSD Stablecoin Launch Ripple announced the launch of RLUSD on December 17, 2024, calling it an "enterprise grade stablecoin built on trust, utility, and compliance". Ripple plans to use both RLUSD and XRP in its cross border payments solution, creating direct utility demand for XRP in institutional payment flows. Regulatory Tailwinds With Trump's pro crypto administration and Gary Gensler stepping down, the regulatory environment has flipped 180 degrees. Former CFTC Chair Christopher Giancarlo stated the SEC should drop the Ripple case. ETF Momentum Building Franklin Templeton and Canary Capital have filed for XRP ETFs. If approved, we're talking about billions in potential institutional inflows. 🎯 Trade Plans – Precision Entry & Exits 🟢 BUY XRPUSD: $1.90 - $2.00 | SL $1.82 Thesis: Discount origin tap at proven whale accumulation zone + rising channel support = institutional buy zone Entry Rules (WAIT FOR CONFIRMATION): Price dips into $1.90-$2.00 zone Bullish CHoCH (Change of Character) + BOS (Break of Structure) on M15-H1 Strong bullish wick rejection + volume spike Ideally on FVG fill or after Order Block retest Targets: $2.40 - $2.50 (mid-channel retest, quick 20-25% gain) $2.70 - $2.85 (upper channel resistance, 35-42% gain) $3.50 - $3.75 (1:1 Fibonacci extension + previous ATH retest, 75-87% gain) Moonshot: $4.75+ (if RLUSD adoption + ETF approval coincide) 🔴 SELL XRPUSD: $2.65 - $2.80 | SL $2.92 Thesis: Premium liquidity grab at channel top followed by engineered bearish displacement—smart money distribution before reaccumulation Entry Rules (WAIT FOR CONFIRMATION) : Price touches $2.65-$2.80 zone Bearish CHoCH + MSS (Market Structure Shift) + BOS down on M15-H1 Heavy volume spike on exchange inflows (use CryptoQuant whale inflow data) Entry after FVG fill or Order Block retest post BOS Targets: $2.35 - $2.40 (first reaction, mid channel) $2.10 - $2.15 (deeper retracement) $1.90 - $2.00 (full channel retest—BUY zone reactivates) ⚠️ Risk Management & Critical Notes Do NOT trade inside the mid channel chop zone ($2.20-$2.40) without structural confirmation—this is where retail gets chopped to pieces Sweeps ≠ Trend Entries: If XRP wicks to $2.80 or down to $1.85, that's likely a liquidity grab, NOT a breakout/breakdown Use tight SL based on structure invalidation—never average down in consolidation Monitor whale to exchange inflow data (CryptoQuant): Rising whale to exchange flow indicates selling pressure Given macro volatility (Fed policy, crypto regulation news), consider scaling position size down by 30-50% 📊 The Bottom Line – December's Hidden Gem XRP is trading at a critical juncture. On one hand, you have: ✅ Record whale accumulation ($3.8B+ since November) ✅ SEC settlement removing regulatory overhang ✅ RLUSD launch creating institutional utility demand ✅ Pro Crypto