Technical analysis by SMC-Trading-Point about Symbol PAXG: Buy recommendation (10/27/2025)

SMC-Trading-Point

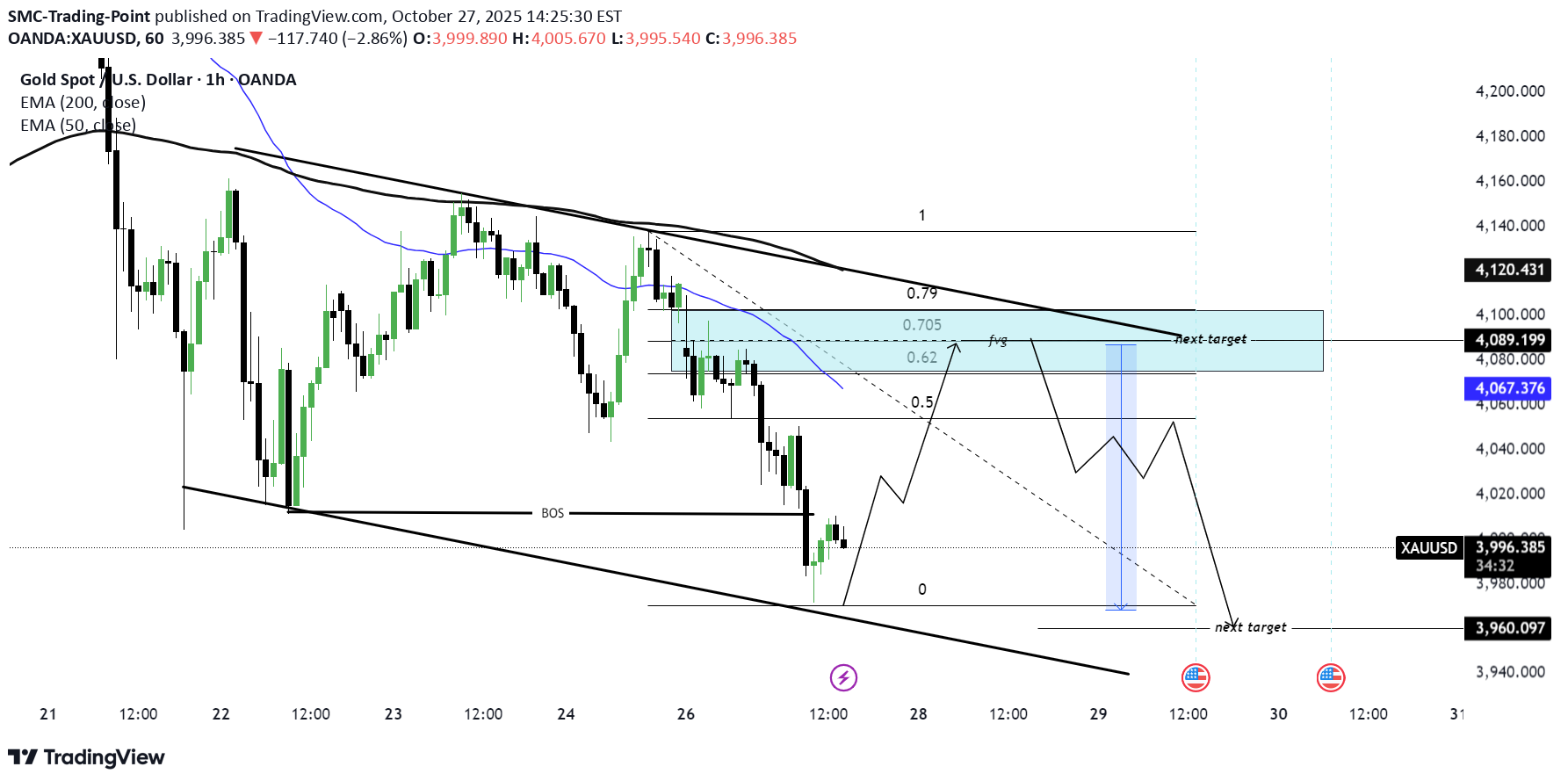

تحلیل طلا (XAU/USD): فرصت شورت در مسیر نزولی با استراتژی اسمارت مانی (SMC)

SMC Trading point update - Technical analysis of XAU/USD (Gold Spot) Timeframe: 1H (OANDA) Technical Basis: Smart Money Concepts (SMC) + EMA Confluence --- Market Structure Current trend: Bearish, price respecting a descending wedge/channel. Recent Break of Structure (BOS) confirms bearish momentum continuation. Price is retracing after forming a new low and may move back to mitigate imbalance (FVG). --- Key Technical Areas Retracement Levels: 0.5 – 0.79 Fibonacci zone marks the premium shorting area. Fair Value Gap (FVG) zone between 0.62–0.79 levels is the ideal entry region. EMA Resistance: EMA-50 ≈ 4,067 EMA-200 ≈ 4,120 Both EMAs align with the supply zone, strengthening sell bias. --- Projected Move 1. Expected retracement toward the 4,067–4,100 zone (supply/FVG region). 2. Potential short entry within that area. 3. Bearish continuation targeting the next structural low at 3,960 (as marked). --- Targets Next Target (retracement zone): 4,089 Final Bearish Target: 3,960 Mr SMC Trading point --- Summary Gold remains under bearish pressure within a contracting structure. A retracement to the premium zone (4,067–4,100) offers potential short opportunities aligned with structure and EMA resistance. A break below 3,995 would further confirm bearish continuation toward 3,960. --- Pelas support boost 🚀 this analysis