SwingTrade_Concept

@t_SwingTrade_Concept

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SwingTrade_Concept

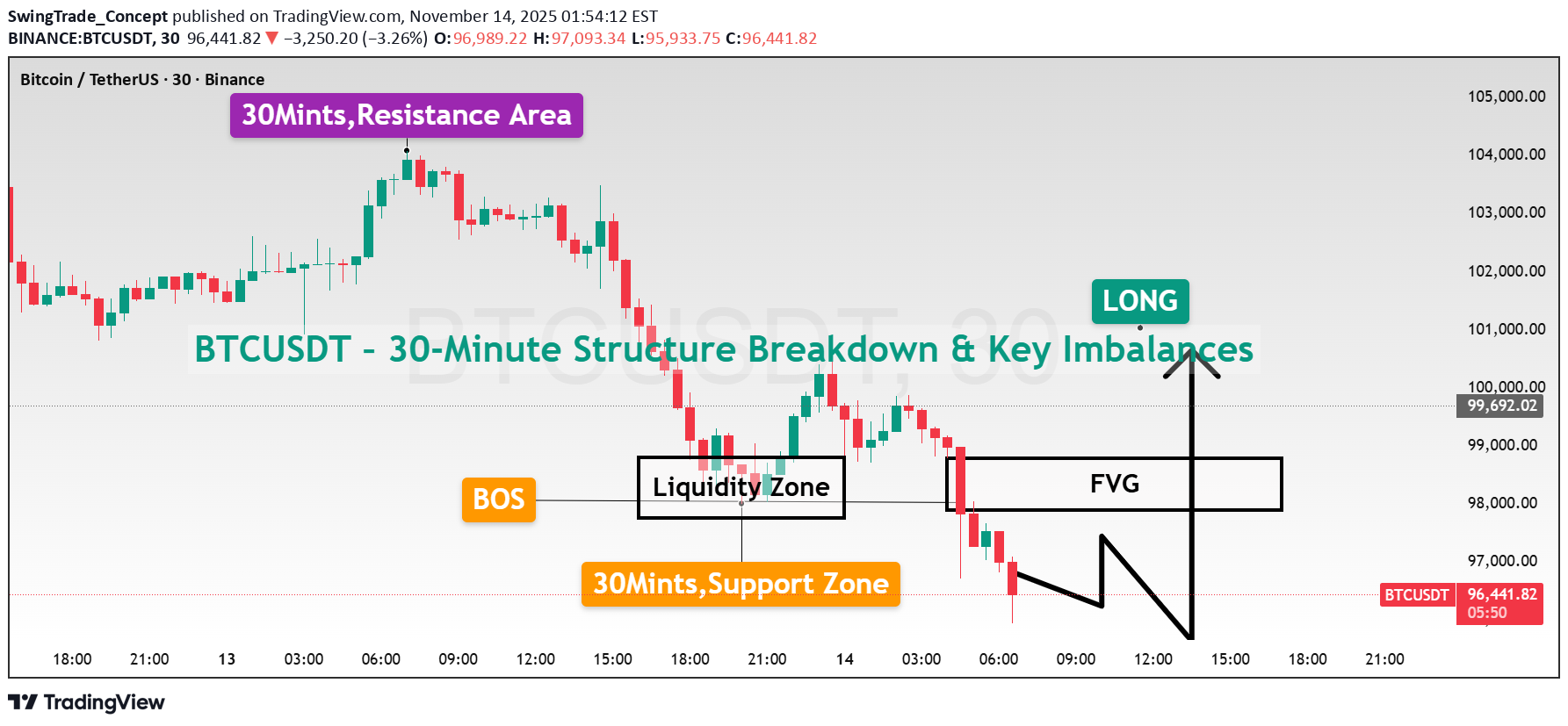

تحلیل ساختار بیت کوین (30 دقیقهای): شکست ساختار و فرصتهای معاملاتی کلیدی

Bitcoin on the 30-minute timeframe is showing a clear shift in short-term structure after rejecting the 30-minute resistance area. Price broke below the recent swing level, creating a Break of Structure (BOS) and opening the door for a deeper retracement. 1. Liquidity Sweep & BOS Price tapped into the highlighted liquidity zone, swept resting orders, and then continued lower, confirming a near-term bearish move through BOS. 2. Fair Value Gap (FVG) Identified A clean FVG has formed below the current price. This imbalance may attract a price for a potential short-term retracement. If the price returns to this level, it can act as a point of reaction. 3. Support Zone Under Observation The chart highlights the 30-minute support zone, where the price previously reacted strongly. If this zone holds again, a move back toward the FVG or higher levels is possible. 4. Market Context Current movement reflects normal intraday volatility with liquidity grabs and imbalance formations. Structure will remain flexible as BTC reacts to key zones.