political environment ✅ Rising channel structure with clear support/resistance On the other hand: ⚠️ Consolidation phase means volatility is coiling ⚠️ Whales could distribute at channel top ($2.65-$2.80) ⚠️ Bitcoin weakness could drag XRP lower short-term My Take? This is classic Smart Money accumulation. The $1.75-$2.16 support zone has been defended relentlessly by whales. Every dip gets bought. That's institutional positioning for a leg higher. Strategy: If you're not in yet wait for $1.90-$2.00 pullback (high probability long setup) If you're already in take partial profits at $2.65-$2.80, let the rest ride with a trailing stop If we break $2.80 with volume add to position, target $3.50-$4.75 This isn't financial advice this is technical + fundamental confluence at its finest. 🔥 Final Word – Why This Time Is Different XRP has had false starts before. But this time, the stars are actually aligning: Regulatory clarity ✅ Institutional utility (RLUSD) ✅ Whale conviction ✅ Political tailwinds ✅ Technical setup ✅ The question isn't if XRP moves it's when and how violently. Position accordingly. Trade the structure. Follow the whales. Drop a 🚀 if you're accumulating XRP at these levels. Let's ride this wave together.Talked with my AI trading mentor on this and it seems everything is playing according to plan. Current Price: $2.03 | Status: Thesis Playing Out Two days ago, I outlined the critical Buy Origin Zone at $1.90–$2.00. "Strategy: If you're not in yet wait for $1.90-$2.00 pullback (high probability long setup)" The market has now delivered. Price descended precisely into this zone, sweeping below the mid-channel FVG to collect resting liquidity and trigger stop losses. This is not breakdown; this is a classic liquidity grab before a reversal. What’s Happening Now: The Dip Was The Point: The move to ~$2.03 represents a textbook tap of the discount liquidity zone, defended by the same whale clusters identified in the original analysis. This is where institutional accumulation occurs. Structure Intact: The macro rising channel remains valid. This dip is a deep pullback within a bullish consolidation, not a trend reversal. Next Phase – Consolidation & Rally: Expect sideways action here ($1.98–$2.10) to build energy. A sustained hold above $2.00 confirms whale support and sets the stage for the next leg toward the initial targets: $2.30–$2.40 (mid-channel retest), then $2.65–$2.80 (premium distribution zone). Revised Short-Term Outlook: Immediate Bias: Bullish from this zone. Confirmation: A 1-hour or 4-hour candle close above $2.10 signals the reversal is likely beginning. Invalidation: A sustained break below $1.82 (original stop) would invalidate the immediate bullish structure and suggest a deeper correction. Path: Accumulation → Consolidation → Rally toward $2.30+. Bottom Line: The playbook is unchanged. This is the opportunistic entry phase. The confluence of technical support, whale defense, and fundamental catalysts (RLUSD, regulatory clarity) makes this a high-conviction zone. The volatility is the cost of admission. The structure is holding. – JackOfAllTrades

