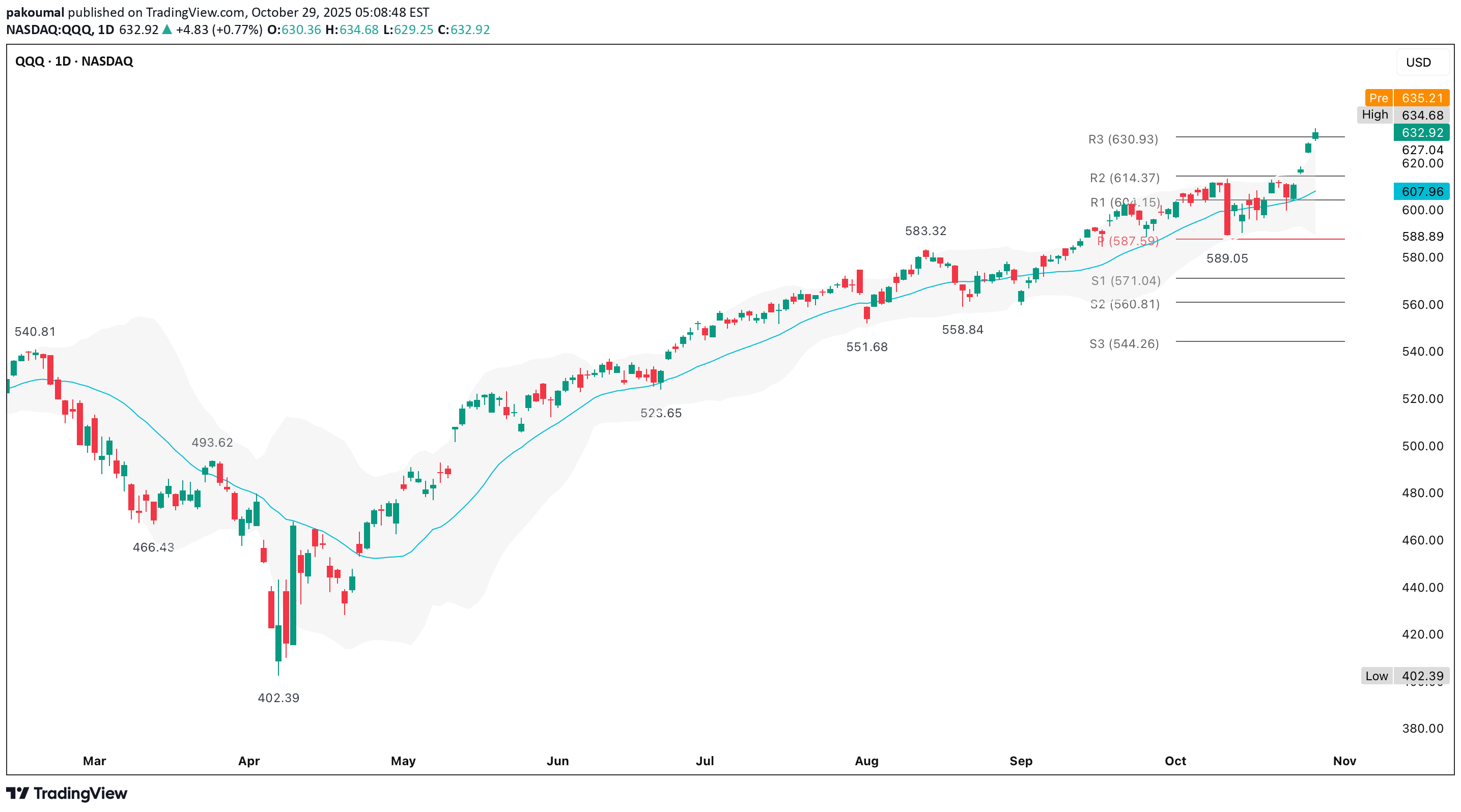

Technical analysis by pakoumal about Symbol QQQX on 10/29/2025

خرید شایعه، فروش خبر: آیا صف خریداران QQQ در حال ترکیدن است؟

Markets don't top on bad news, but on good news that fails to push prices higher Momentum still favors upside, but is technically stretched. Dual-position plan (short-term call hedge + medium-term puts) is sound Just trade fast around $636 & $630 pivots 1. Rumor phase has already played out Fed is expected to cut and stay dovish NVDA/Big Tech optimism has been heavily priced in (QQQ up nearly +5% in 5 sessions) Traders front-ran the narrative of “Fed pivot + solid earnings = soft landing" That rally into the events (FOMC + MSFT, META, AAPL earnings + Trump–Xi optics) is the “buy the rumor” leg 2. Positioning is crowded with gamma-long dealers + heavy call exposure make it harder to squeeze higher without fresh buying - "I'll wait to buy the dip" RSI/Stoch at extremes with 4H chart shows both pinned above 90 which is a classic exhaustion point When everyone’s positioned for good news, even great news can cause a fade “Good Fed” - “yeah, but that’s priced in” “Good earnings” - “guidance wasn’t as hot” So even if the headlines are positive, markets can slip as traders lock profits and dealers unwind long gamma exposure 3. Volatility spikes both ways on FOMC day The first move is often faded by end of session 1-2 days post-event typically follows a mean reversion or mild correction, especially if QQQ stays extended > 5-7% above its 20d MA Focus shifts to “what’s next catalyst?” - if none, prices drift or retrace toward $620-$625 Price breaking out above prior highs ($627) with a steep slope. Distance from 20d MA is about +4% & that’s extended for QQQ historically Tall green run with shrinking real bodies suggests momentum slowing, but not reversing yet Price is now hugging the top of the volatility envelope which is a common “pause or pullback” signal Volume is rising, but not climactic so still bullish, but nearing exhaustion The trend is undeniably up, but this leg is late-stage momentum It’s the kind of move that often tops not with bad news, but when good news stops pushing prices higher We’ve had a 6 day vertical move into