icixbt

@t_icixbt

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

تحلیل روزانه سولانا (SOL): آیا حمایت 130 دلار میشکند؟ چشمانداز 6 دسامبر 2025

SOL Daily Outlook | December 6, 2025 1H Market Structure Overview Solana is currently testing key support at $130.93 after pulling back from the previous highs near $146–$147. On the 1H timeframe, price is showing signs of bearish momentum with lower highs forming after the peak. Structure is at a critical point: a break below $130.93 would confirm further downside, while holding this level could allow for a reversal back toward previous highs. Bias Bearish on 1H — currently favoring the downside while watching the $130.93 support closely. Bias can change if price shows a strong bounce from this level and starts forming higher lows. What We Want to See Next Bullish scenario: Price holds above $130.93 and reverses higher, targeting $137–$143, with a potential retest of the $146–$148 area. Bearish scenario: Price breaks below $130.93, confirming 1H bearish momentum, with the next key support at $123.32. If sellers remain in control, further downside could develop beyond this level.

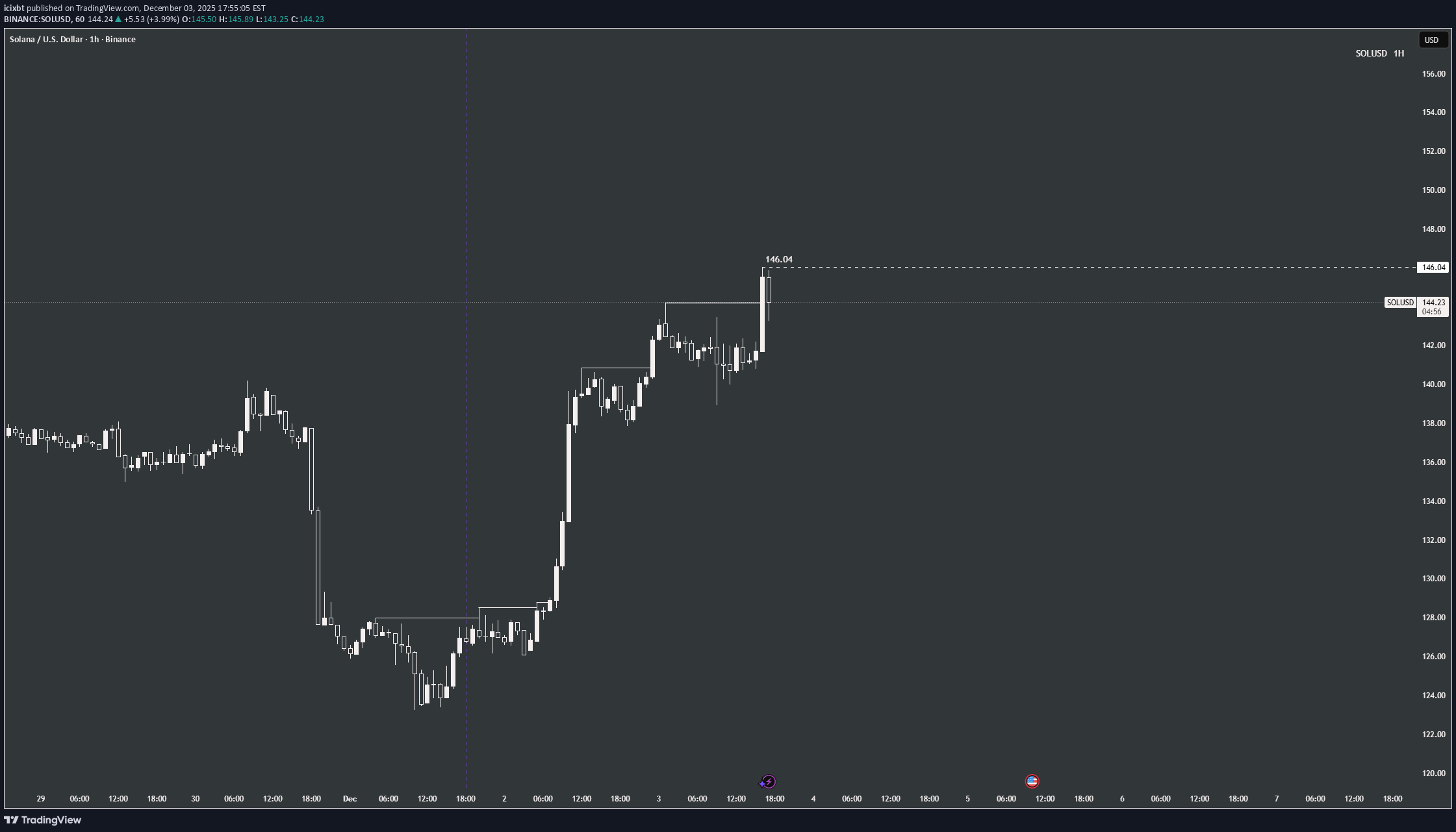

پیشبینی صعودی سولانا: آیا شکست سطح ۱۴۶ دلار طلسم شکنی میکند؟

1H Market Structure Overview Solana is maintaining bullish structure on the 1H timeframe. After reversing strongly from the $128–$130 zone, price has continued forming higher highs and higher lows, showing consistent upward momentum. Price is currently pushing into the previous high at $146.04, but we have not broken above that level yet. Structure is still bullish, and the current impulse suggests buyers are trying to take out that high next. Bias Bullish — expecting a break above $146.04 as long as the most recent higher low holds and structure remains intact. What We Want to See Next A clean break above $146.04, followed by a controlled correction to confirm continuation. If SOL clears that level, the next upside objectives sit toward the $148–$150 region in the upcoming days/weeks.

