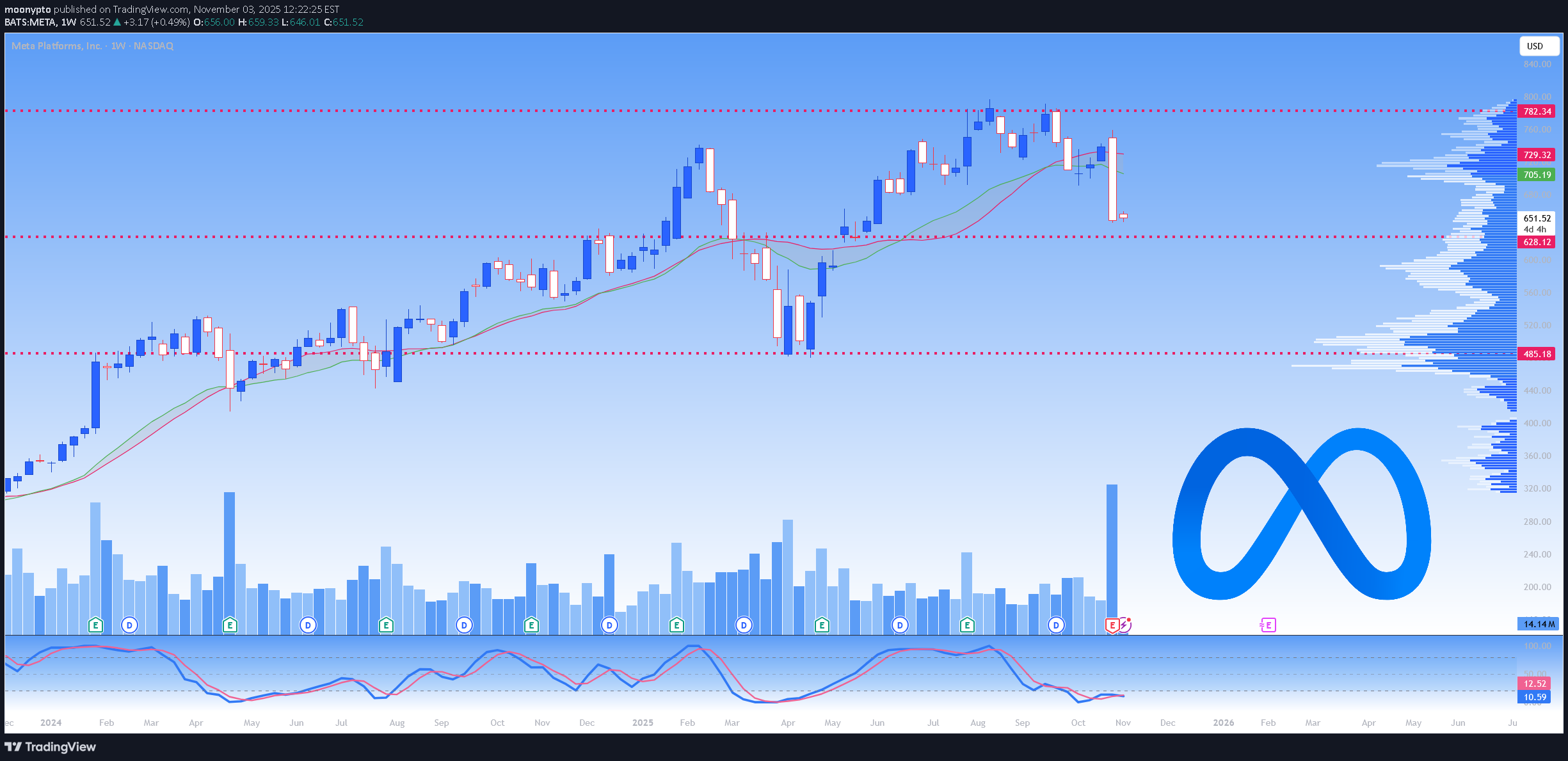

Technical analysis by moonypto about Symbol METAX on 11/3/2025

moonypto

سود مِتا نجومی شد، اما سرمایهگذاران نگرانند: معمای هزینههای عظیم هوش مصنوعی مارک زاکربرگ

Meta’s third quarter results were a study in contrast stellar growth paired with renewed investor skepticism. Revenue jumped 26% year over year to $51.2 billion, far surpassing expectations. Excluding a one time $15.9 billion tax charge tied to a new U.S. tax rule, earnings per share would have landed at $7.25, well above forecasts. Advertising remained the engine of growth, with ad impressions climbing 14% and prices up 10%. Daily users across Meta’s apps reached 3.54 billion, up 8% from last year a sign that the company’s core business is still thriving. Yet investors weren’t celebrating. The concern wasn’t about performance, but spending. Meta slightly raised its 2025 capital expenditure outlook to $70–$72 billion, but what caught attention was the warning that 2026 spending will be “notably larger.” Total expenses are also expected to grow at a “significantly faster” rate. CEO Mark Zuckerberg made it clear he’s betting heavily on AI, describing plans to “aggressively” build out infrastructure aimed at reaching Superintelligence. This ambitious spending spooked the market. Despite strong Q4 revenue guidance of up to $59 billion, shares fell as investors weighed the risks of massive, open-ended AI investments. The moment recalls Meta’s earlier pivot to the Metaverse another costly bet that initially rattled confidence but eventually paid off through disciplined execution. In short, Meta’s Q3 results reaffirm its dominance in digital advertising and its capacity for reinvention. But the company is again asking investors for patience while it spends heavily on the future. Whether this AI push delivers long term rewards will depend on whether history repeats itself for better or for worse