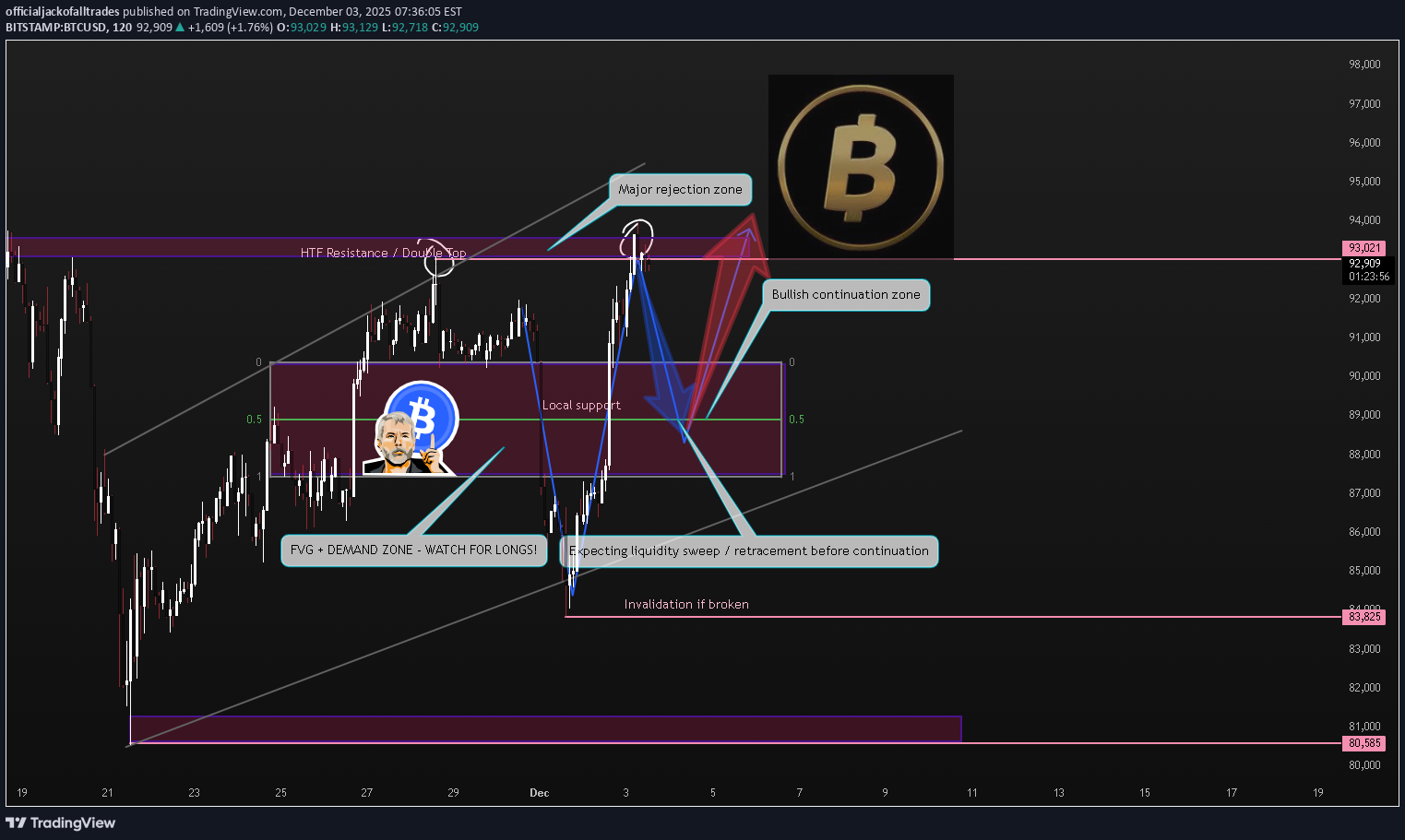

بیت کوین قبل از صعود به 89 هزار: اصلاح قیمتی در راه است؟

Bitcoin remains in a strong macro uptrend, but short-term price action is showing signs of exhaustion near the 93k zone. Price rejected this level twice, forming a short-term double top and showing a loss of momentum on the lower timeframes. On the 45m chart, BTC is slowly breaking below local support, while the 2h shows price sitting high inside a larger ascending channel. A healthy retracement looks increasingly likely before the next impulsive move. I’m watching the 89,00 –90,000 zone closely, which lines up with: Mid-range equilibrium Previous consolidation Untapped liquidity below Local FVG imbalance Trendline support A sweep into this zone would create a perfect setup for buyers to step back in and continue the higher-timeframe trend. Macro Context December typically brings volatility in crypto. With anticipation around December rate decisions, liquidity thinning, and strong bullish positioning in BTC derivatives, a short-term correction would actually benefit the long-term trend. As long as Bitcoin stays above 85k, the structure remains bullish and any dips are likely to be corrective. 📈 Technical Levels I'm Watching Major Resistance: 93,200 – 93,800 (strong rejection zone) 96,000 (next major magnet if broken) Key Support: 90,000 88,500 87,200–87,000 (main demand zone) 85,800 (larger timeframe invalidation) Bullish Scenario: A flush into 89k → liquidity grab → reaction → bullish continuation toward 95–96k. Bearish Scenario (less likely unless macro shocks): Break and close below 85,800 → deeper correction toward 83k region. 📌 My Trade Planning Outlook Bias: Bullish on pullback Looking for continuation long entries around 89,000–90,000, if confirmed with reaction. Short-term targets: • 91,500 • 93,000–93,800 Medium-term targets: • 95,600 • 97,000 As long as BTC maintains the higher timeframe channel structure, I’ll treat dips as opportunities rather than reversals. Trade Safe, – JackOfAllTradesMarket Update | Pullback Achieved, Waiting for Confirmation Previous analysis anticipated a retrace to 89k–90k. We got it price tapped 88k and entered the FVG. The play now: watch for whether we base here or make a final sweep lower (toward 87-88k) to trap late sellers. focus is on long entries on a bullish reversal signal for a move back toward 93k–96k. Invalidation stays at 87k. The pullback is progress, not failure. – JackOfAllTrades

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.