Double_RR

@t_Double_RR

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

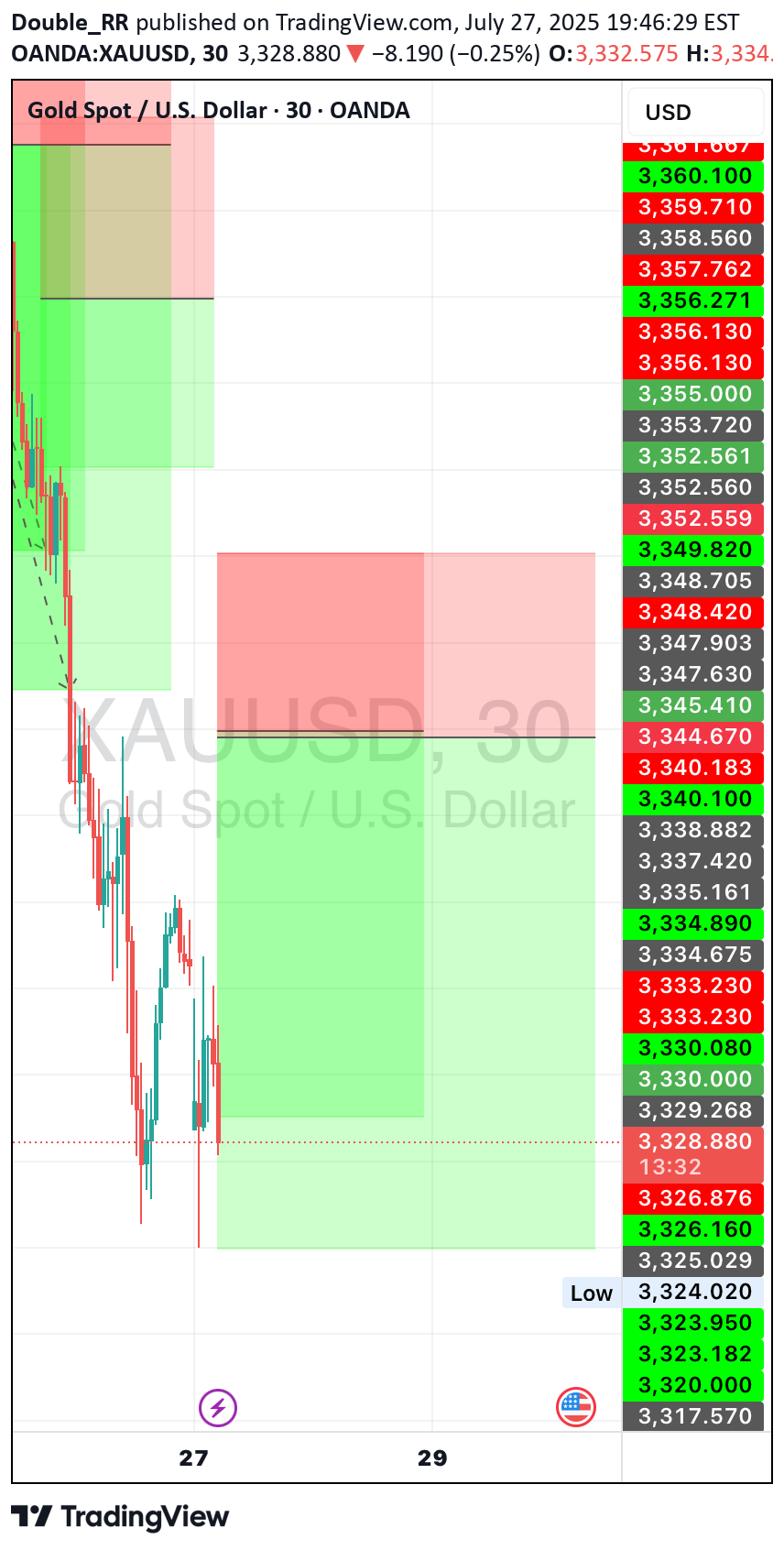

Double_RR

XAUUSD there is no clear trend expectations

The way we trade our system monitors that the gold market is in a clear structural window. The current market lack of macro shock events, there is no clear trend expectations, resulting in gold into the "no main line, no support" vacuum zone. This stage is usually characterized by price repetition, sparse transactions and inefficient trading. AI further identifies that the volume of gold social opinion topics has declined, and the heat of search and position attention has continued to fall. This indicates a widespread lack of market interest and confidence in gold, a typical signal of a phase of ebb and flow. The operation strategy is recommended to reduce positions, short positions, not recommended to build more in the short term. If you are already in the market, you can cope with the systemic volatility by increasing the level of risk control and narrowing the stop-loss range. We recommend continuing to closely track early signals from AI of momentum restart or sentiment focus in order to respond quickly when conditions are right.