SwingTrade_Concept

تحلیل تکنیکال بیت کوین: آیا کف سازی برای جهش بزرگ آغاز شده است؟ (سطوح کلیدی)

Btcudt is trading near $103,600, showing early signs of recovery after rebounding from the $101,500–$102,000 support area. Price action is shaping an ascending channel, with both boundaries clearly respected. The recent bounce from the lower boundary highlights renewed demand within the structure. As long as BTC holds above 102,000, short-term momentum may favor further testing of higher resistance zones. Potential resistance lies near $105,500, $106,800, and $107,000, aligning with the channel’s upper range. A decisive break below 101,500 would invalidate the current bullish structure and shift bias to neutral. Structure: Ascending Channel Market Bias: Mildly Bullish (above 102,000) Key Levels: 101,500 (support), 105,500–107,000 (resistance zones) Disclaimer This analysis is for educational purposes only and does not constitute financial advice.

SwingTrade_Concept

سیگنال فروش بیت کوین: منتظر ریزش از منطقه مقاومت کلیدی باشید!

The market is showing a clear 1H break of structure, with price approaching a strong resistance area. After a bullish impulse, BTC is expected to pull back from resistance for a short-term correction. Key Levels: Sell Entry: Around 106,000 Stop Loss: 106,700 Take Profit: 104,100 Reasoning: Technically: Price has completed a clear bullish leg and tapped into the 1H resistance area. The structure suggests exhaustion with the potential for rejection. A lower high formation suggests bearish correction toward the 1H support zone. Fundamentally: Market sentiment remains cautious as BTC faces resistance amid uncertainty in broader crypto risk appetite and mild dollar strength. Short-term selling pressure may dominate before any new bullish continuation. Disclaimer: This analysis is for educational purposes only. It is not financial advice. Always manage risk before trading.

