Connix

@t_Connix

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Connix

Uniswap breakout?

Unlike many others ,Uniswap has recently broken out of a traingle pattern. Confirmatiom touch would be nice to see Target $6.50

Connix

Do you trust the Bitcoin ETF

Just imagine. Ultimate fakeout into the Extended Shark Harmonic. Bullish Structure, Painful retrace. Unpopular opinion im sure lol

Connix

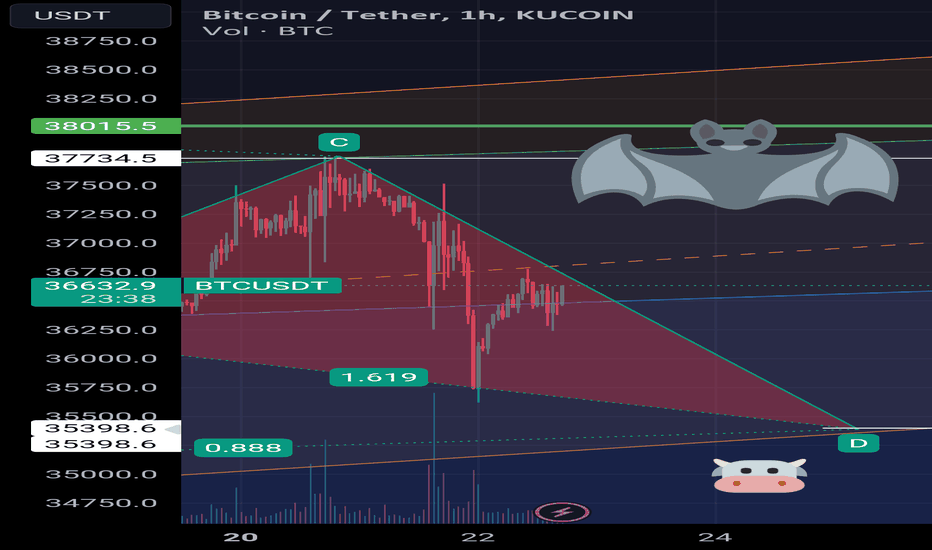

Bullish bat harmonic?

Possible Bat harmonic on the short term timeframes. Buy target 35400 with tight SL. Targets are B C and A.

Connix

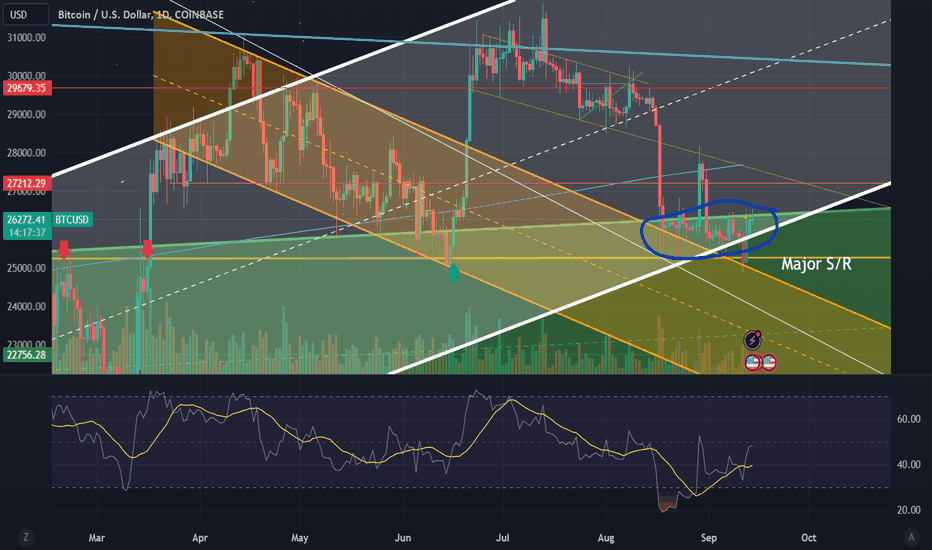

Parallel channel tight squeeze. BTC

Long story short without going into to much detail. BTC is currently trapped between 2 important parallel channel (blue hand drawn circle). confirmation of breakout in either direction is likely to mean volatility . Breaking out of the top of the green channel likely mean bullish movements shortter. Breaking down out of the white channel likely means bearish shortterm. These channels have been valid S and R for over a year

Connix

Bitcoin Patterns #2

Bitcoin Patterns #2 This is an update to a previous post attached below. White traingle Looking at the white traingle pattern it looks like BTC has broken down, with a confirmed retest. Bearish. The measure move (target) would be around $28540 as shown by red box. Yellow Parralel Channel The channel is playing out nicely so far, you can see it react well on smaller timeframes, especially the central line! Although we broke down from the triangle we have for tbe meantime found some support around the bottom of the channel. Blue line The thicker blue line is a longer term support/resistance begining in January 2021. We have yet to break back above it since May 2022, with multiple attempts.

Connix

Big bitcoin resistance

Big bitcoin resistance So ignoring everything on the chart apart from the thick green with arrows indicating support and resistance touches. This has been a major resistance line for BTC since January 16th. High volatility whenever we break or get rejected from this line. Anyone else been watching this one?

Connix

Bitcoin fakeout! 👀

Bitcoin fakeout! 👀 I had dowts this morning watching the price break out of the shortterm triangle pattern (red) luckily it was a fakeout. The thicker blue line is a major weekly support/resistance line which I personally don't see us pushing past short term. Green horizonal is my personal target before I become bearish. See other posts on my tradeview for revivence and follow me for updates!

Connix

Pepe prediction

Pepe prediction Now I'm not entirely sure I can do TA on a hype meme coin but il try as I want to buy some. Pepe might be the next meme coin champion next cycle 🤷♂️ We over shot the 1.13 fib massively because of crazy fomo hype (circle) but ultimately came back down, retested and got rejected. All ups have thier downs and I expect pepes to be a deep retrace. X marks where il hopefully be able to pick some up 🤞🔥 This price was pepe's last resistance which was not retested. This price is also the 0.886 fib from the first up swing. Price is also the 1.13 from the most recent swing.

Connix

Fakeout. Short term targets btc

Fakeout. Short term targets btc OK so a little breakdown from What I'm seeing short term. The yellow hand drawn circle is a brilliant example of a fakeout. We recently broke down from a equal triangle shape after a fakeout (fakeouts are usual signs of reversal coming) The target for breaking down from this triangle would be about 27900. As shown by simple cloning the high to low of the beginning of the triangle. 27900 also brings us to out support zone again (red dashed horizontal) Happy Bank Holiday 🍻

Connix

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.