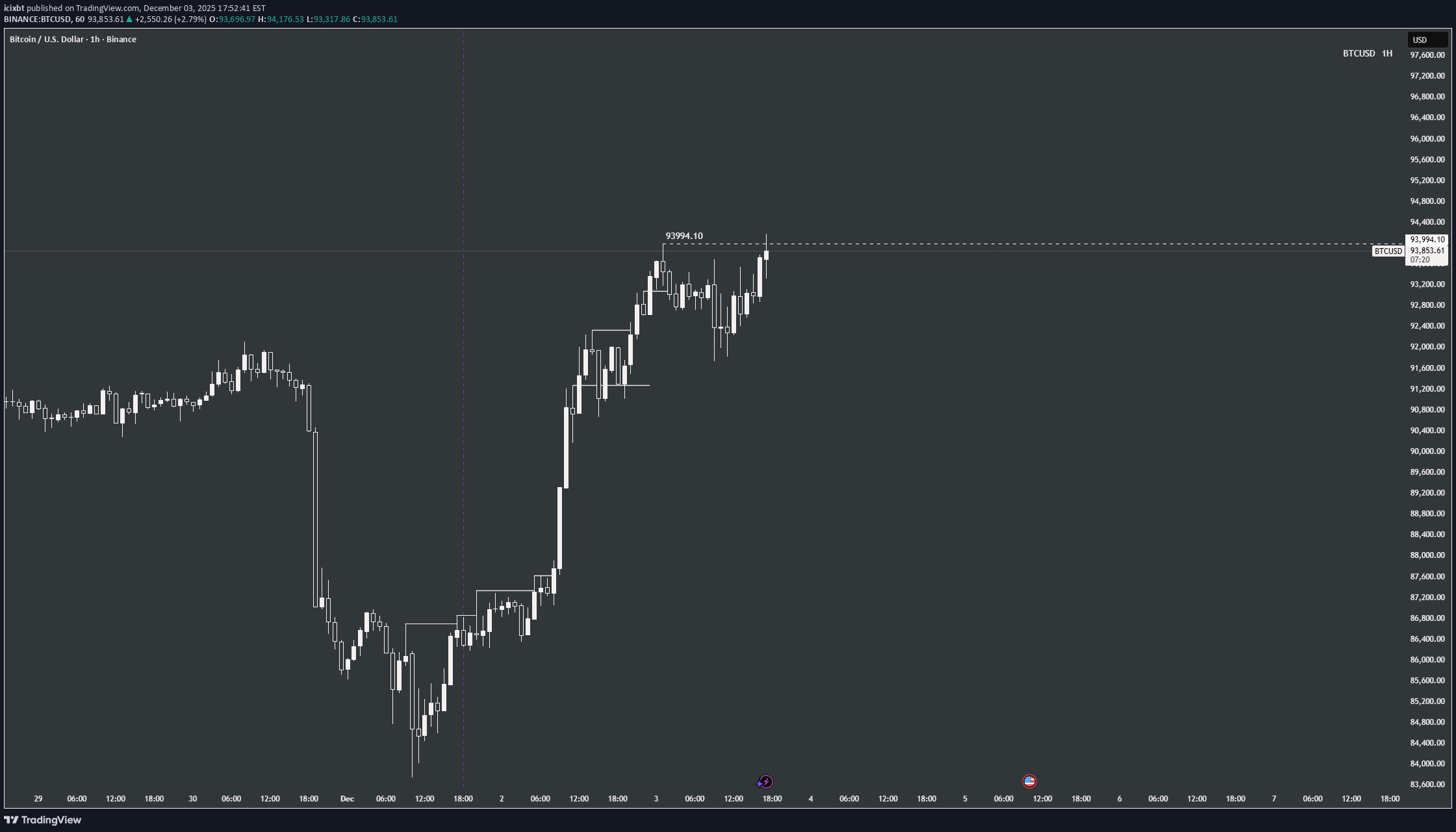

تحلیل روزانه بیت کوین (۳ دسامبر): آیا پامپ بزرگ بعدی در راه است؟

1H Market Structure Overview Bitcoin continues to show clear bullish structure on the 1H timeframe. Price has been forming higher highs and higher lows ever since the strong reversal from the lows around the $87K–$88K region. The most recent leg shows another clean impulse to the upside, followed by shallow corrections—showing buyers maintaining control. Price is now trading just under the previous high at $93,994, and we’re seeing attempts to break above that level. Structure remains bullish as long as BTC holds its most recent higher low and continues making ICIs upward. Bias Bullish — looking for continuation to the upside as long as 1H structure maintains higher highs and higher lows. What We Want to See Next A clean break above $93,994 followed by a controlled pullback (correction) would confirm continuation. If BTC forms a new impulse above this level, the next leg up could target the mid-$94K area and beyond in the coming days/weeks.

