Technical analysis by The-Thief about Symbol METAX: Buy recommendation (11/10/2025)

The-Thief

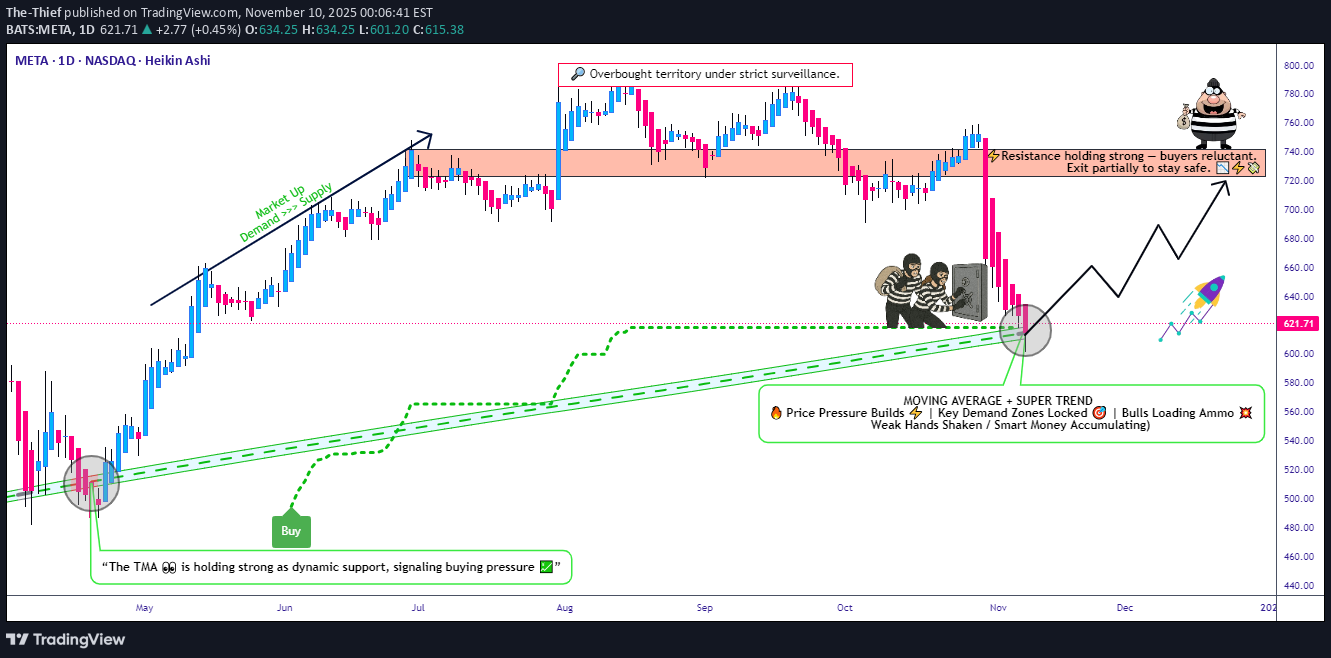

متا (META) ریزش یا حرکت قدرتمند؟ ساختار فنی مسیر صعودی را مشخص میکند

🎯 META PLATFORMS INC. (NASDAQ) | THE THIEF'S PROFIT PLAYBOOK 💰 Bullish Swing Trade Setup | Supertrend + Triangular Moving Average Pullback 📊 SETUP OVERVIEW This analysis presents a disciplined swing trading strategy on META (NASDAQ: Meta Platforms Inc.) leveraging proven technical indicators combined with strategic entry layering methodology. Current Market Context: 🔍 Current Price: ~$625.24 (as of Nov 9, 2025) RSI Status: Oversold Territory (<30) ⚠️ 52-Week High: $796.25 | 52-Week Low: $479.80 Analyst Target: $824.02 (+32.54% potential upside) 📈 Sentiment: 44 Analysts = "Strong Buy" Rating ✅ 🎬 ENTRY STRATEGY: THE LAYERING APPROACH Rather than risking a single entry, this "Thief" methodology utilizes multiple limit order layers for optimal risk-adjusted position building: Primary Entry Layers (Building Position Gradually): Layer 1️⃣: $590 | Entry volume allocation: 25% Layer 2️⃣: $600 | Entry volume allocation: 25% Layer 3️⃣: $620 | Entry volume allocation: 25% Layer 4️⃣: $630 | Entry volume allocation: 15% Layer 5️⃣: $640 | Entry volume allocation: 10% 💡 Strategy Rationale: Layering captures value through market dips while maintaining capital preservation. Adjust layer counts/prices based on your risk tolerance and account size. 🛑 RISK MANAGEMENT Stop Loss Level: $560 🛑 Represents approximately -10.4% from current price Protects against breakdown of support structure Triggered if key technical support fails ⚡ IMPORTANT DISCLAIMER: Stop loss placement is a personal decision based on your risk appetite. The 560 level is suggested only—manage YOUR risk YOUR way. 🎁 PROFIT TARGET Primary Target: $730 🚀 Represents +16.8% upside potential from current levels Aligns with resistance confluence + technical overbought signals Incorporates trap avoidance in highly contested resistance zones 🎯 Exit Strategy Note: Take profits strategically as price approaches target. Don't get greedy—serious resistance + market structure at these levels. The $730 zone is crowded; exit positions intelligently. ⚡ DISCLAIMER: Target selection is your own. Book profits when comfortable—risk management requires personal decision-making, not blind following. 🔗 RELATED PAIRS TO WATCH (TECH SECTOR CORRELATION) Monitor these correlated assets for confirmation signals: 📱 GOOGL (Alphabet Inc.) - Tech sector bellwether; typically leads META moves in AI narrative Correlation: Strong positive | If GOOGL struggles, META upside may be capped Watch: Positive correlation breakouts suggest sector momentum 💻 NVDA (NVIDIA Corp.) - AI chip leader; META's infrastructure partner Correlation: Strong positive | NVDA strength = confidence in AI capex spending Watch: NVDA drops could signal META weakness despite fundamentals 🤖 MSFT (Microsoft Corp.) - Competing AI ecosystem player Correlation: Moderate positive | Sector rotation