RidgeHavenCapital

@t_RidgeHavenCapital

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

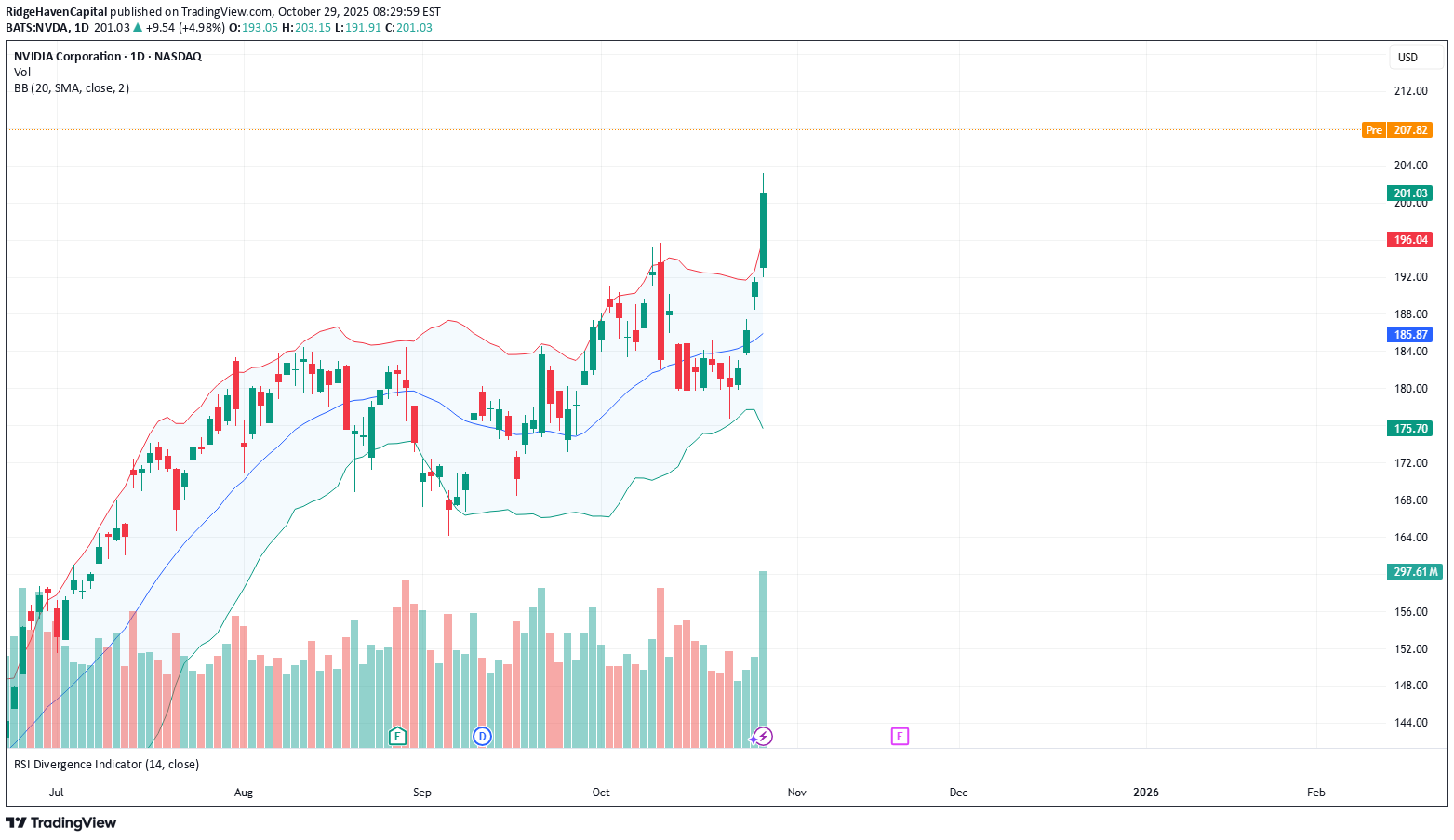

سقف انفجاری انویدیا: پایان این صعود افسانهای کجاست؟

No question that this is a blow off top. Where does it end? Premarket open above the BB channel on Day and Week view.

فروپاشی قریبالوقوع بازار سهام: 9 دلیل هشداردهنده برای ریزش امروز!

Reasons the stock market could fall today: Government shutdown fears creating uncertainty and GDP drag White House instability after East Wing destruction shaking political confidence Rising China tensions and supply chain disruption fears New or expanded tariffs increasing costs and squeezing margins Inflation pressures staying elevated despite weak growth Stagflation worries combining slow growth with high prices Investor sentiment turning risk-off amid multiple uncertainties Corporate earnings at risk from weaker demand and higher input costs Global contagion from China or Europe worsening growth outlook

