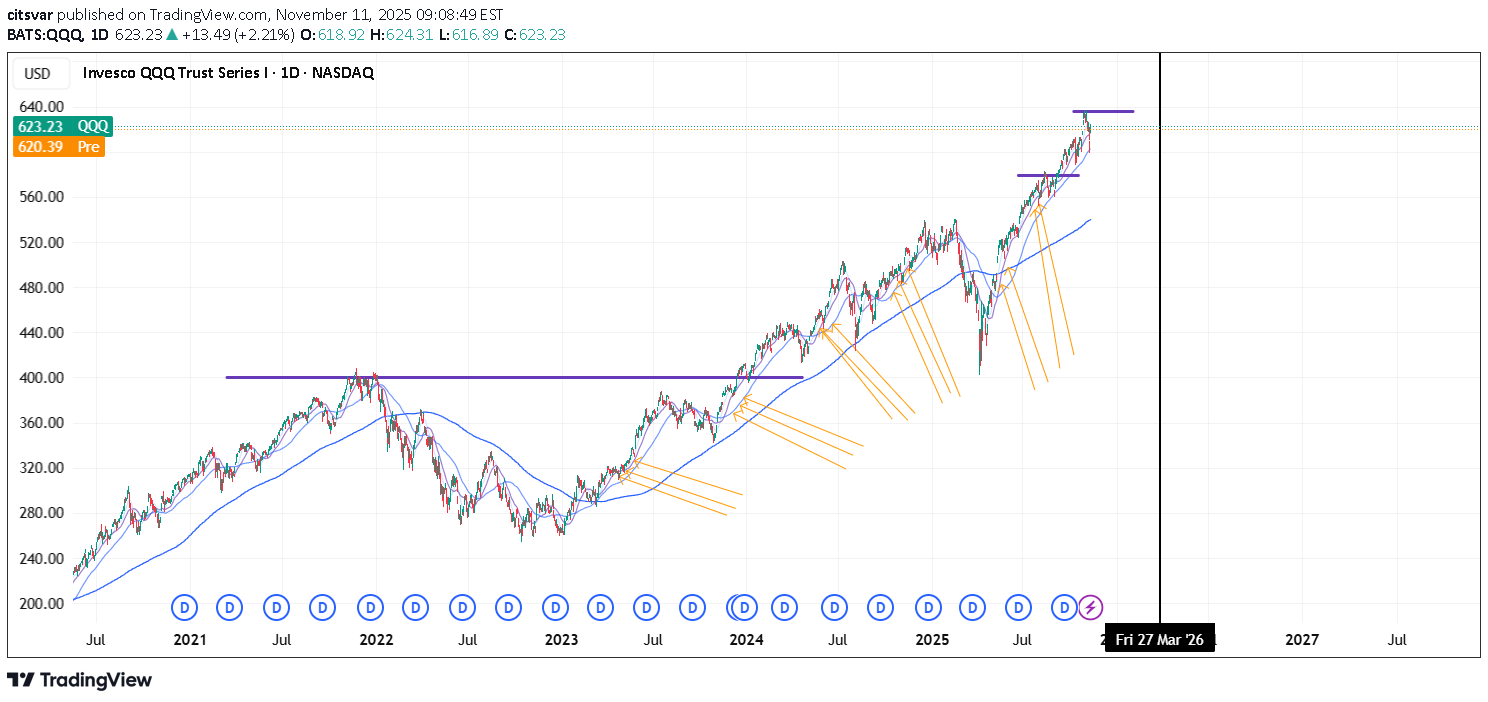

Technical analysis by citsvar about Symbol QQQX on 23 hour ago

citsvar

راز بازدهی شگفتانگیز در نوسانگیری: تلههای روانشناسی بازار و چرخههای تکراری!

You got to look long-term or use an outside view. -using qullamaggie's 10/20/50 (upsloping) concept and that -you cant run away from 200dma. Your best returns will be on periods with perfect setups. Where you most likely want to know the best stocks to own? //ie during upswingy or in-pattern VIX, small caps underperform etc. simple but not easy. ie the edge. market forces.here's example, owning the HOOD compounding forces in action. Hardest thing to stay patient. And not FOMOing on bad setups?you want to tap into the invisible market forces? but mostly they are predictable?trends can be misleading. market forces does notOliver Kells "price cycle" holds true. Livermores concepts also hold true. Livermores core concept was about "Least resistance". Combining that with Qullamaggies expertise, where he says markets always repeat. If you look from an outside view -- on strong momentum markets, people EXPECT bull market to last forever. at some point it either has "bull stagnation" (peak)... or "bull pause" and it continues (ie re-accumulation phases, flags). from an outside view, least resistance (based on Supply-demand) will always be on bottoms. Then it rallies. And 3rd wave will be an exhausted rally? Psychology always repeat. From Doubt (FUD) --> conviction ---> exhaust. (based on strong "demand" not caution or doubt). markets always revert to mean and respect where 200dma stands?the theory is true, because not many people want to buy the 3rd wave. There's always type of stagnation, that leads to peaks. during 2nd wave it can be an bull pause. where nothing happens... and you may panic or have doubts. same cycle repeat over and over againhere's an example with $CRDO. Great company? 1st wave the easiest %? or LACK OF RESISTANCE. when u are on that market, u tend to focus on short term not statistical side. 2nd wave - could have strong bounce? momentum wave. 3rd - exhaust. on it's last legs. psychology - people expect strong trends to last forever. ie post 3rd wave, u expect a strong market.CLSK Qullamaggie speaks how the 10/20/50 pattern always repeat. Over and over again. I would say, so do the psychology around 1-2-3 waves. Because markets are risk averse? profit seeking, minimizing risk.here's small cap returns with falling dollar DXY as an market force. And falling TNX yields. which fuels risk taking. When you are on these markets at real time --- you ignore the fundamental forces that made market so strong lol hence -- such "3rd wave" exhausts happen.Oliver Kell was great with his price cycle concept. You could probably borrow the concept for 50/200 cycle. There can only be one rally EXTENSION or exhaust. and one exhaust or extension to the downside. Peak or trough basically. if you dont know where it is - it's high variance. avoid. If you are not in the market, holding pos.theoretical returns for $HOOD. assuming you knew the right stock or the category to own. note there would be periods of lag. and your returns wouldn't come right away. it compounds with the 10/20/50 push, extensions. That's why making profit is so tough. I use different approach than qullamaggie, but he also says he only get winning trades 30% of times. ---> longterm, statistics unbeatable. People think it's shit ie underestimate the statistics.and theoretical waves. most risk taking during "1" and "2". because strong market obviously. Momentum of inflows. "3" is exhaust. hard to kill the trend. Where sooner or later nobody wants to buy, or demand from bellow starts pulling things back to earth.-Qullamaggie speaks how you should spend 1000 hrs studying "historical" charts. whilst true. -never be "past" oriented. only forward. There's nothing in the past, that makes you profit.