indicator Watch: MSFT outperformance = potential META underperformance 📊 QQQ (Nasdaq-100 ETF) - Tech sector aggregate Correlation: Very strong | META weighted ~4.7% in QQQ Watch: If QQQ breaks down, META faces headwinds regardless of company-specific factors 🌐 SMH (Semiconductors ETF) - Supply chain health indicator Correlation: Moderate positive | AI infrastructure demand gauge Watch: SMH weakness signals potential capex disappointment 📈 TECHNICAL ANALYSIS FRAMEWORK ✅ Supertrend Confirmation: Bullish alignment detected—uptrend structure intact ✅ Triangular Moving Average (TMA) Pullback: Price respecting key moving average zones, setting up continuation ✅ Oversold RSI: Current market conditions suggest reversal potential ✅ Support Structure: $560 level acts as psychological + technical floor 🎓 WHY THIS SETUP WORKS Entry Discipline: Layering reduces emotional decision-making; mechanical execution improves psychology Risk Control: Multiple entries allow tighter overall stop losses while maintaining position exposure Technical Confirmation: Supertrend + TMA alignment = higher probability setups Sector Tailwinds: META's $600B AI investment announcement provides fundamental support Oversold Bounce Potential: RSI <30 historically precedes relief rallies in strong companies ⚠️ RISK FACTORS & CONSIDERATIONS 🔴 Key Risks: Meta's aggressive capex spending concerns some investors—watch for guidance revisions Regulatory pressure on AI/advertising practices could derail momentum Macro headwinds (interest rates, economic data) always threaten growth narratives Market structure at $730 is HEAVY—resistance may be tougher than expected Position sizing matters: don't over-leverage this trade 💼 Trade Management Checkpoints: Scale in via layering rather than going all-in Monitor daily closes near stop loss; don't let winners turn into losers Consider taking partial profits as price approaches resistance zones Watch related pairs ( QQQ , NVDA ) for confirmation/divergence 💡 PRO TIPS FOR THIEF TRADERS 🔓 Lock in Partial Gains: At $670 level, consider closing 40% of position to secure profits 🔓 Trail Your Stop: Once price establishes above $650, move stop to breakeven to protect capital 🔓 Watch Earnings Calendar: Next catalyst could accelerate move—prepare position accordingly 🔓 Timeframe Matters: This is swing trade—target 2-4 week holding period 🔓 Keep Thesis Tight: Market conditions change—be prepared to exit if setup breaks 📌 FINAL NOTES This analysis is provided for educational & entertainment purposes only. ✨ Every trader must make independent decisions regarding position sizing, entry levels, exit targets, and risk management. What works for one trader's account may not work for another. Test strategies on smaller positions first; respect your stops; manage your risk. Remember: The best trade isn't always the one that makes the most money—it's the one that lets you live to trade another day. 📢 SUPPORT THE ANALYSIS ✨ If you find value in this analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!