SwingTrade_Concept

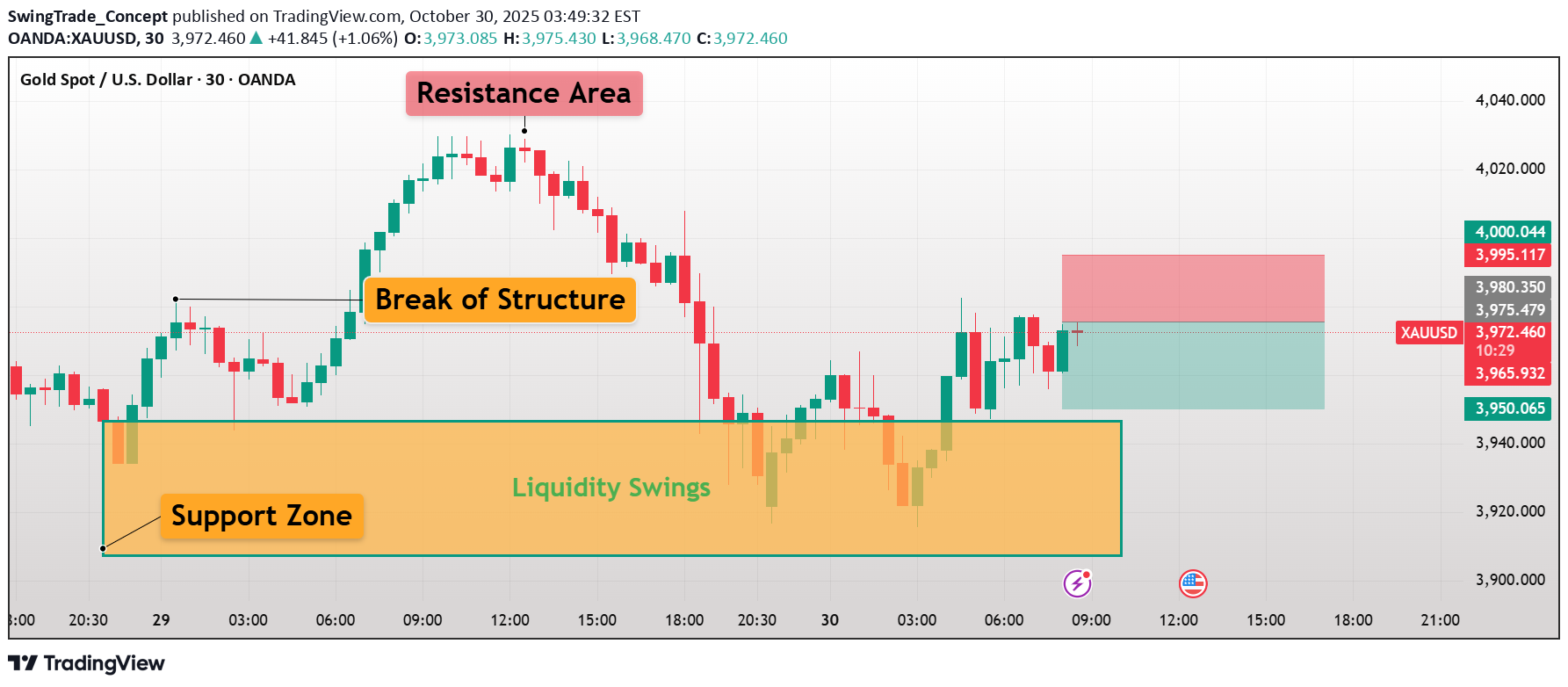

پیشبینی طلا (XAUUSD) هفته آینده: آیا حمایت 3965 حفظ میشود؟ تحلیل تکنیکال و فاندامنتال

Gold remains consolidative after strong rejection at the 4H Resistance Area near 4,100, with a visible break of structure to the downside confirming a shift in short-term momentum. The price is currently stabilizing near the 4H Support Zone at 3,965–3,980, as the market awaits high-impact U.S. data later in the week. Key Levels Support: 3965 — 3980 Resistance: 4010 — 4035 liquidity zone: 4000 Reasoning: Technically, the 4H structure shows a clear lower-high formation after the resistance rejection, signaling that sellers are regaining control. The support zone between 3,965–3,980 will act as a key decision area — a break below could extend the bearish leg, while a bounce might trigger a short-term recovery. Fundamentally, this week’s focus is on U.S. economic data, including the ISM Manufacturing & Services PMI, ADP Employment, and Non-Farm Payrolls (NFP) reports. Stronger-than-expected numbers could strengthen the U.S. dollar and pressure gold prices, while weaker data might support a short-term rebound. Disclaimer: This analysis is for educational purposes only and not financial advice. Always confirm your own entries and apply proper risk management before trading.

SwingTrade_Concept

آیا طلا آماده سقوط است؟ تحلیل فنی و سطوح کلیدی فروش طلا

Gold has faced rejection from the 30-minute resistance area near 4,012, followed by a break of structure to the downside indicating renewed bearish momentum. The market structure suggests a potential short-term continuation toward the 3,968 support zone as sellers regain control. Key Levels: Sell Entry: 4,000 Take Profit: 3,968 Stop Loss: 4,012 Reasoning: Technically, XAUUSD has rejected the resistance zone and confirmed a break of the structure, suggesting sellers are stepping in after a failed attempt to push higher. Lower highs and increasing bearish candles reflect momentum shifting in favor of the downside. Fundamentally, gold remains under mild pressure as investors await upcoming U.S. economic data, while a slightly firm U.S. dollar limits bullish extension in the short term. Disclaimer: This analysis is for educational purposes only and not financial advice. Always manage risk and follow your own trading plan before executing any trade.

SwingTrade_Concept

بیت کوین پس از حمایت 30 دقیقهای خیز برداشت: آیا مسیر صعود به 111800 هموار شد؟

Bitcoin has shown a clean rebound from the 30-minute support zone, followed by a break of structure, indicating renewed bullish momentum. The market structure suggests a potential short-term continuation toward the 111,800 resistance area as buyers step back in control. Key Levels: Buy Entry: 109,700 Take Profit: 111,800 Stop Loss: 108,500 Reasoning: Technically, BTC/USD has confirmed a structure break after retesting the support base, signaling strength from buyers. The formation of higher lows and the appearance of increasingly bullish candles reflect momentum continuation toward the next resistance. Fundamentally , improving crypto market sentiment and stable U.S. dollar movement ahead of upcoming macro data are helping sustain Bitcoin’s recovery tone. Disclaimer: This analysis is for educational purposes only and not financial advice. Always manage risk and follow your own trading plan before executing any trade.