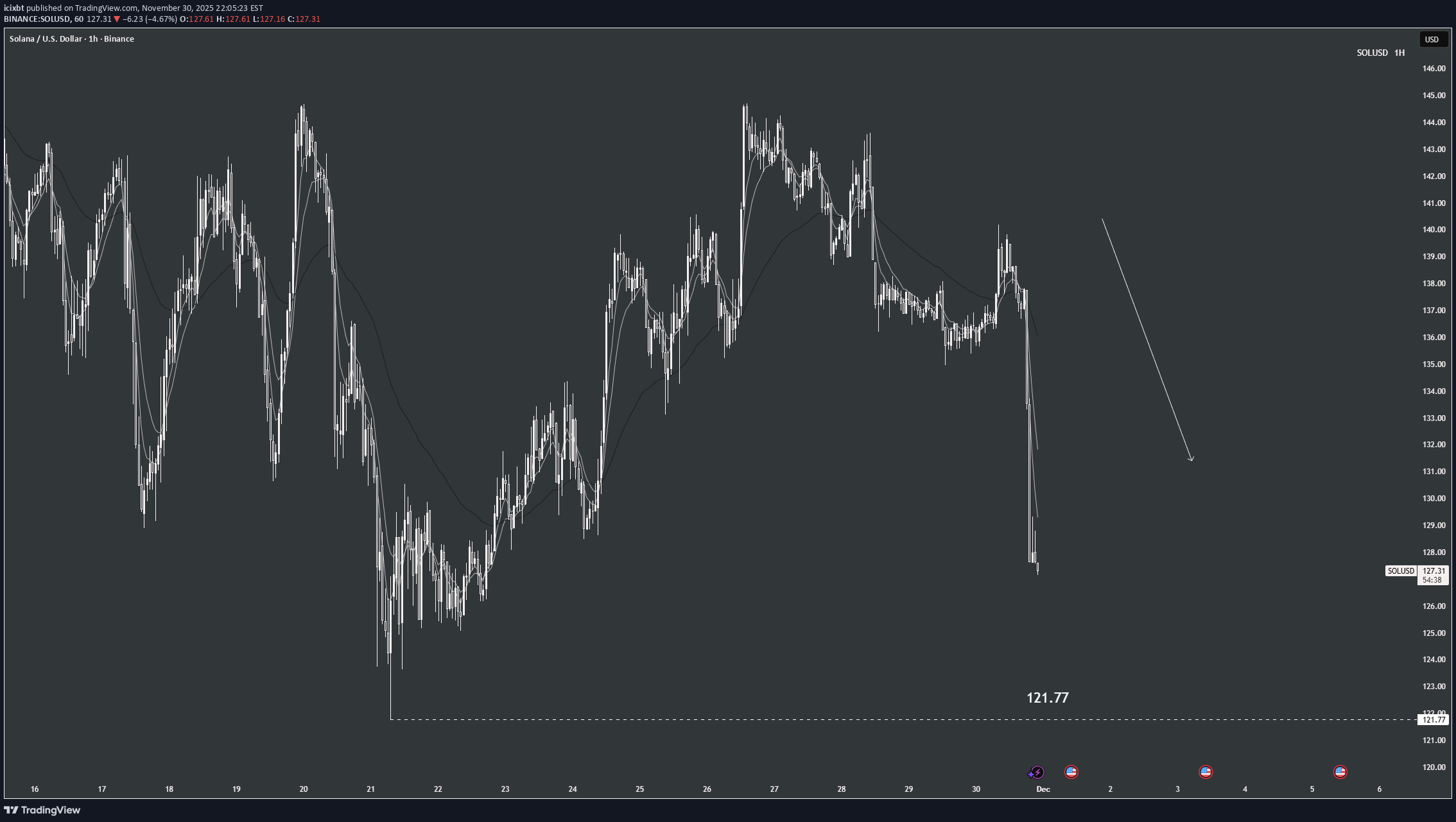

پیشبینی سقوط سولانا (SOL): آیا قیمت به ۱۲۱ دلار خواهد رسید؟ تحلیل امروز بازار

SOLUSD – 1H – Binance Current Price: ~$124.44 Market Structure • Strong bearish impulse after breaking $130–132 higher low (CHoCH confirmed) • Correction rejected exactly at broken structure + 50 EMA confluence • Second, sharper impulse leg already in motion • 5 > 10 > 50 EMA perfectly stacked & fanning bearish → dynamic resistance • Volume spikes on downside, almost none on rebounds = sellers in full control We remain firmly bearish on the 1H timeframe. Price is currently retracing (classic liquidity grab), but I expect rejection in the $130–132 zone and continuation lower to at least $121. Key Levels Resistance (sell zone): $130.00 – $132.00 Primary Target: $121.00 – $122.00 Extension Target: $115–118 if momentum stays strong Invalidation: 1H close above $138.00 Bias Strongly Bearish – this pullback is fuel for the next leg down Risk If we reclaim and hold >$132 with strong volume, bearish setup is invalidated and we flip neutral-to-bullish fast.

پیشبینی سولانا (SOL) امروز: آماده افت بیشتر باشید!

Timeframe 1 Hour (1H) EMAs Used 5 EMA 10 EMA 50 EMA Market Structure SOL has shifted into a bearish impulse–correction sequence on the 1H chart. Price broke structure to the downside and followed with a sharp impulse lower. The recent correction has failed to reclaim previous highs, and the 5, 10, and 50 EMAs are now aligned bearishly, supporting continued downside movement. What I Want to See I want to see SOL continue this bearish sequence, using any smaller corrections as fuel for the next impulse down. Bias Bearish.