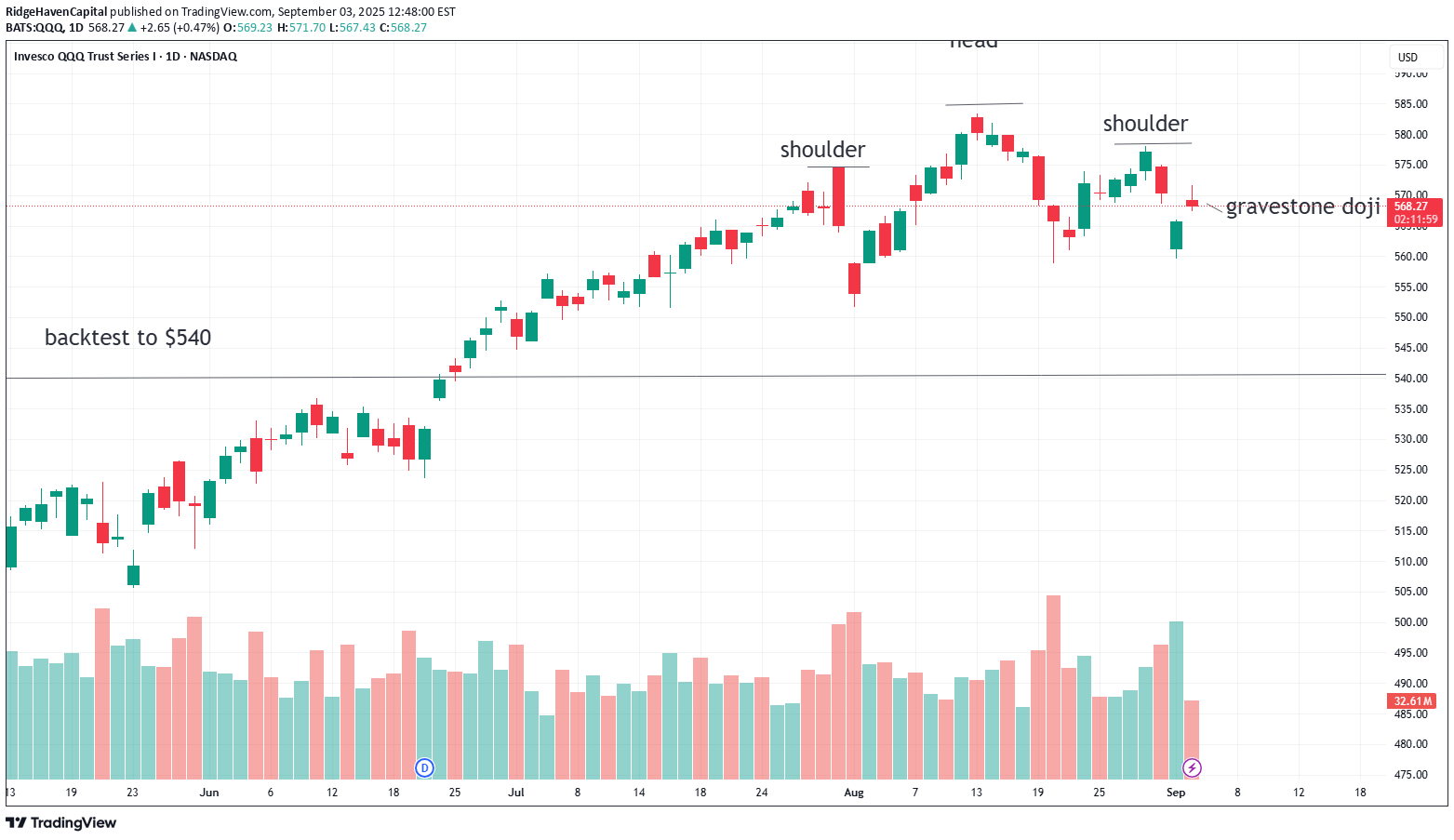

از دست دادن قدرت گاوها: آیا سقوط ۱۰ درصدی در انتظار بازار است؟

We may have a double or triple top before breaking down and having a 10% correction. Prior resistance post-election was $540 and the market blew through that level since April without stopping. Should be a support level.

سقف دوقلو یا پایان حباب تسلا؟ علائم هشداردهنده بازار

Tesla's move since 9/11/25 has characteristics of a Blow Off Top Parabolic price rise Extremely high trading volume Widespread optimism or “fear of missing out” Sudden reversal and heavy selling The high appears to match prior highs from last year, making this a double top. Near the top, there was a period of distribution, as shareholders exited positions, creating new bagholders.

سقوط قریبالوقوع نزدک (QQQ): آیا این نشانههای نگرانکننده هشدار میدهند؟

Declining volume, diverging RSI, sell-offs throughout the day.

هشدار: آیا بازارها آماده سقوط هستند؟ نشانههایی که نباید نادیده بگیرید!

Diverging RSI confirmed with today's faded rally. Lots of uncertainty with the shutdown, but also no release of government data. How will the Fed know to lower rates without data? Markets are at all-time highs, but also at all-time high VALUATIONS. P/S, Case Shiller PE, Earnings Yield, and others all pointing to a sell-off being needed to contain the bulls.

سیگنال هشدار: همزمان شدن واگرایی نزولی و الگوی چکش آویزان در نمودار!

Possible reversal pattern. Lower Highs on RSI with Higher Highs on price. Daily candle is a hanging man.

Gravestone doji formed by 1:30 PM EST, showing a failure of the ETF to rally. The short pattern is still in play.

After the April Tariff collapse, the index rose significantly off of the bottom and blew right past prior highs. There is a need to back-test to the $540 range. Further, which the government taking fascist equity positions in publicly traded equities and threatening the independence of the federal reserve, there are black swans looming everywhere. Also, tariffs will soon start impacting inflation, just as cracks are forming in the job market. However, can you really rely on the data since the head of BLS was fired for telling the truth about jobs?Look for confirmation with a break below $560 with volume.Scenario 1: NVDA beats earnings, markets rally, and the economy looks strong → September rate cuts are canceled. Scenario 2: NVDA misses earnings, markets soften, and the economy looks weak → September rate cuts remain on course, but growth doubts emerge. Scenario 3: NVDA beats earnings, markets rally, and the economy looks strong. Trump removes Cook → Rate cuts stay on track, markets surge, but inflation accelerates to new highs. Scenario 4: NVDA beats earnings, markets rally, and the economy looks strong. Trump removes Cook, and Powell resigns → Rate cuts stay on track, Trump secures a 50 bp cut, stocks surpass dot-com bubble levels, followed by a crash and deep depression.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.