Technical analysis by Swissquote about Symbol ETH on 10/9/2025

Swissquote

آیا اتریوم تا پایان ۲۰۲۵ به ۶۰۰۰ دلار میرسد؟ پیشبینی تحلیل تکنیکال

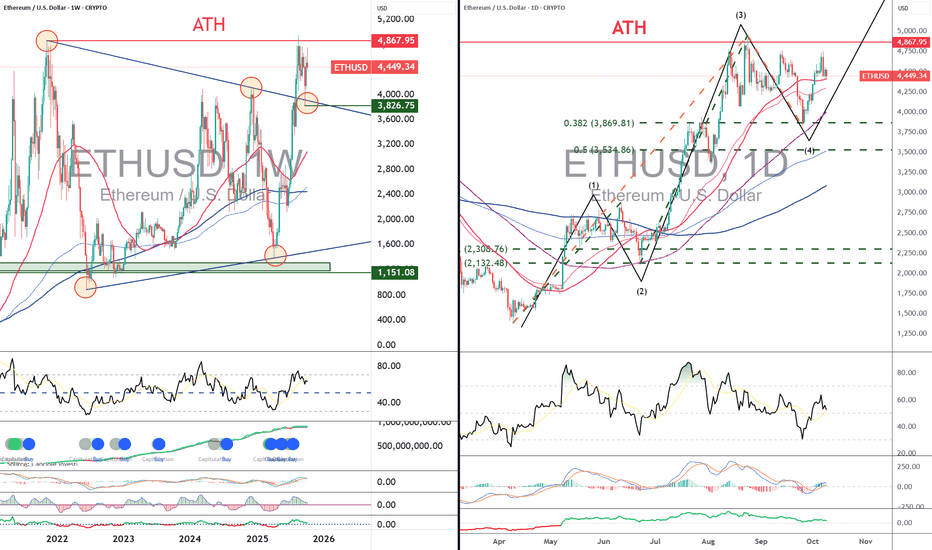

While the debate over the timing of the end of the bullish cycle continues, Ether (ETH) has reached the 26th position worldwide ($540 billion USD) in the ranking of global market capitalizations across all asset classes. For comparison, gold ranks first at $27 trillion USD, and Bitcoin is in 7th place with $2.45 trillion USD. Regarding Bitcoin’s price and the possible dates for the end of the bullish cycle linked to the 2024 halving, I invite you to click on the chart below. You’ll see that the end-of-cycle window lies between October 18 and November 20. But let’s return to the focus of this analysis: Ethereum — specifically the ETH/USD price and a realistic price target for this cycle, taking into account its positive correlation with Bitcoin. In this article, I will rely on chart analysis using weekly and daily timeframes, applying classical charting tools, Elliott Waves, and Fibonacci extension ratios. 1) According to the medium-term chart (Japanese candlesticks, weekly data), the underlying trend remains bullish above the $3,800 support. The chart below shows that ETH/USD’s long-term trend remains bullish as long as the market price holds above a large triangular pattern that broke upward this summer. The primary trend is therefore bullish above the $3,800 support on a weekly closing basis. The first chart below shows ETH/USD weekly Japanese candlesticks: 2) According to Elliott Wave analysis, the final end-of-cycle target could be $6,000 by late 2025. On this Ethereum (ETH/USD) chart, Elliott Wave analysis shows a five-phase bullish structure, with Wave 5 yet to come. After the Wave 4 correction, the market appears to have found a bottom around $3,800 — an area corresponding to the 0.382 retracement of Wave 3. The current recovery suggests the potential start of the fifth impulsive wave. The theoretical target for Wave 5 is around $6,000, corresponding to a 0.618 Fibonacci extension from the bottom of Wave 1 to the top of Wave 3, projected from Wave 4. This level also aligns with a major psychological zone and a classic target for the end of a full bullish cycle. As long as the price stays above $3,800, this remains the most likely technical scenario. The second chart below shows ETH/USD daily Japanese candlesticks: DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.