SwingTrade_Concept

تحلیل طلا: آماده شدن برای ریزش از مقاومت 30 دقیقهای (سیگنال فروش قوی)

Gold is showing signs of weakness after retesting the 30-minute resistance area, following a clear break of structure. The market currently respects the lower high formation, suggesting a potential short-term correction toward the support zone as sellers regain control. Key Levels: Sell Entry: 3980 Take Profit: 3950 Stop Loss: 4000 Reasoning: Technically, the price has completed a structure break and is now retesting previous resistance, turning it into a new supply zone. Candlestick behavior shows bearish pressure, supporting a short setup. Fundamentally, stronger U.S. dollar sentiment and cautious risk tone before upcoming U.S. data keep gold under pressure. Disclaimer: This analysis is for educational purposes only and not financial advice. Always manage risk and follow your own trading plan before executing any trade.The gold (Xauusd) reached 3970 from 3980

SwingTrade_Concept

تحلیل تکنیکال بیت کوین: سیگنال فروش پس از شکست ساختار اصلی (با سطوح کلیدی)

Bitcoin continues to trade in a bearish structure, forming lower highs after a clear break of the structure from the resistance area. A short-term retest toward the 1H resistance provides a potential swing sell opportunity targeting the next support zone as sellers remain active below key levels. Key Levels: Sell Entry: 110,400 Take Profit: 108,200 Stop Loss: 111,700 Reasoning: Technically, price action confirms a shift in market structure as BTC/USD fails to maintain bullish momentum and breaks below previous support. The 1H chart clearly shows sellers defending the resistance area, suggesting further downside continuation. Fundamentally, Bitcoin remains under pressure as the U.S. dollar strengthens and global risk sentiment weakens. Investors are turning cautious ahead of upcoming U.S. economic data, favoring safe-haven assets and reducing crypto demand. Disclaimer: This analysis is for educational purposes only and not financial advice. Always manage risk and follow your own trading plan before executing any trade.The Bitcoin Price reached the Target as we expected, 108,200 from 110,400

SwingTrade_Concept

فروش طلا در نزدیکی 3975: آیا فشار فروش سنگین بازار را پایین میکشد؟

XAU/USD is positioned near 3975, showing potential for a downside move as selling pressure builds and short term bullish momentum fades. If the current resistance holds, the pair could test the next support zone. Key Levels: Sell Entry: 3975 Take Profit: 3950 Stop Loss: 3995 Reasoning: Technically, Gold has stalled near 3975, forming a local ceiling. Price action suggests that sellers may push the pair lower toward 3950. Fundamentally, gold is facing headwinds from a firm U.S. dollar and rising interest rate expectations. Diminished haven demand and improving market sentiment in risk assets further limit upside potential. Disclaimer: This analysis is for educational purposes only and does not constitute financial advice.

SwingTrade_Concept

بیت کوین در آستانه خیز جدید صعودی: سطوح کلیدی خرید و فروش کجاست؟

Bitcoin shows potential recovery from the support zone after a clean structure break, maintaining a bullish bias. After retesting the previous breakout region, BTC is forming a base near 112,400, suggesting possible upside movement toward the 114,800 zone if buyers hold control. The overall structure remains positive as price continues to respect higher lows within the bullish channel. Key Levels: Buy Entry: 112,400 Take Profit: 114,800 Stop Loss: 111,000 Reasoning: Technically, Bitcoin is showing signs of continuation after a break of structure, indicating renewed buyer interest from the support zone. The price has reacted positively near demand, maintaining momentum above key moving averages. Fundamentally, BTC sentiment is improving as investors await clarity on U.S. economic data and potential rate-cut expectations, while broader risk appetite in crypto markets strengthens. The reduced dollar strength is also helping BTC stabilize near its recent lows. Disclaimer: This analysis is for educational purposes only and not financial advice.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.