پیشبینی روزانه اتریوم (ETH): صعود ادامه دارد؟ تحلیل تکنیکال 29 نوامبر

Still looking really clean on the 1-hour. Higher lows are holding firm, no bearish break of structure at all. We’re just in a shallow corrective pullback right now, price sitting right on the 5 EMA while the 10 and 50 are stacked perfectly below and still pointing up.Volume’s basically gone to sleep on the dip and funding is quiet, classic sign the move isn’t over. As long as we stay above the last higher low and that 50 EMA zone, this is nothing more than a healthy pause in the markup.A quick bounce off the 5/10 area and we flip straight back into impulse mode for the next leg up.My bias stays aggressively bullish as long as the EMA stack and structure stay intact. Any touch of the 50 EMA is a buy for me.

تحلیل روزانه بیت کوین: آیا رالی صعودی ادامه دارد؟ سطوح حیاتی ۲۸ نوامبر

My bias on BTC remains bullish. Price is holding structure after tapping into the 93,071 level and is now pulling back into support. This pullback still looks corrective, and as long as BTC stays above 89,500–90,000, I expect the trend to continue higher. A reclaim of the local consolidation would confirm strength and set up another move toward 93,071. If BTC dips into 89,500–90,000 first, I still expect buyers to defend that area and keep bullish structure intact. As long as price stays above 89,500, I expect BTC to push higher and eventually break through 93,071 in the coming days or weeks.