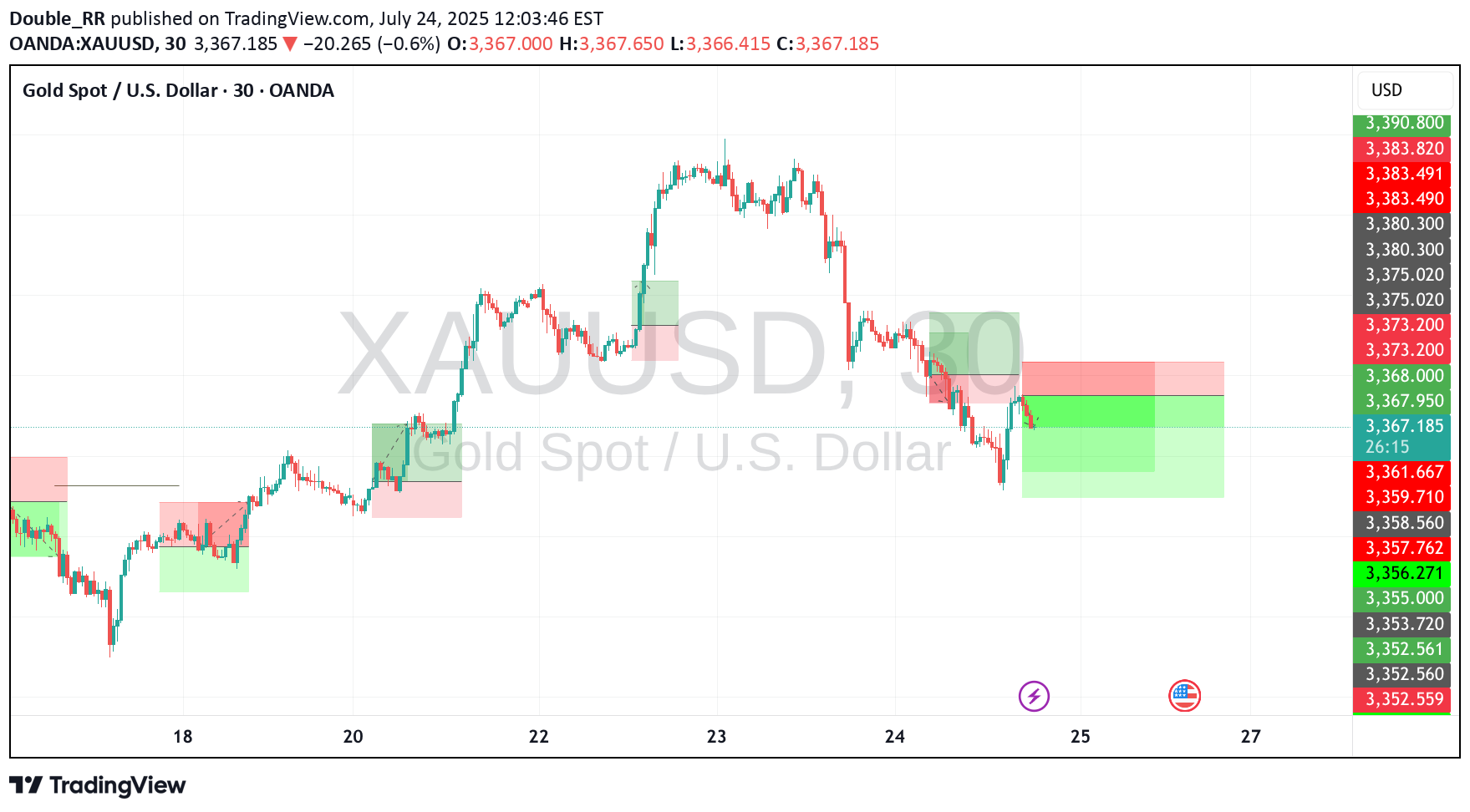

Double_RR

Gold recently experienced a typical "suppression and release"

Capital dynamics and sentiment modeling, found that the gold market has recently experienced a typical "suppression and release" type of reaction. After a period of sustained pressure on the emotional background, the dominant force of the short side began to weaken, and both long and short sentiment tends to be balanced, and the logic of gold as a safe-haven asset has been re-explored and recognized. This type of trend is often non-explosive, but through the emotional layers of repair and structural slow reversal of the gradual unfolding. The current signal strength has reached the bearish threshold set by the system, with a certain operational feasibility. It is recommended that traders try to follow up with a low percentage of positions, but still need to retain enough position space to cope with the possible continuation of fluctuations. The whole layout is mainly defensive and offensive, and it is appropriate to seek progress in a stable manner.

