تحليل التحليل الفني Swissquote حول PAXG في رمز في 10/10/2025

Swissquote

معامله تضعیف پول: چرا سرمایهگذاران به طلا و بیتکوین هجوم بردهاند؟

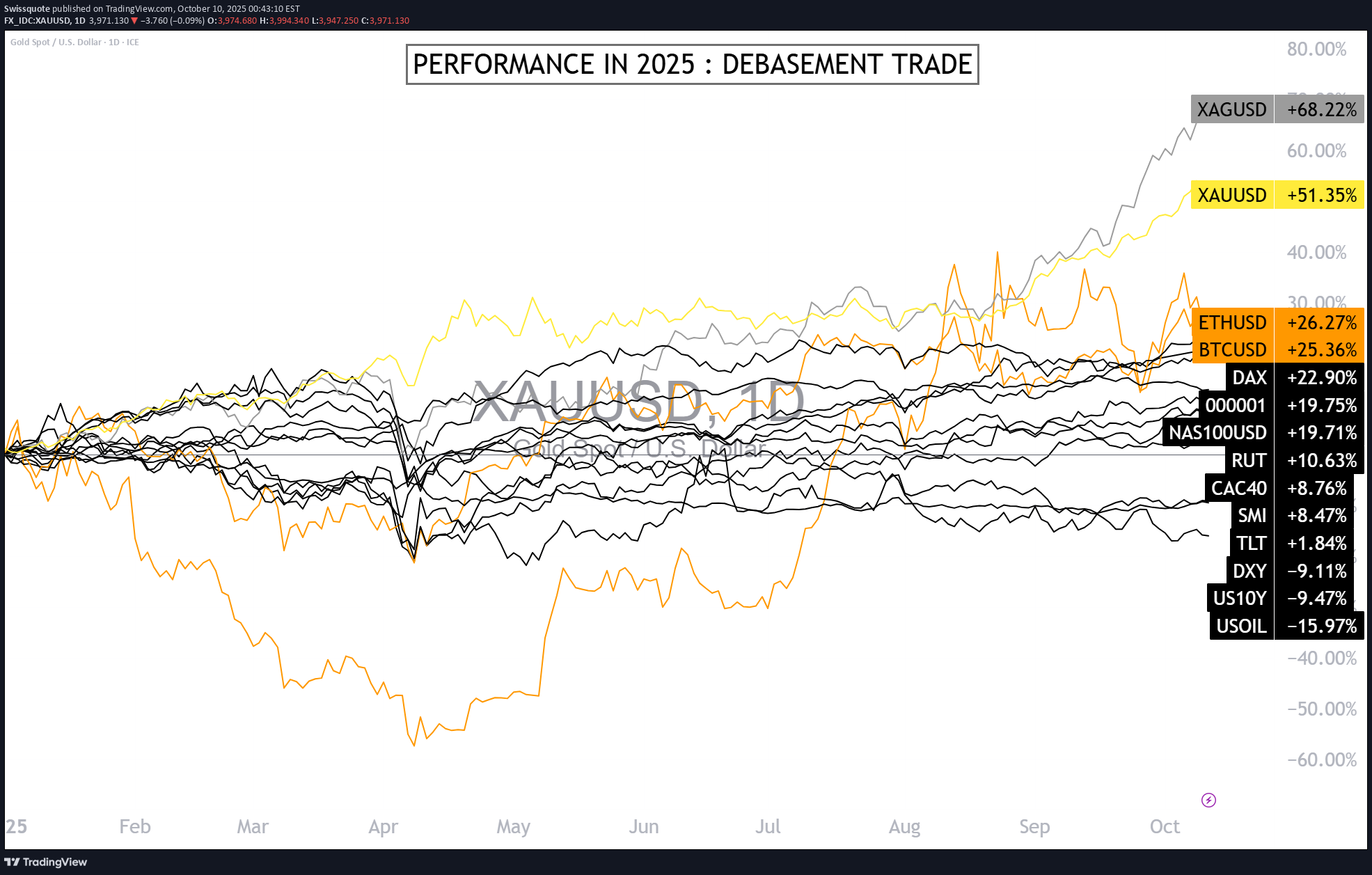

In 2025, the best-performing assets are not tech stocks or sovereign bonds, but gold, silver, Bitcoin, and Ethereum. This striking fact reflects a much deeper trend: the powerful comeback of the “debasement trade” — the bet on the devaluation of major currencies. Amid soaring public deficits, record debt levels, and increasingly accommodative monetary policies, more and more investors are questioning the ability of leading economies to preserve the value of their money. The term “debasement” originates from the era when monarchs reduced the precious metal content of their coins — an early way to create money at the expense of those who held it. Today, the mechanism is different, but the logic remains the same: governments finance their spending through debt, which central banks ultimately absorb indirectly. The result is expanding money supply, eroding purchasing power, and waning confidence. In this environment, a trade has emerged — selling or avoiding fiat currencies in favor of real and scarce assets. Bitcoin and Ethereum benefit from their algorithmic scarcity; gold and silver, from their historic role as stores of value. This movement is not merely defensive; it signals a paradigm shift. Investors are seeking assets uncorrelated with sovereign debt — instruments that can preserve wealth in a world of ever-expanding public balance sheets. In other words, it is less about speculation and more about insurance against monetary erosion. In the short term, this “debasement trade” supports precious metals and cryptocurrencies. But in the medium term, it conveys a more troubling message: a structural loss of confidence in fiat money. As long as governments postpone fiscal adjustments, demand for these alternative assets is likely to remain strong. Ultimately, 2025 confirms a truth many preferred to ignore: when money weakens, investors turn to what cannot be printed. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.