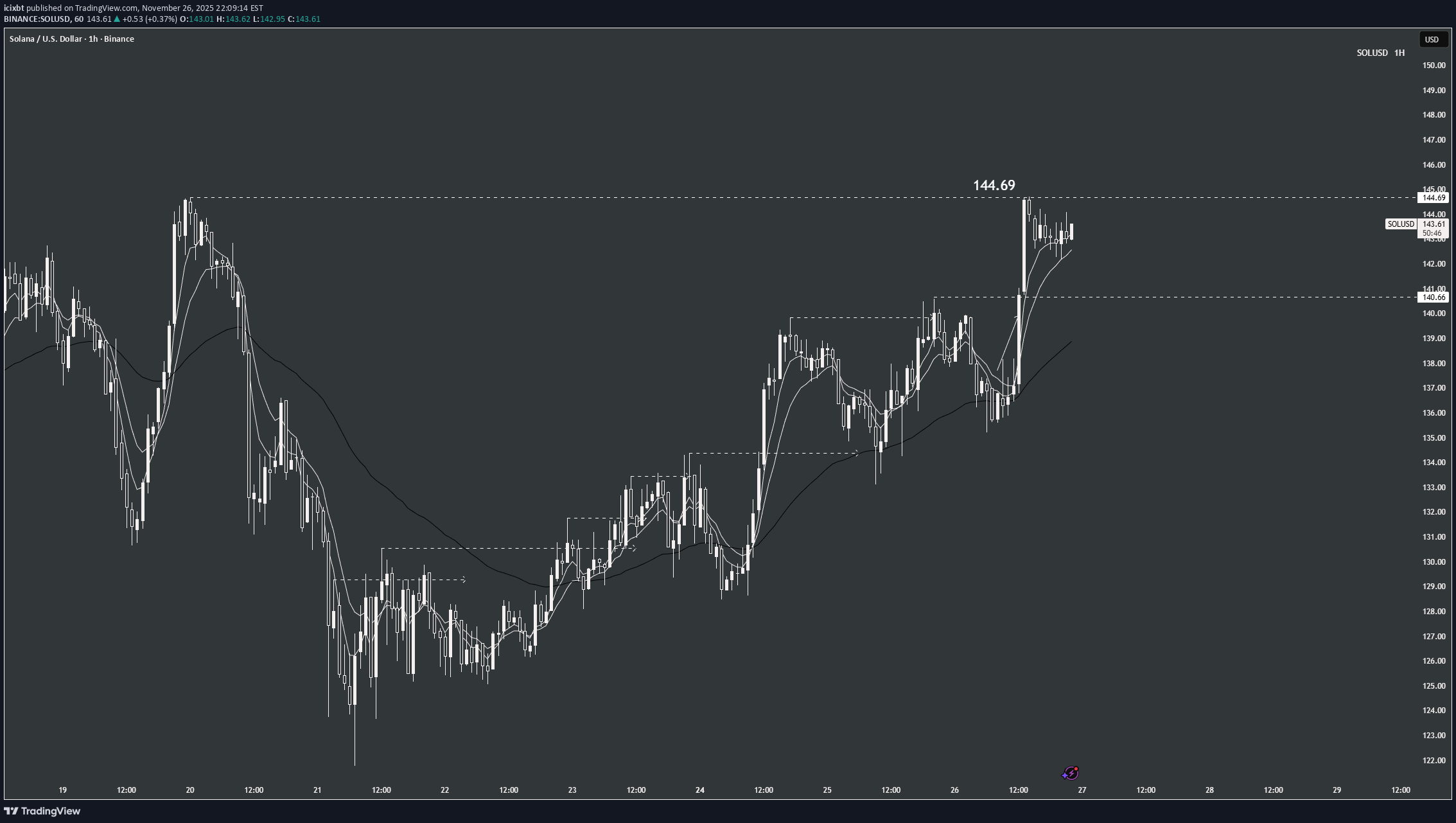

پیشبینی صعودی سولانا (SOL): سطح کلیدی برای شکستن مقاومت و اهداف بعدی در 28 نوامبر