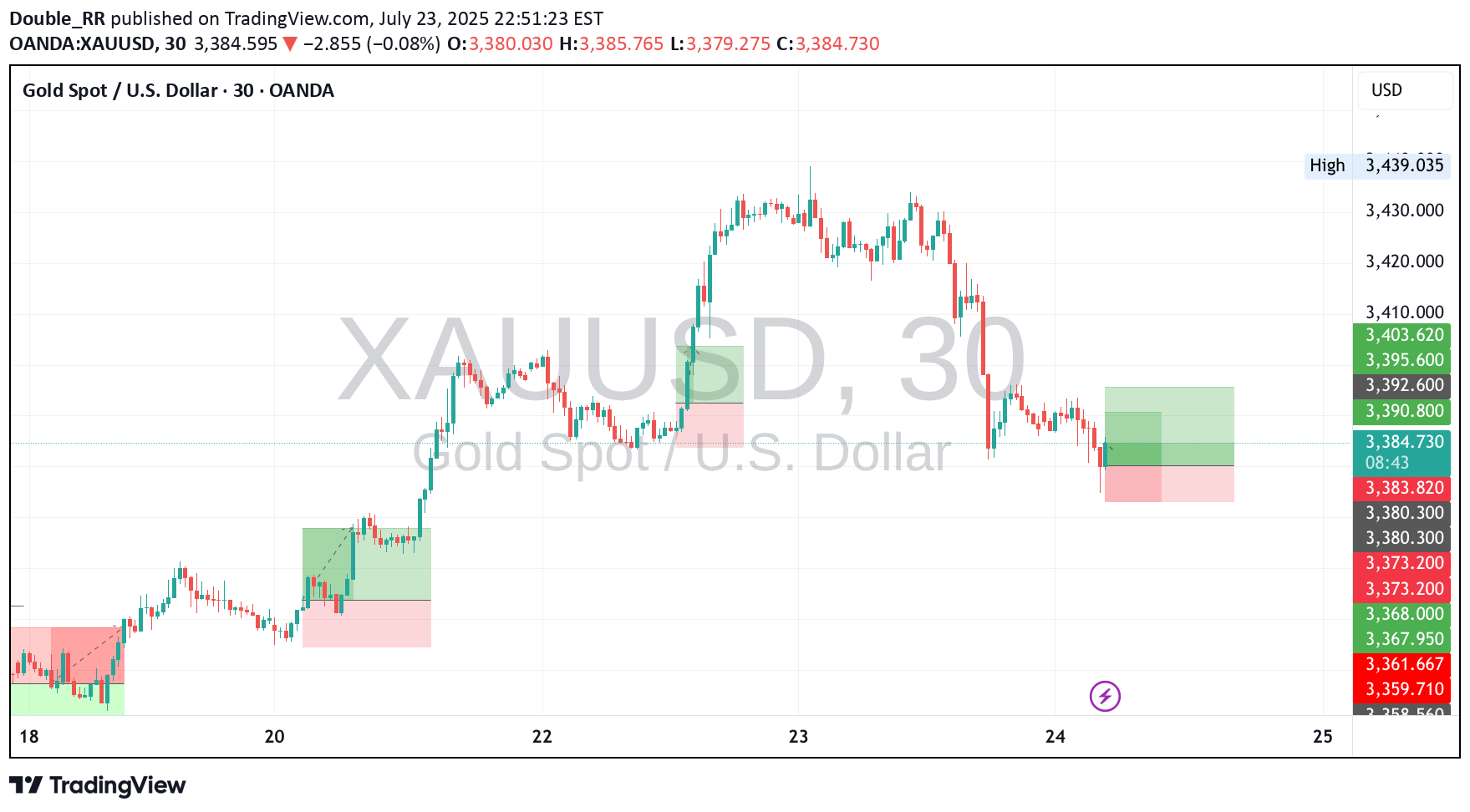

Double_RR

GOLD stage is "downgraded" treatment

Market confidence is gradually repairing, from a number of markets reflected in the panic indicators decline, liquidity can be known, risk aversion demand then weakened. Gold, as a defensive asset, is gradually losing its short-term support. The signal is not only reflected in the transaction data, but also reflected in the social public opinion of the decline in the heat of gold. From our sentiment engine judgment, gold stage is "downgraded" treatment, institutional configuration strategy tends to wait and see or shrink positions. The operation suggestion is to avoid, before the risk appetite falls again, the performance space of gold is limited. Positions can be controlled in a low-exposure state, reserved for operational flexibility.