multiple catalysts (FOMC, mega-cap earnings, geopolitical optics) Short-term traders are full-long, gamma is high & realized volatility is low That’s exactly when “sell-the-news” reactions bite hardest with one big headline shift & everyone runs for the door at once If you’re holding puts keep them through the events since they’ll benefit from any air-pocket back toward $625-$620 Consider trimming if QQQ holds >$635 after the dust settles; that would indicate trend continuation instead of fade If you’re considering calls Only add on a decisive breakout >$636 with strong breadth; otherwise, they’ll decay fast once event volatility deflates If you already hold short-dated calls, take profits into strength; don’t let them ride through Powell + earnings unless deeply ITM Market rallied on expectation of a dovish Fed and strong tech earnings If Powell confirms what’s priced in, there’s no new fuel so fade likely If Powell disappoints, yields pop & fade even sharper Only a shockingly dovish tone + blowout earnings could keep the rally running & even that may get sold into strength If QQQ breaks and holds above $635 Could stretch to $640 short-term (gamma squeeze) Great moment to exit or roll up short-dated calls since risk of reversal rises fast If QQQ fades below $630 We’re stretched ~4% above R2, now approaching R3, the outer bound of most “normal” rallies Historically, when QQQ closes >R3, you often see a 1-3 day pause or fade (especially after catalysts) Volume isn’t panic high, so this looks like exhaustion buying, not panic covering - a subtle, but key difference This week’s triple stack FOMC (Wednesday) is expected dovish & priced in Mega-cap earnings from MSFT, META, AAPL with expectations high Trump–Xi macro optics, minor impact unless major policy statement The setup is classic “buy rumor (rally), sell news (this week’s events)” ~60% odds of a near-term consolidation/pullback vs. 40% continued melt-up Any calls should be short-dated (expiring this week) & closed into any strength >$635 Avoid adding long exposure until price tests $625 or $606 - better reward/risk Expect chop or fade post-FOMC/earnings Best risk/reward trade is holding any existing puts & fading strength into event-day highs