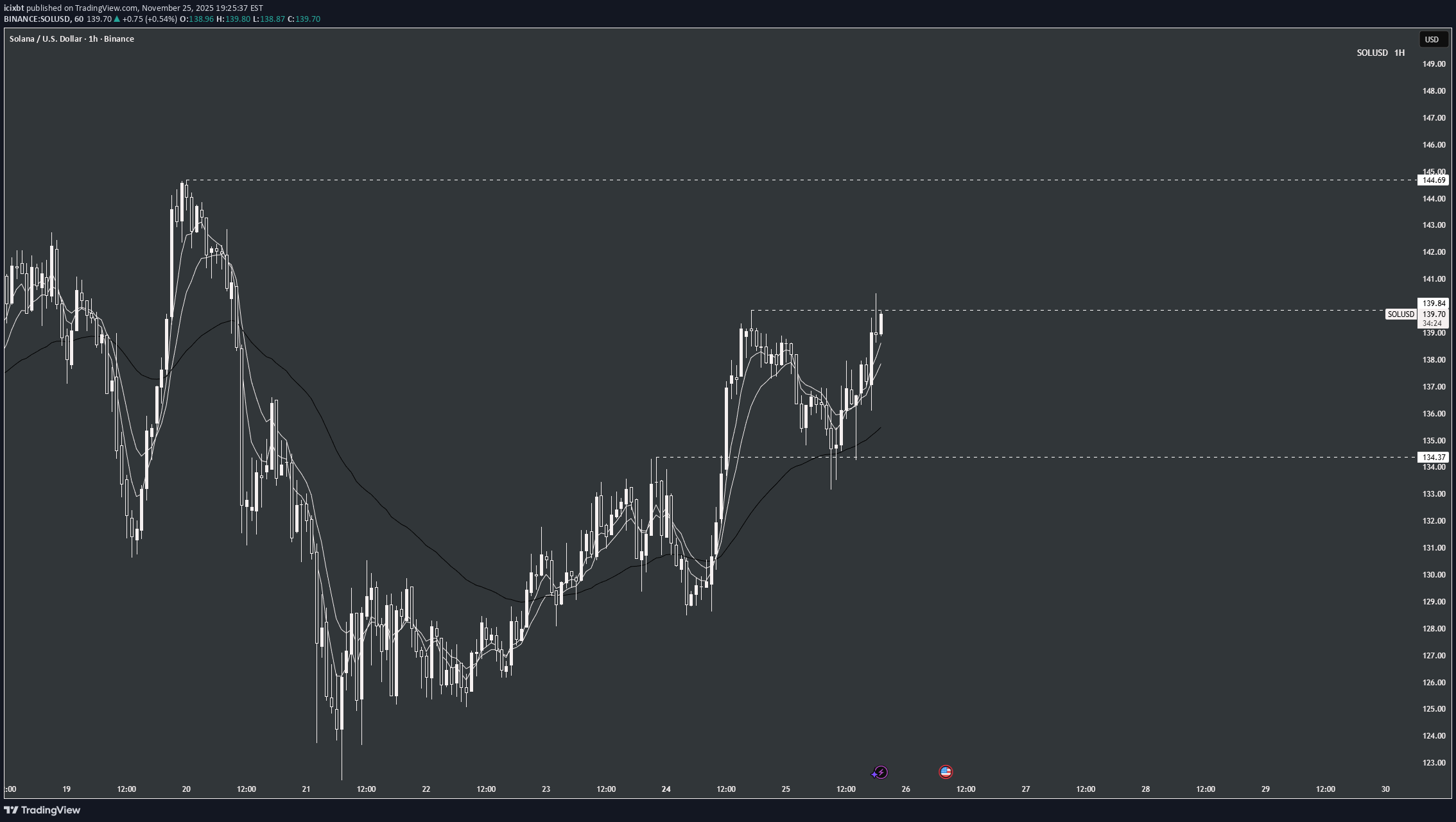

SOL Daily Outlook | November 28, 2025 My bias on SOL remains bullish. Price is still holding higher-timeframe structure after rejecting 144.69, and the pullback into 136–138 looks corrective rather than a reversal. I want to see price reclaim 140–141 to confirm continuation and make another move toward 144.69. If that reclaim doesn’t hold, a retest of 133–135 is the next area of interest before pushing higher. As long as SOL stays above 133–135, I expect the market to continue higher and eventually break through 144.69 in the coming days or weeks.

پیشبینی روزانه سول (SOL): فرصتهای خرید در مسیر صعودی قدرتمند!

1hr timeframe has been pushing up to 144.69 beautifully above the 50ema. Lots of opportunity to catch long entries here inside the 1hr ranges. Bias: We continue to push higher BULLISH

سولانا در اوج: خریداران بازار را در دست گرفتند و هدف ۱۷۴ دلار کجاست؟

Solana buyers in control. Price is above the 50ema with a strong push heading towards 144.69! Bias: Bullish

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.