Double_RR

Gold's safe-haven attribute has lost its key pivot point

A comprehensive judgment, the current market overall defense mechanism is lifting. With the liquidity risk gradually easing, gold's safe-haven attribute has lost its key pivot point. the market preference indicators tracked show that gold as a defensive asset is being marginalized, with trading activity and capital attention both declining. The structure of institutional positions in gold tends to be decentralized, and funds are migrating to assets with higher return expectations. This indicates that in the short term the market is not looking forward to gold out of the systematic market, but rather more inclined to use it as a hedging asset rather than the main configuration. It is recommended that investors appropriately shrink the gold direction of the strategy exposure, to avoid high-frequency operations in the trend of the state of uncertainty. Position should be light, operation should be stable. In the future, if the system captures the signal of the refocusing of risk aversion logic, we will be the first time to issue strategy alerts.

Double_RR

Gold Bullish

After Synthesized public opinion analysis, capital dynamics and sentiment modeling, it found that the gold market has recently experienced a typical "suppression and release" type of reaction. After a period of sustained pressure on the emotional background, the dominant force of the short side began to weaken, and both long and short sentiment tends to be balanced, and the logic of gold as a safe-haven asset has been re-explored and recognized. This type of trend is often non-explosive, but through the emotional layers of repair and structural slow reversal of the gradual unfolding. The current signal strength has reached the bearish threshold set by the system, with a certain operational feasibility.

Double_RR

Triangle has broken through the resistance line

Triangle has broken through the resistance line at 5/28 06:30. Possible bullish price movement forecast for the next 7 hours towards 3,320.19.

Double_RR

Possible bullish price movement towards the resistance 3,318.23

Approaching Resistance level of 3,318.23 identified at 5/28 06:30. This pattern is still in the process of forming. Possible bullish price movement towards the resistance 3,318.23 within the next 1 day.

Double_RR

GOLD Rising Support Ahead! Buy!

Hello,Traders! GOLD is making a nice bearish Correction and will soon hit A rising support line at which point Gold will be trading at a 10% discount Giving us a great entry point To ride the coming bullish wave Buy! Comment and subscribe to help us grow! Check out other forecasts below too!

Double_RR

XAUUSD

Not going to give to much away but buy it now amd you will no regret Inbox for any details

Double_RR

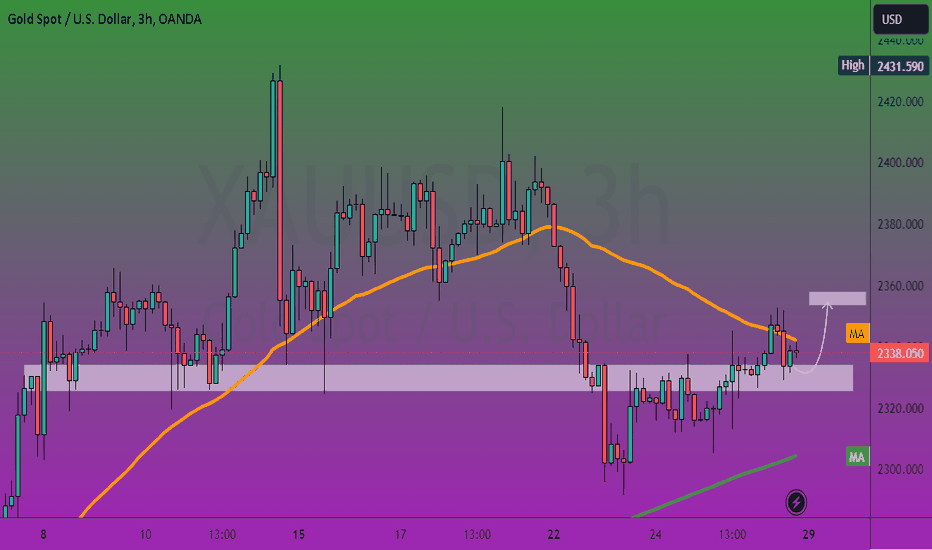

GOLD went above the Key horizontal level Of 2325$

GOLD went above the Key horizontal level Of 2325$ then made a Retest and is going up now Again so I will be expecting A further move up Buy! Like, comment and subscribe to help us grow! Check out other forecasts below too!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.